“What we do today echoes in eternity.”

— Marcus Aurelius

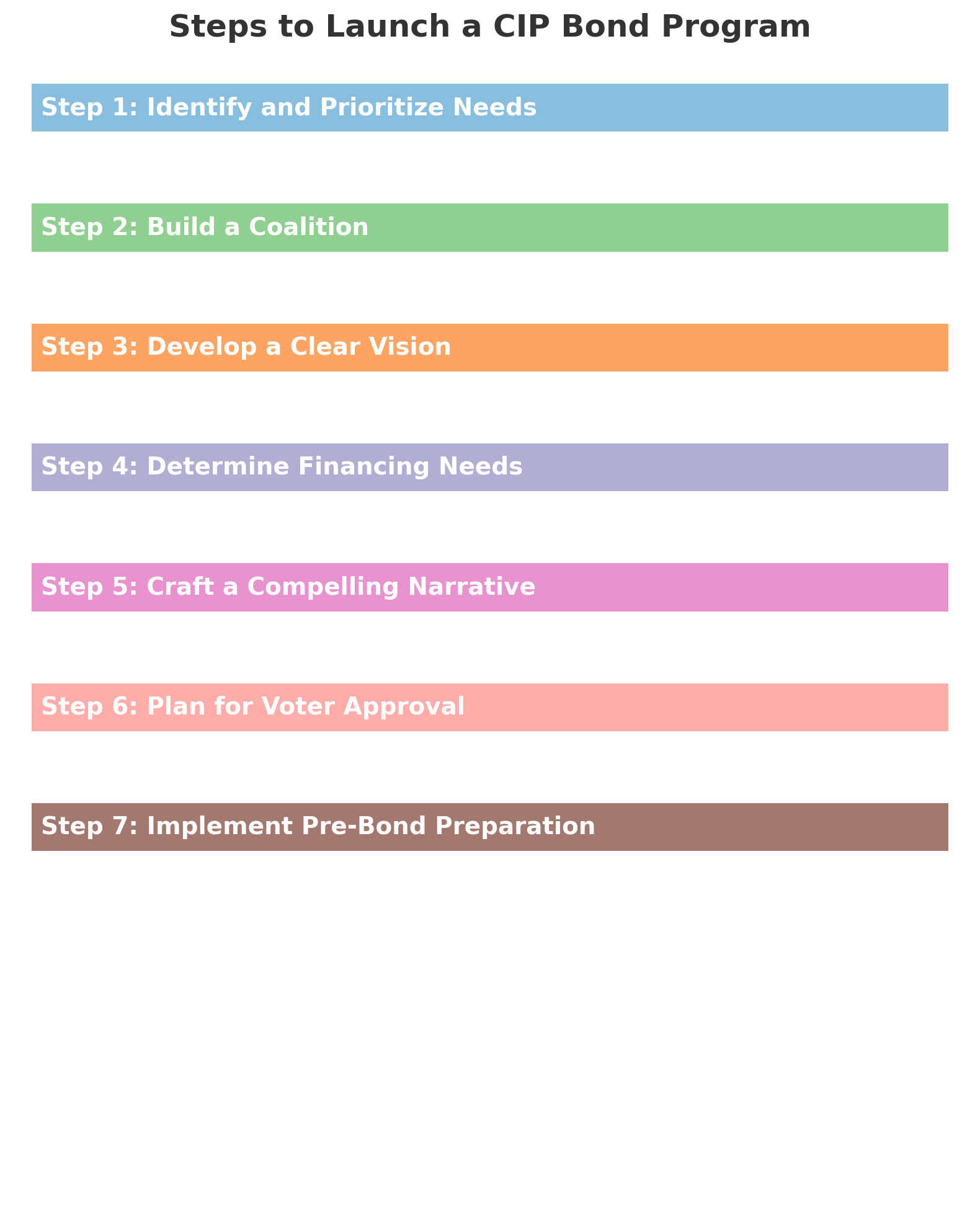

Building Our Future: A Roadmap for Launching a New Capital Improvement Program Bond in Our Local Government

Our local government stands at a pivotal moment. With aging infrastructure and a growing population, the need for substantial improvements in our municipal infrastructure development is clear. Roads riddled with potholes, overcrowded schools, and outdated public safety facilities signal that it’s time for action. Initiating a new Capital Improvement Program (CIP) bond may seem overwhelming, but it’s an essential step toward fixing what’s broken and fostering sustainable development. So, how do we get started?

Understanding the Importance of a CIP Bond Program

Bonds have long been a crucial funding source for Capital Improvement Programs—from roads and schools to public safety facilities and parks. A CIP bond program allows local governments to raise the necessary funds upfront for municipal infrastructure development, with the promise to repay investors over time. Understanding the differences between Revenue Bonds and General Obligation Bonds is essential in selecting the right financing mechanism. The challenge lies in moving from identifying needs to creating a bond that voters will support.

Step 1: Identify and Prioritize Needs

A comprehensive assessment of the local government’s challenges and opportunities is the first step:

- Conduct a Community Needs Assessment: Use data to evaluate infrastructure conditions, service gaps, and growth projections. This helps in understanding the extent of repairs and new developments required for our Capital Improvement Program.

- Engage the Public: Hold town halls, surveys, and focus groups to learn what matters most to residents. Community engagement ensures public buy-in starts with listening to their concerns and aspirations.

- Prioritize Projects with Long-Term Strategic Planning: Categorize needs by urgency, impact, and feasibility, keeping in mind infrastructure sustainability. Focus on projects that deliver clear community benefits and support the local government’s long-term strategic plans.

Step 2: Build a Coalition

A bond program succeeds when diverse stakeholders work together:

- Local Government Leadership: Engage council members, mayors, and other elected officials who can champion the bond initiative.

- Community Advocates: Partner with business leaders, educators, and civic organizations to advocate for specific projects.

- Expert Consultants: Hire professionals like program managers, general engineering consultants, and financial advisors to guide planning and execution using established project management frameworks. Ensure that the proposed CIP bond program aligns with the municipality’s financial health and debt capacity.

Step 3: Develop a Clear Vision

Voters support bonds when they see how their investment will improve their community:

- Create a Master Plan for Sustainable Development: Outline the scope, timeline, and cost of each proposed project, aligning them with the local government’s long-term strategic planning for sustainable development.

- Be Transparent: Explain how funds will be allocated, ensuring accountability for every dollar spent.

- Emphasize Economic and Social Impacts: Highlight how the bond will enhance safety, boost economic growth, and improve the quality of life for residents.

Step 4: Determine Financing Needs

Decide how much funding is required and how the bond will be structured:

- Estimate Costs: Collaborate with consultants to calculate realistic costs for each project, including contingencies for inflation or unforeseen delays.

- Explore Funding Sources for CIP: Identify how the bond will be repaid—typically through property taxes, sales tax increases, or other revenue options—while considering the municipality’s debt capacity and financial health.

- Assess Bond Types: Evaluate the advantages of Revenue Bonds versus General Obligation Bonds to determine which best suits the CIP bond program for our local government.

Step 5: Craft a Compelling Narrative

People are more likely to support initiatives they understand and believe in:

- Communicate Early and Often: Use plain language to explain the bond’s purpose and impact through social media, local media, and direct outreach.

- Showcase Success Stories: Reference past projects funded by bonds to build credibility and illustrate positive outcomes.

- Address Concerns: Be upfront about potential tax implications and how they will be managed responsibly.

Step 6: Plan for Voter Approval

An informed and motivated electorate is crucial:

- Leverage Grassroots Support: Empower community leaders and advocates to spread the word. Personal connections can make a significant difference.

- Prepare Informational Materials: Create brochures, FAQs, and websites that explain the bond in accessible language.

- Get-Out-The-Vote Efforts: Mobilize volunteers to remind and assist residents in casting their ballots.

Step 7: Implement Pre-Bond Preparation

Set the stage for success by addressing common obstacles before the bond appears on the ballot:

- Secure Approvals: Work with government bodies to draft and approve the bond language.

- Resolve Inter-Local Agreements: Collaborate with neighboring municipalities to avoid duplication of efforts or conflicting priorities.

- Conduct Preliminary Studies Using Project Management Frameworks: Start environmental reviews and feasibility studies for high-priority projects, demonstrating readiness to act immediately after the bond passes.

Conclusion: Empowering Our Local Government’s Future

Embarking on a new Capital Improvement Program bond is undoubtedly a complex endeavor, but it’s a necessary one for our local government’s sustainable development and municipal infrastructure development. By systematically assessing our needs, considering the economic and social impacts, building a coalition of support, and maintaining transparent communication, we can transform challenges into opportunities. This journey may seem daunting, but every successful CIP bond program starts with a single step: understanding the needs of our community and committing to meeting them.

Call to Action

Let’s come together to build a brighter future. Get involved, stay informed, and let’s make our community a place we’re all proud to live in.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com