Capital infrastructure bonds are pivotal financial instruments for ambitious public projects. However, the recurring theme of these ventures overshooting both timelines and budgets demands meticulous analysis. In this investigative piece, we offer a granular exploration of the five principal factors contributing to these deviations, shedding light on their intricacies and broader ramifications on infrastructure projects.

Challenges in the Construction Phase Unveiled

In-depth Insight: Construction can be fraught with unforeseen obstacles. From encountering unexpected geological formations beneath the surface to wrestling with adverse weather conditions, such contingencies can disrupt operations. Technical snags, such as equipment breakdowns or difficulties in procuring specialized materials, can further elongate timelines and inflate costs.

Wider Repercussions: Such challenges not only pose immediate logistical hurdles but can also influence the overall quality and integrity of the project if hasty workarounds or subpar materials are deployed.

The Fluid Nature of Project Design or Scope

In-depth Insight: Even the best-laid plans can witness alterations post-initiation. Be it due to evolving stakeholder demands, the introduction of cutting-edge technologies, or a refined comprehension of a project’s ramifications, these changes often warrant redesigns, invariably consuming additional resources and time.

Wider Repercussions: Although alterations might augment the project’s ultimate value, they invariably disturb the pre-established workflow, often leading to elongated timelines and escalated costs.

The Maze of Permit Procurement and Approvals:

In-depth Insight: The regulatory framework for infrastructure projects can be exceedingly intricate. Acquiring the necessary permits, particularly for mammoth projects with wide-reaching impacts, can turn into a prolonged endeavor, mired in bureaucracy or evolving regulatory stipulations.

Wider Repercussions: Delays in obtaining approvals not only defer the project’s kickoff but can breed financial uncertainties, especially if resources or contractors were pre-secured based on original estimations.

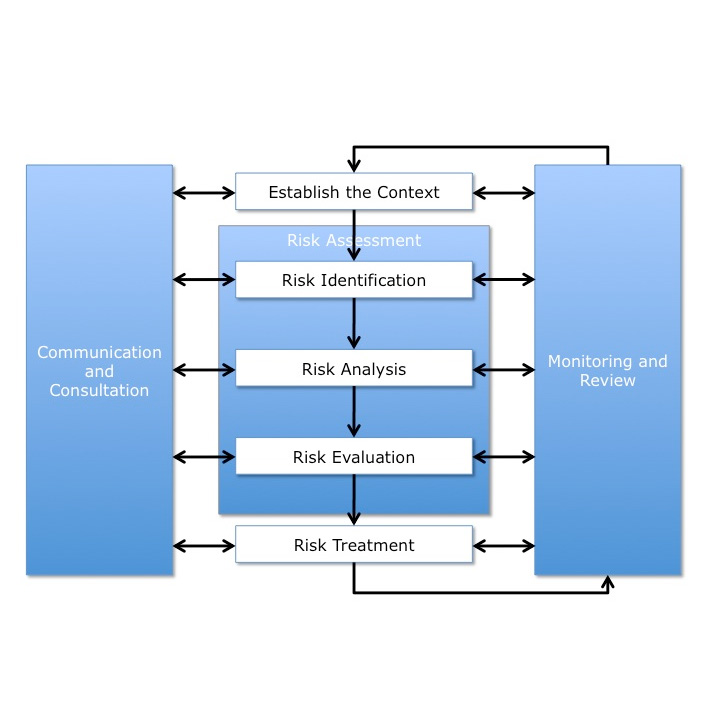

The Crucial Role of Project Oversight

In-depth Insight: Exceptional leadership is the cornerstone of any triumphant initiative. In its absence, the project can face a multitude of challenges—be it through miscommunication, resource mismanagement, or inadequate risk assessment.

Wider Repercussions: Beyond the palpable impacts of time and budget overruns, ineffectual leadership can diminish team morale, compromise the caliber of work, and potentially tarnish the reputation of involved entities.

The Perils of Misjudging Resource Requirements

In-depth Insight: Precise resource estimation remains one of the most arduous tasks. At times, project evaluations might fall short due to incomplete market intelligence, unpredictable shifts in material pricing, or a simplistic understanding of specific project components.

Wider Repercussions: Inaccurate projections can precipitate financial crunches mid-way through a project, either necessitating supplementary funds or, in extreme scenarios, stalling the project indefinitely. Additionally, compressed timelines can jeopardize both the safety standards and overall project quality.

Final Thoughts: The multifarious nature of infrastructure

Extensive research underscores that these impediments can arise in projects regardless of their scale or character. For instance, a vast transportation infrastructure might grapple with setbacks owing to regulatory roadblocks, while a modest-scale water purification facility might face financial strains due to inaccurate construction cost projections.

Yet, data from a comprehensive study by the Project Management Institute (PMI) suggests a heightened vulnerability to overruns in larger projects. This research discerned that projects with allocations exceeding $1 billion witnessed an average financial overrun of 27%, in stark contrast to projects valued at less than $10 million, which experienced a 9% deviation. Similarly, time delays were more pronounced in expansive projects, with an average lag of 22 months, whereas smaller initiatives reported an average delay of just 4 months.

In Simple Terms: Big projects, like building bridges or highways, can often run into problems and take more time and money than expected. By really understanding the main reasons these problems happen, people in charge can do a better job of planning and avoiding these issues. This means we get better projects that finish on time and within the budget.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, meet our team or reach out to us at info@frontlineadvisorygroup.com