Public Improvement District (PID) bonds are an effective financing option for municipalities looking to fund public projects while maximizing local control. PID bonds have seen increased interest over the last five years in Texas, where they can help attract private investment, promote economic growth, and meet the increasing demands for new infrastructure.

How Do PID Bonds Work?

To issue a PID bond, a local government creates a PID and defines its boundaries. The properties within the boundaries of the PID are subject to an additional assessment, which is used to pay for the bonds. This assessment is usually based on the appraised value of the property, and it can be either a fixed rate or a variable rate.

The funds generated are then used to finance the public projects within the PID. The bonds issued by the city or county are backed by the tax revenue generated by the properties within the PID. The bonds are usually long-term and can have a maturity of up to 30 years.

Why are PID Bonds Increasingly Popular in Texas?

PID bonds are popular in Texas for several reasons. First, they provide a way to finance targeted public projects without raising taxes on the entire city or county. Instead, only the properties within the boundaries of the PID are subject to the additional tax. This makes it easier to gain public support for the projects, as the residents who benefit from the projects are the ones who are paying for them.

Second, PID bonds can help attract private investment to the area. By financing public projects, PID bonds can help increase the value of the properties within the PID, making them more attractive to investors. This can lead to more development and economic growth in the area.

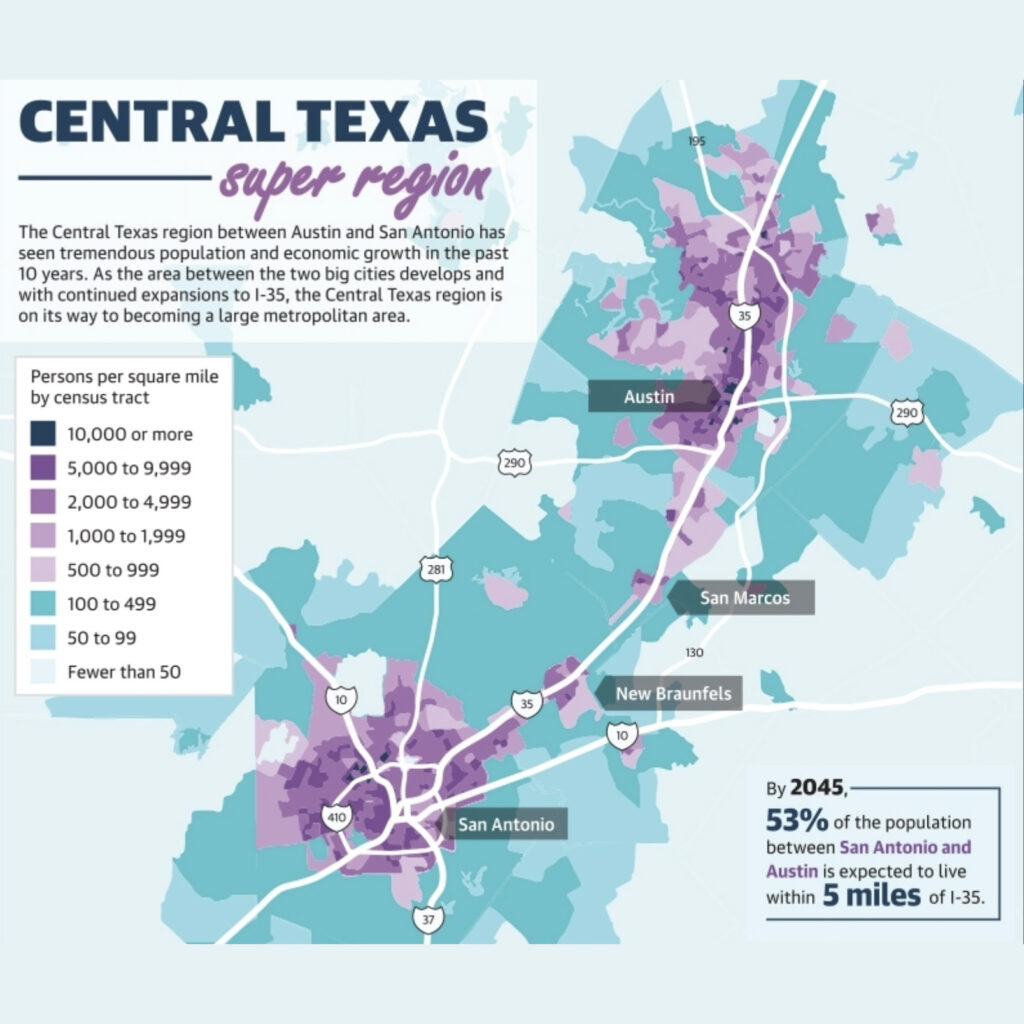

Finally, PID bonds can help cities and counties meet the infrastructure needs of their communities. As Texas continues to grow, many cities and counties are struggling to keep up with the demands for new infrastructure. PID bonds provide a way to finance these projects without burdening the entire community with the cost.

How Do PID Bonds Differ from Municipal Utility Districts?

PID bonds and municipal utility districts (MUDs) are similar in that they are both financing options for public projects. However, there are some key differences between the two.

While PIDs are conservative measures that are controlled by local governments, MUDs are regulated by the state, require a local election to issue bonds, and exist separately and out of the control of a city or county government. MUDs are special districts created to provide water, sewer, and other utility services to areas outside of the city limits. MUDs can issue bonds to finance the construction of the necessary infrastructure. The bonds are usually backed by the revenues generated from the sale of the utility services.

PID bonds, on the other hand, are created to finance a wide range of public projects within the city or county limits. PID bonds are usually backed by property taxes collected from the properties within the PID. While MUDs are focused on providing utility services, PID bonds can finance a wider range of projects, not limited to utilities.

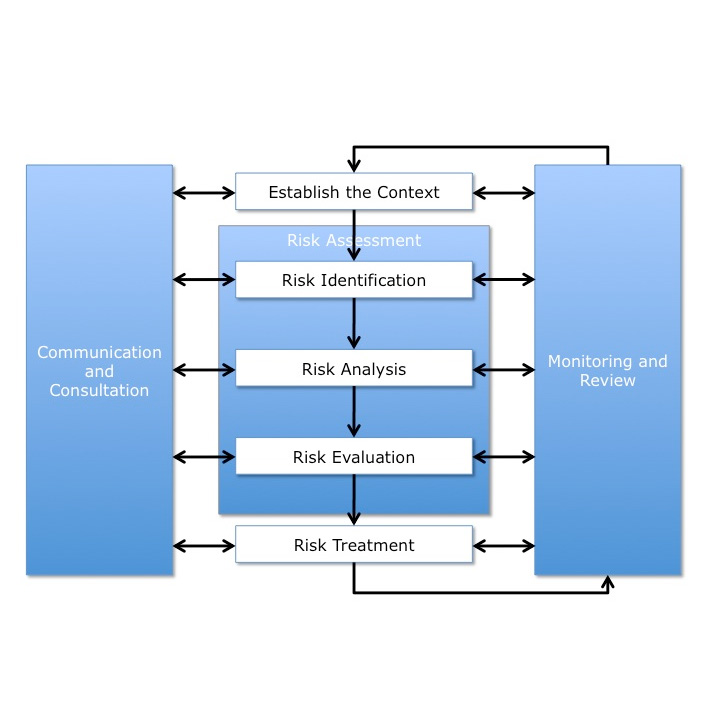

Obstacles to PID Bonds and How to Overcome Them

While PID bonds have many advantages, there are some objections to their use. One common objection is that they increase the tax burden on property owners within the PID. Some property owners may be hesitant to support PID bonds if they feel that they are already paying too much in taxes.

To overcome this objection, it is important to communicate the benefits of the public projects that will be financed by the PID bonds. By demonstrating the value of the projects and how they will improve the community, property owners may be more willing to support the measure.

Another objection is that PID bonds can lead to inequities among property owners within the PID. Properties with higher values will pay more in taxes than properties with lower values, which may create an imbalance in the burden of financing the public projects.

To address this objection, it is important to ensure that the PID boundaries are drawn in a way that is fair and equitable. The measure should be based on the appraised value of the property, which should be assessed objectively and fairly.

Finally, implementation of PIDs in certain jurisdictions may be met with pushback from constituents whose residential property may fall within the designated boundaries. In those instances where this has been the case, the local governments could not legally exempt or exclude certain property types. Under these circumstances, it is critical for local governments to involve property owners throughout the bond process. From defining boundaries to engaging in open, transparent, and inclusive communication with all stakeholders, local governments must ensure that everyone has a voice in the decision-making process and that the needs and concerns of all residents are taken into account.

PID bonds provide a locally-administered measure to finance infrastructure needs without raising taxes on the entire community. PID bonds can also help attract private investment and promote economic growth. While there are objections to their use, careful planning and communication can help overcome these objections and ensure that the benefits of PID bonds are realized by the entire community. As a management consultant, I recommend that city and county officials carefully consider the use of PID bonds as they plan for the future development of their communities.

At Front Line Advisory Group (FLAG), we are providing Capital Improvement Program management consulting, process improvement, and change management services to help municipalities collect and analyze data, improve stakeholder communication, leverage technology, develop training plans, and more. We believe these are the most effective and affordable ways for municipalities to scale their capabilities. Contact us for more info at info@frontlineadvisorygroup.com.