Navigating the Challenges of Completing Projects on Time and Budget in a Rising Interest Rate Environment

Completing projects on time and budget is crucial in any environment, but it becomes even more important in a rising interest rate environment. Rising interest rates can have a significant impact on project management, making it necessary to adapt strategies and approaches.

In a rising interest rate environment, businesses face challenges such as increased borrowing costs and extended project timelines. These challenges can disrupt cash flow projections and strain project budgets. To successfully navigate these obstacles, business owners, project managers, and financial professionals need to implement effective strategies.

This blog post aims to provide insights and strategies for effectively managing projects in a rising interest rate environment. By understanding the importance of completing projects on time and budget, businesses can mitigate the impact of rising interest rates and ensure successful project execution.

The Importance of Timely and Cost-Effective Project Management

Completing projects on time and within budget is crucial for the success of any business endeavor. However, in a rising interest rate environment, the importance of timely and cost-effective project management becomes even more pronounced.

Meeting Deadlines and Staying Within Budget

Completing projects on time ensures that businesses can start generating revenue or achieving their desired outcomes without delay. When projects are delayed, it not only hampers progress but also leads to missed opportunities in the market. By adhering to project timelines, businesses can stay ahead of the competition and capitalize on favorable market conditions.

Staying within budget is equally important as it helps businesses avoid unnecessary costs and maintain financial stability. Overspending on a project can strain resources and impact cash flow, potentially leading to financial difficulties. By carefully managing project budgets, businesses can allocate resources effectively and ensure that funds are available for other critical areas of operation.

Enhancing Stakeholder Confidence

Timely and cost-effective project completion builds trust and confidence among stakeholders, including investors, clients, and employees. When projects are completed as planned, stakeholders have increased faith in the capabilities of the business. This trust translates into stronger relationships with investors who may be more inclined to provide additional funding for future projects.

Meeting project deadlines and budgets demonstrates professionalism and reliability, enhancing the reputation of the business. Clients value organizations that deliver on their promises, which can lead to repeat business and positive referrals. Additionally, employees feel a sense of accomplishment when they successfully complete projects on time and within budget, boosting morale within the organization.

In summary, timely completion of projects ensures that businesses can capitalize on opportunities while staying within budget maintains financial stability. Moreover, meeting deadlines and budgets enhances stakeholder confidence by showcasing professionalism and reliability. In a rising interest rate environment where every dollar counts, effective project management becomes paramount for sustainable growth.

The Impact of Rising Interest Rates on Project Execution

Rising interest rates can have a significant impact on project execution, posing challenges for businesses in managing their projects effectively.

Increased Cost of Borrowing

One of the primary effects of rising interest rates is the increased cost of borrowing. As interest rates rise, it becomes more expensive for businesses to finance capital improvement projects through loans or credit. Higher borrowing costs can strain project budgets, as businesses may need to allocate additional funds to cover the increased interest expenses. This can potentially lead to a reduction in available resources for other project components or even require seeking additional financing options.

Extended Project Timelines

Higher interest rates can also result in extended project timelines. Businesses may need to adjust their cash flow projections and secure additional financing due to the increased cost of borrowing. These adjustments can introduce delays in project completion as businesses navigate the process of securing additional funds or reassessing their financial plans. Extended project timelines can have negative consequences, such as missed market opportunities or increased competition from other businesses that were able to complete similar projects more quickly.

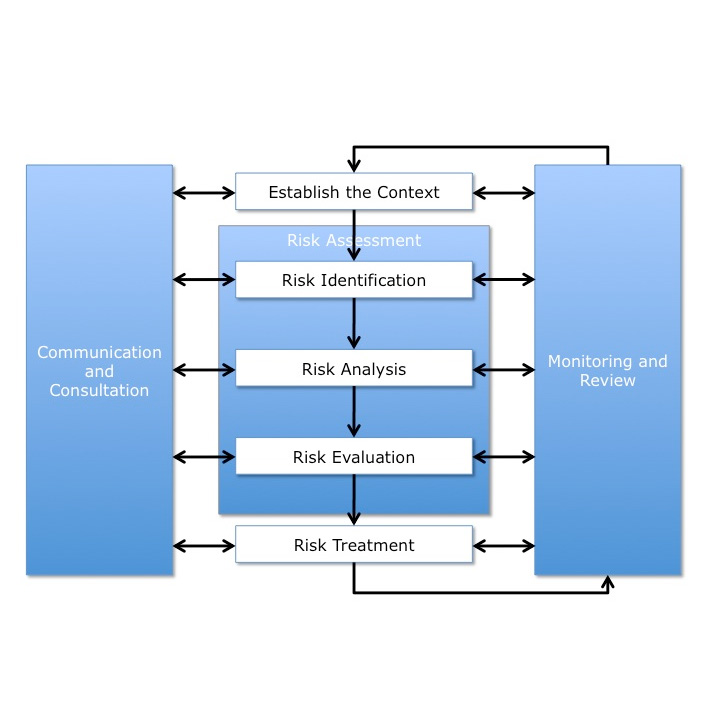

To mitigate the impact of rising interest rates on project execution, businesses should carefully consider these factors during the planning phase. Thorough risk assessment and contingency planning are essential to account for potential delays and increased costs associated with higher interest rates. By proactively addressing these challenges, businesses can adapt their strategies and minimize disruptions caused by rising interest rates, ultimately ensuring successful project execution.

Strategies for Effectively Managing Projects in a Rising Interest Rate Environment

To successfully manage projects in a rising interest rate environment, businesses need to implement effective strategies that address the challenges posed by higher borrowing costs and extended project timelines.

Thorough Planning and Risk Assessment

Careful planning and risk assessment are crucial for identifying potential challenges and taking proactive measures to mitigate the impact of rising interest rates. During the planning phase, businesses should consider different interest rate scenarios and develop contingency plans accordingly. By anticipating potential delays or increased costs, businesses can make informed decisions and adjust their project timelines or budgets as needed. Thorough planning also involves identifying alternative financing options or exploring partnerships that can help offset the impact of rising interest rates.

Optimizing Cash Flow and Financing Options

Efficient cash flow management is essential in a rising interest rate environment. Businesses should closely monitor their cash flow projections to ensure they have sufficient funds to cover increased borrowing costs. Exploring alternative financing options can also help minimize the impact of rising interest rates. This may include negotiating favorable loan terms with lenders, refinancing existing debt at lower rates, or seeking government assistance programs designed to support businesses during challenging economic conditions. By optimizing cash flow and exploring different financing avenues, businesses can alleviate some of the financial burdens associated with rising interest rates.

Implementing these strategies requires careful analysis, collaboration with financial professionals, and ongoing monitoring of market conditions. By proactively managing projects in a rising interest rate environment, businesses can navigate challenges effectively and ensure successful project execution while minimizing the impact on their bottom line.

Conclusion

Completing projects on time and within budget is crucial in a rising interest rate environment to ensure financial stability and maintain stakeholder confidence. Rising interest rates can pose challenges for project management, but with thorough planning and strategic approaches, businesses can navigate these obstacles effectively. By implementing strategies such as optimizing cash flow and exploring financing options, businesses can mitigate the impact of rising interest rates on project execution. It is essential for business owners, project managers, and financial professionals to stay proactive, adapt their strategies, and make informed decisions to successfully complete projects in a rising interest rate environment.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com