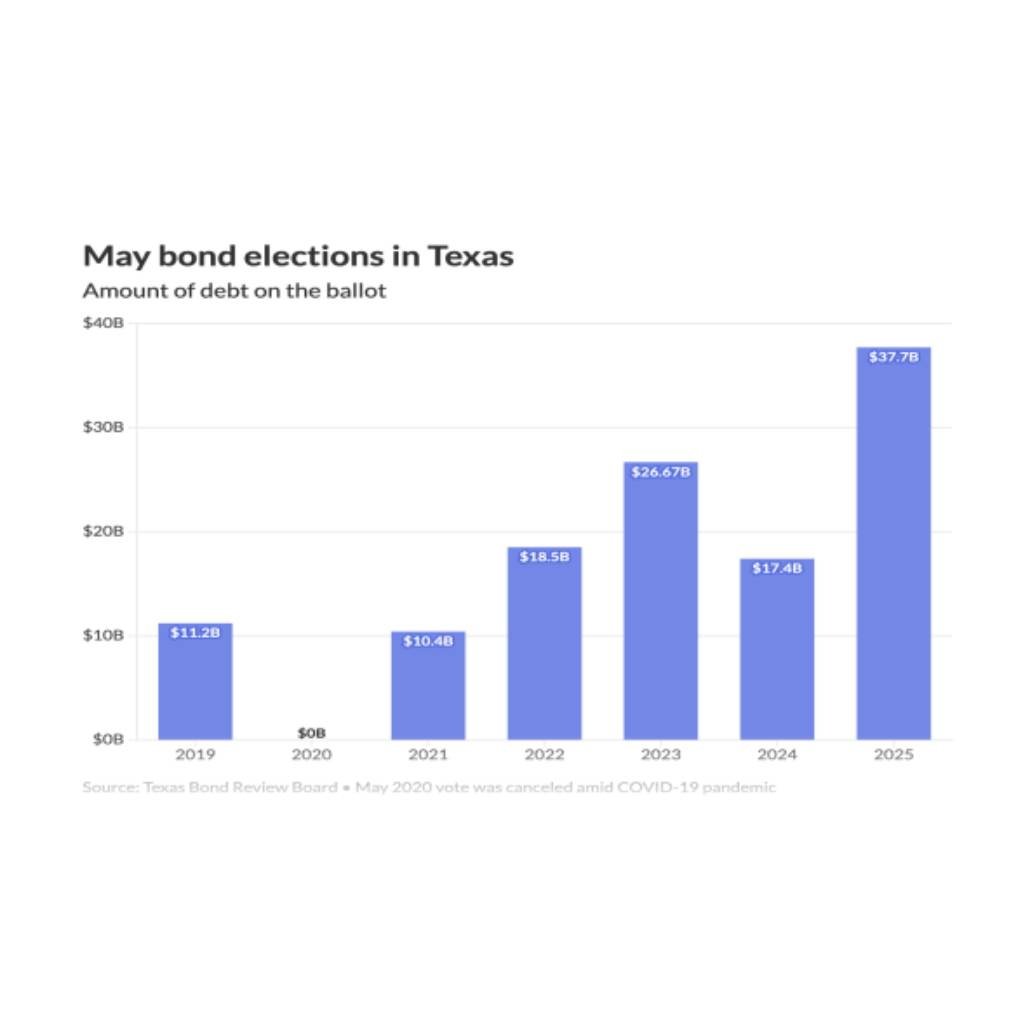

A capital improvement bond program is a way for municipalities, schools, and other public entities to fund necessary infrastructure projects, such as building repairs and upgrades, road construction, and equipment purchases. While these programs are essential for maintaining and improving the public’s infrastructure, they can also be challenging to execute effectively. In this article, we will explore the most common challenges experienced during a capital improvement bond program and offer solutions for addressing them.

Lack of Comprehensive Planning

One of the most common problems experienced during a capital improvement bond program is inadequate planning. Without a comprehensive plan, projects can be delayed, and costs can spiral out of control. To address this issue, local governments should develop a detailed plan that identifies all necessary projects, prioritizes them, and establishes a timeline for their completion. The plan should also include accurate cost projections and factor in any contingencies.

Front Line Advisory Group, LLC believes the planning phase of a Capital Improvement Bond Program is the most critical phase, as it sets the foundation for the entire program and determines its success. Proper planning aligns the program with organizational goals, identifies potential obstacles, and builds stakeholder support. Therefore, prioritizing and investing in the planning phase is essential for achieving program objectives.

Inadequate Community Involvement

Another common problem is inadequate community involvement. When the community is not engaged in the planning process, projects can be met with opposition, causing delays and increased costs. To address this issue, local governments should engage the community early in the planning process through meetings, surveys, and outreach efforts. This can help identify community needs and preferences, build support for the projects, and reduce opposition.

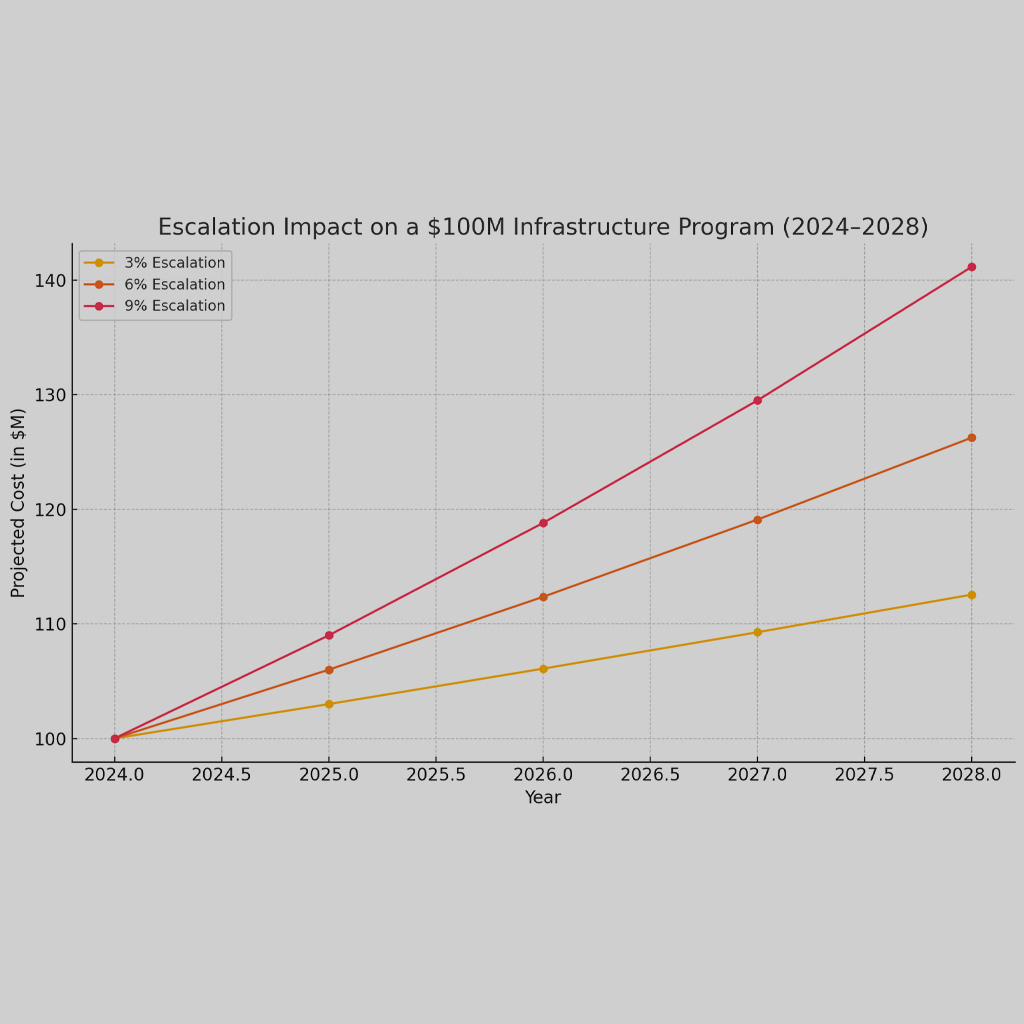

Inaccurate Cost Projections

Inaccurate cost projections are also a common problem during a capital improvement bond program. When cost projections are inaccurate, projects can quickly exceed their budgets, causing delays and reducing the number of projects that can be completed. To ensure accurate projections, local governments should conduct thorough research, consult with experts, and consider all potential costs, including design, construction, materials, and maintenance. It is also important to include contingencies for unforeseen circumstances.

Delayed Implementation

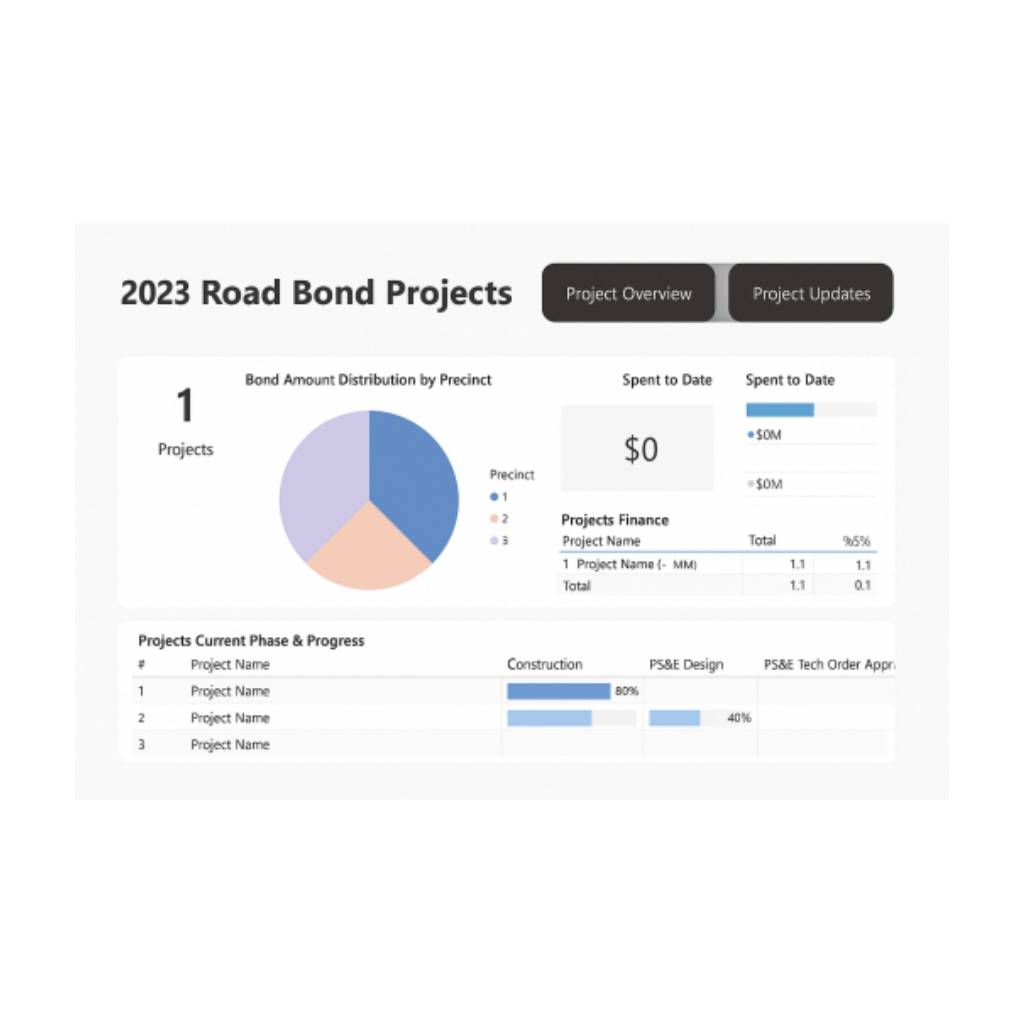

Delayed implementation is another issue that can arise during a capital improvement bond program. Delays can be caused by a lack of planning, community opposition, unforeseen construction challenges, and inadequate project management. To address this issue, local governments should prioritize projects based on their importance and feasibility, streamline the implementation process, and hire experienced project managers.

Inefficient Project Management

Inefficient project management can also cause problems during a capital improvement bond program. Project managers must ensure that projects stay on track, are completed on time and within budget, and meet the needs of the community. To establish efficient project management, local governments should hire experienced project managers, provide them with the necessary resources, and establish clear communication channels.

In conclusion, capital improvement bond programs are an essential source of funding for critical infrastructure projects. However, they can be complex and challenging to manage. By developing a comprehensive plan, engaging the community, conducting accurate cost projections, prioritizing and streamlining implementation, and establishing efficient project management, local governments can overcome common problems and increase the success rate of their capital improvement bond programs.

At Front Line Advisory Group, we transform Capital Improvement Bond Management through expertise & industry knowledge. We empower clients & maximize tax dollars through Program Management Consulting. Contact us for more info at info@frontlineadvisorygroup.com.