As cities and counties around the globe grapple with the complexities of managing capital infrastructure bond programs, the role of Program Management Consultants has become more critical than ever. Not only do these professionals bring a wealth of knowledge and technical expertise to the table, but they also serve as the linchpin for ensuring these programs deliver value for money to taxpayers. The following expands on their pivotal role in these processes.

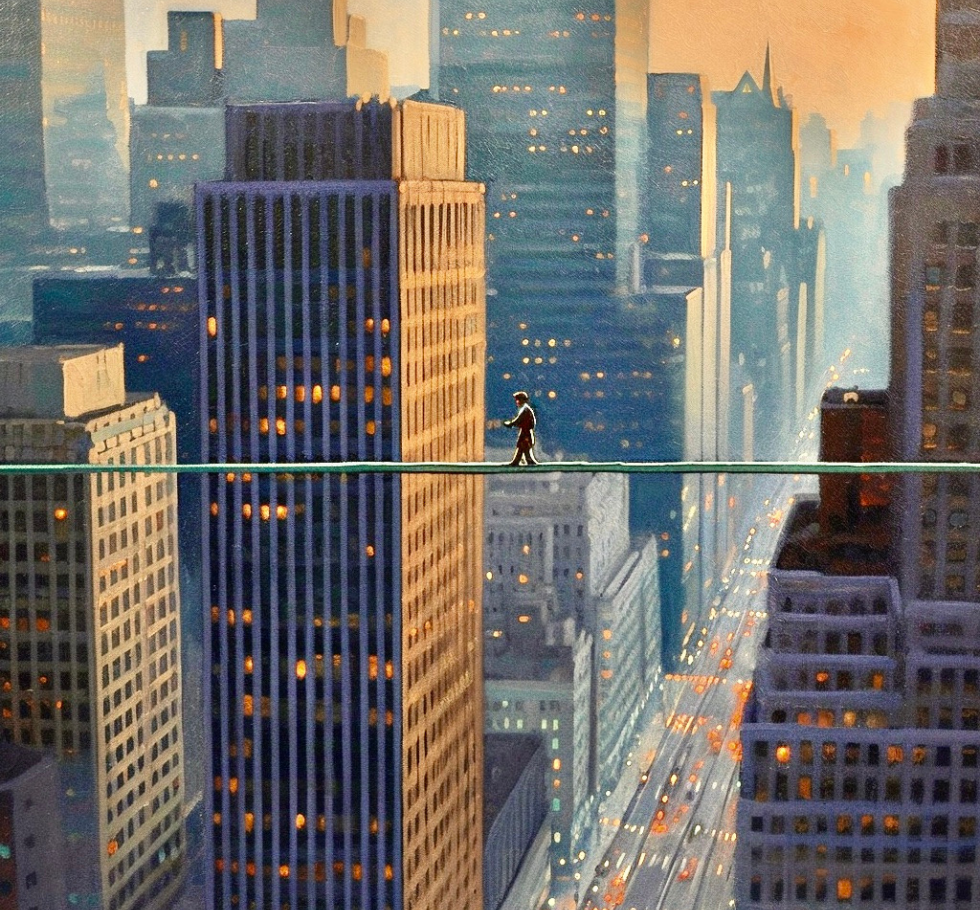

An Unwavering Eye for Independent Oversight: At the heart of a Program Management Consultant’s mandate is providing independent oversight of bond programs. Their impartiality enables them to objectively assess the program’s adherence to the planned schedule, budget, and desired outcomes. As an external party with no vested interests, consultants can offer unbiased insights into program optimization strategies, ultimately contributing to taxpayer value.

Mastering the Expertise Matrix: Navigating the labyrinth of processes in capital improvement bond programs calls for varied and nuanced expertise. Consultants serve as invaluable conduits of knowledge in complex areas such as finance, construction, and legalities. Their understanding of these intricacies aids in executing critical tasks – from issuing bonds and selecting contractors to managing intricate cost dynamics. This results in more streamlined processes, helping to ensure that taxpayers’ hard-earned money is judiciously utilized.

Aligning the Compass Towards Overall Goals: Beyond their technical acumen, consultants possess a strategic prowess critical for aligning bond programs with a city or county’s broader goals and objectives. They bring a forward-thinking approach to their roles, providing strategic counsel that guides program managers towards delivering outcomes that serve taxpayers’ interests in the long run.

Navigating the Risk Landscape: Every bond program comes bundled with inherent risks. Consultants help illuminate these potential pitfalls, devising appropriate mitigation strategies. Their timely updates and detailed reports bring transparency to the program’s progress, allowing for proactive issue resolution and the avoidance of unnecessary surprises. This risk management expertise is crucial in protecting taxpayer investments.

Championing Transparency and Accountability: Program Management Consultants serve as vanguards of transparency and accountability in bond programs. Their role goes beyond ensuring efficient execution; they are custodians of the program’s integrity. By fostering transparency and addressing taxpayer concerns or queries in a timely and accurate manner, they instill confidence in the community that their investments are well-managed.

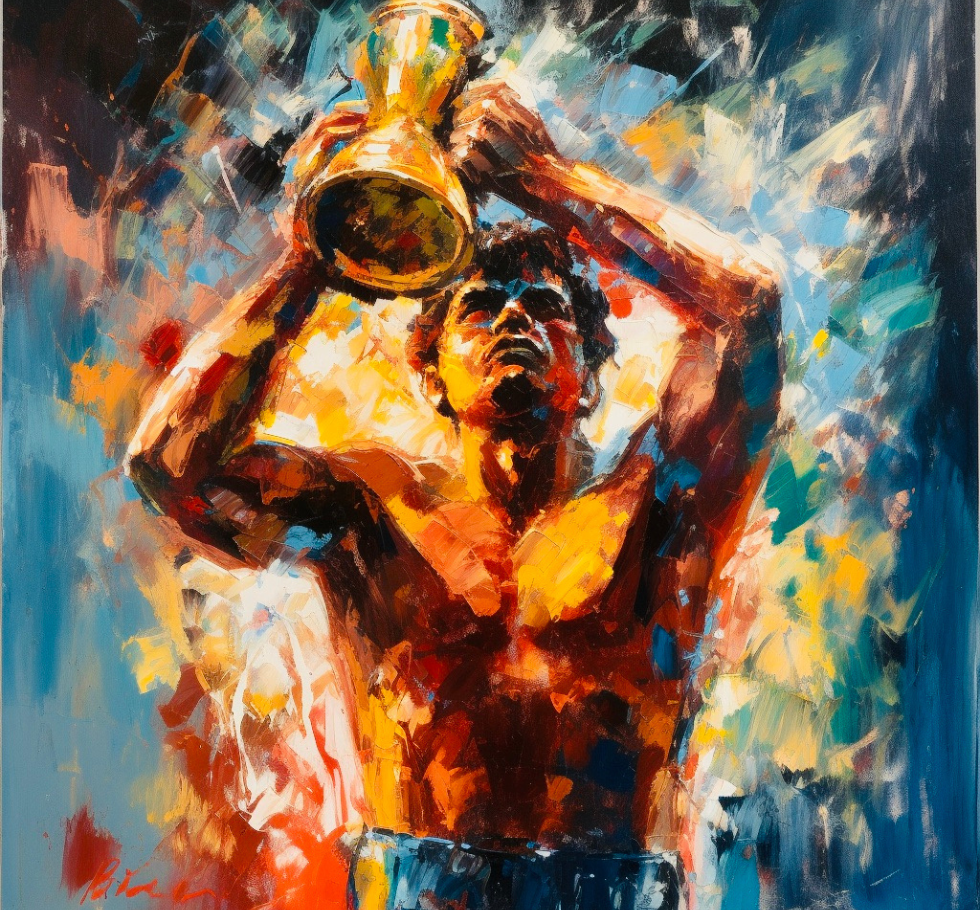

In sum, Program Management Consultants play a pivotal role in capital infrastructure bond programs. Through their independent oversight, deep technical and strategic expertise, risk management skills, and unwavering commitment to transparency and accountability, they ensure these programs are not only effectively managed but also deliver maximum value to the taxpayers. Although their work often unfolds behind the scenes, its impact is profoundly visible in every successful project, reinforcing the crucial role these professionals play in public infrastructure development.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com

Related Site