“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.”– Peter Drucker

Capital Improvement Program Risk in Bond Programs: Why It Matters Now More Than Ever in Texas

Capital improvement programs (CIPs) are essential for maintaining and upgrading the infrastructure that keeps our communities functioning—whether it’s building new schools, expanding roads, or modernizing water systems. In Texas, where growth is booming and infrastructure demands are rising, the role of bond-funded CIPs is more critical than ever. However, the success of these programs isn’t guaranteed. As many bond programs face risks that can derail projects, blow up budgets, and delay timelines, stakeholders must focus on understanding and managing these risks to ensure success.

In this article, we’ll explore the key risks associated with capital improvement programs in bond programs and explain why risk management is paramount in today’s Texas infrastructure landscape.

What Are Capital Improvement Program Risks?

Capital improvement program risks can be defined as any potential threats that might prevent a project from being completed on time, within budget, or to the agreed-upon specifications. For bond programs, where public funds are allocated toward large infrastructure projects, these risks can range from budget overruns and construction delays to regulatory issues and changes in public policy. When not managed effectively, these risks can have significant consequences—both for the project itself and for the taxpayers funding it.

Here’s a breakdown of the most common risks in CIPs:

- Budget OverrunsPerhaps the most visible and impactful risk is going over budget. CIPs are often multi-year projects with many variables—labor costs, material prices, and unforeseen issues like environmental factors—that can cause costs to spiral out of control. A project that exceeds its allocated bond funding may require additional taxpayer dollars or cuts to other essential services, leaving communities frustrated and project owners facing public backlash.

- Schedule DelaysStaying on schedule is crucial in any bond-funded project, particularly when public scrutiny is high. Delays can occur for many reasons: supply chain disruptions, bad weather, or contractor issues. Every day a project is delayed, it potentially increases costs and undermines public confidence. A small delay can snowball into a significant risk if not addressed early.

- Regulatory and Compliance IssuesTexas is no stranger to evolving environmental, safety, and zoning regulations. Changes in policy at the local, state, or federal level can delay or halt projects entirely if they require additional compliance measures. When projects fail to navigate these regulations properly, it can lead to hefty fines, legal battles, or even the scrapping of the project altogether.

- Public and Political PressureLarge-scale bond programs are often subject to intense public and political scrutiny. Stakeholders need to communicate effectively with the public to maintain trust and manage expectations. A lack of transparency can result in negative press, public discontent, or political intervention, which can alter or endanger projects.

- Market VolatilityThe prices of essential construction materials like steel, concrete, and lumber can fluctuate dramatically, and labor markets can be just as unpredictable. If market conditions shift during the course of a CIP, bond program budgets might suddenly become insufficient, forcing difficult decisions to cut scope or seek additional funding.

Why It Matters Now More Than Ever in Texas

The state of Texas has seen explosive population growth in recent years, especially in urban centers like Austin, Houston, and Dallas. With this growth comes increased pressure on schools, transportation, and utilities to keep pace. Bond programs are the primary funding mechanism to address this surge in demand. However, the stakes are higher now than ever, and here’s why:

- Rapid Population Growth and Infrastructure NeedsTexas added more than 4 million people over the past decade, and this growth shows no signs of slowing down. Public schools, transportation networks, and water systems are already strained, and future growth will only increase these pressures. Bond-funded CIPs are crucial to meeting this demand, and any delay or failure could have long-lasting consequences on the state’s infrastructure capacity.

- Economic UncertaintyInflation, rising interest rates, and supply chain disruptions have made project costs harder to predict. In Texas, where inflation has hit the construction industry particularly hard, maintaining control over costs in bond programs has become an even bigger challenge. Without proactive risk management, many projects could run into serious financial difficulties, eroding taxpayer trust in the bond program process.

- Climate Change and Environmental ChallengesTexas is experiencing more frequent and severe natural disasters, including hurricanes, flooding, and extreme heat. These events can devastate infrastructure and derail capital improvement projects. Preparing for these risks in the planning and execution phases of CIPs is critical to ensure that new and existing infrastructure can withstand the challenges posed by a changing climate.

- Increased Public AccountabilityWith social media and 24/7 news cycles, public entities and contractors working on bond-funded projects are under constant scrutiny. Delays or budget overruns quickly become public knowledge, leading to negative press and political pressure. In Texas, where local governments often seek voter approval for bond measures, maintaining public trust is vital for future funding opportunities. Mishandling risk on one project can tarnish the reputation of bond programs statewide, making it more difficult to secure funding for future projects.

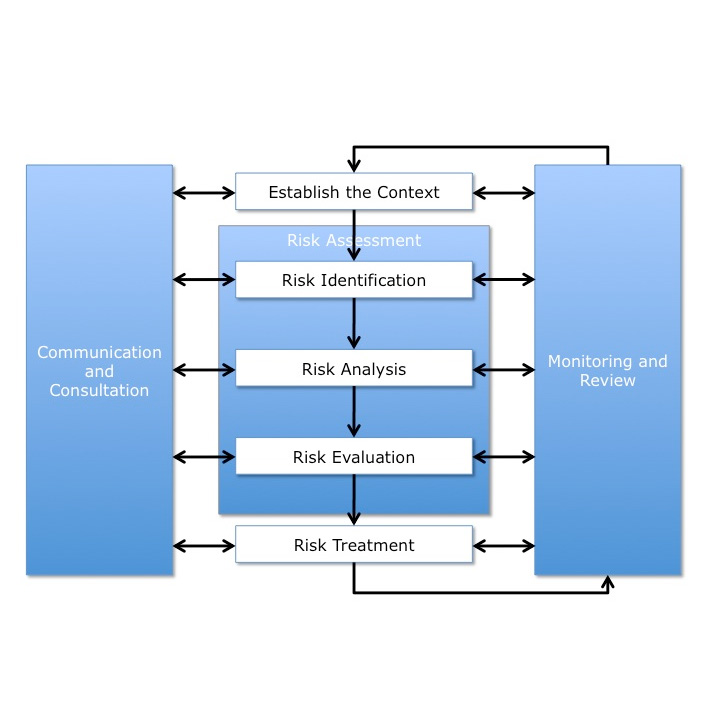

The Importance of Proactive Risk Management

Managing risk isn’t just about reacting to problems as they arise; it’s about planning ahead and mitigating potential issues before they become insurmountable. Proactive risk management in capital improvement programs means:

- Accurate and realistic budgeting based on current market conditions.

- Buffering project timelines to accommodate potential delays without blowing past deadlines.

- Building flexibility into contracts with vendors to adjust for regulatory changes or market shifts.

- Engaging stakeholders early and often to manage public expectations and build support.

As Texas continues to grow, the importance of effectively managing CIP risks in bond programs cannot be overstated. With proper planning, transparency, and risk mitigation strategies, bond programs can continue to deliver essential infrastructure projects that will support the state’s rapid expansion and ensure a high quality of life for its residents.

In conclusion, CIP risks are ever-present in bond programs, but with the right approach, Texas can manage these risks and build the future its growing population needs.

At Front Line Advisory Group, we manage Capital Improvement programs to ensure they are completed on time and within budget. We make sure every dollar is used wisely to improve our community. For more information or to start your project, contact us at info@frontlineadvisorygroup.com.