A confluence of high stakes, multifaceted dynamics, and the intrinsic complexity of bond programs necessitates the leadership of an exceptionally skilled professional—a Program Management Consultant (PMC). These individuals must navigate the turbulent seas of the bond industry with precision, deep knowledge, and astute judgment. They should exhibit a comprehensive set of qualifications and skills to excel in their role. Digging deeper into the nuances of these attributes reveals their inherent importance in shaping an effective PMC:

1. A Solid Foundation of Experience in the Field

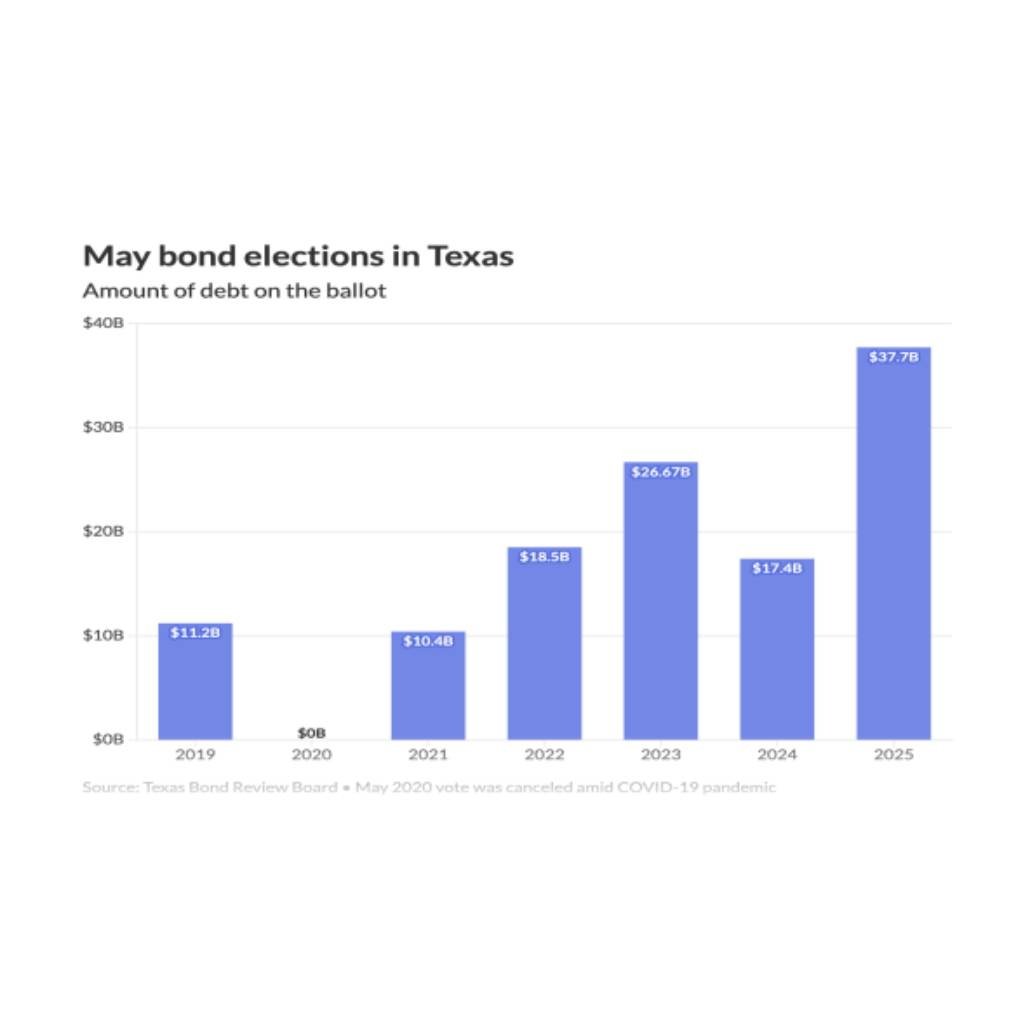

An indispensable cornerstone for any PMC navigating the bond program industry is a strong foundation of practical experience. They must not only have a general understanding of program management but should be deeply embedded within the industry-specific context of bond programs. Such a sturdy background fosters an intricate understanding of the industry’s unique characteristics. A PMC endowed with such experience is equipped with the ability to perceive and leverage underlying patterns, trends, and subtleties that might escape the untrained eye. This can facilitate the generation of valuable insights, strategic decisions, and accurate foresight.

2. Profound Mastery of Project Management Principles

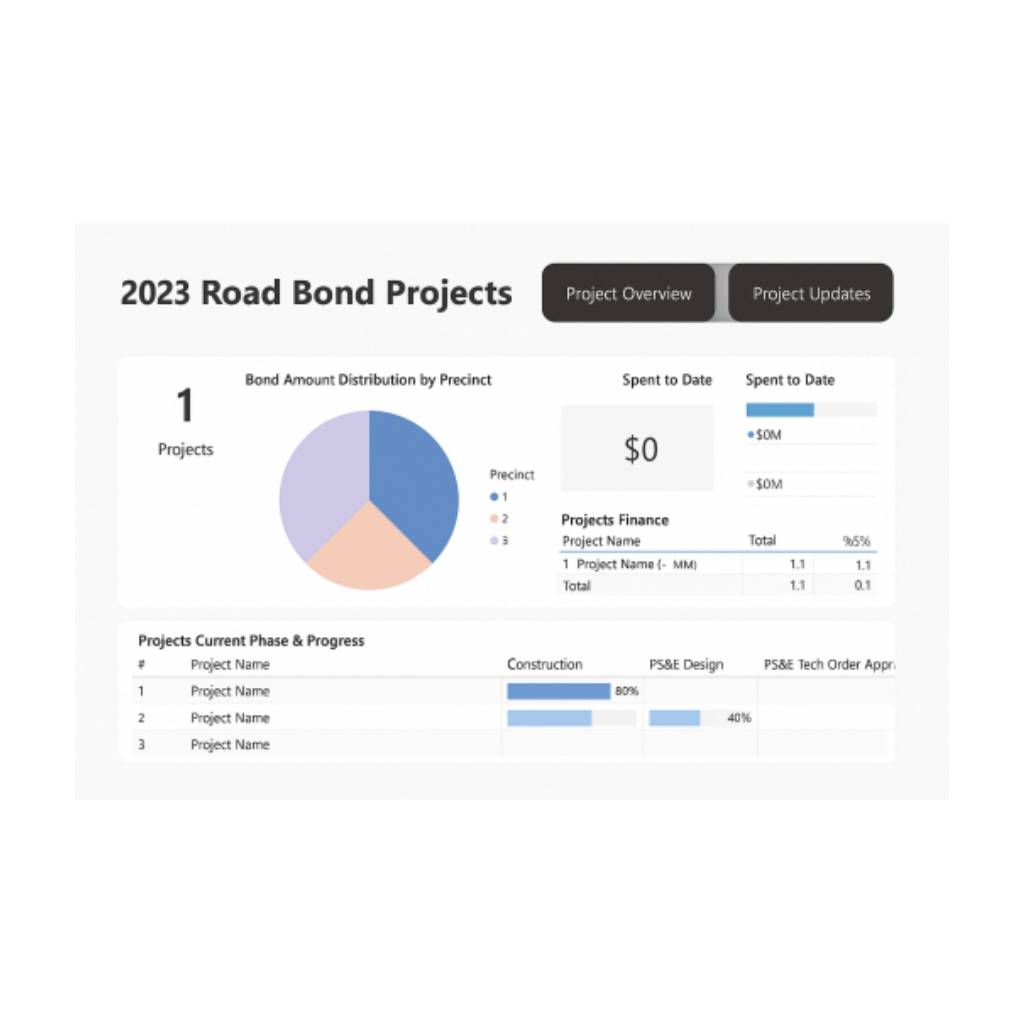

Project management serves as the core framework for the successful execution of any bond program. A PMC must exhibit a profound mastery of its principles, theories, and methodologies. Their ability to adopt these principles and tailor them to the specific needs of the bond program is crucial. From conceptualization to completion, they should efficiently manage resources, time, and costs while maintaining the quality and integrity of the project. As such, their understanding of project management should encompass risk management, process optimization, and change control, effectively ensuring that the program remains on course, within budget, and delivered on time.

3. Exceptional Communication Skills

The intricate web of a bond program involves multiple stakeholders, each with their unique expectations, needs, and reservations. Thus, the PMC must wield exceptional communication skills to bridge these gaps effectively. This extends beyond mere conveyance of information—it involves active listening, empathy, negotiation, and persuasion. The PMC should not only relay the status of the program but also articulate the strategic alignment with its objectives, easing potential concerns, and ensuring consensus among stakeholders, including bondholders, program managers, and contractors. In doing so, they play a crucial role in promoting stakeholder engagement and fostering a harmonious working environment.

4. Advanced Technical Acumen

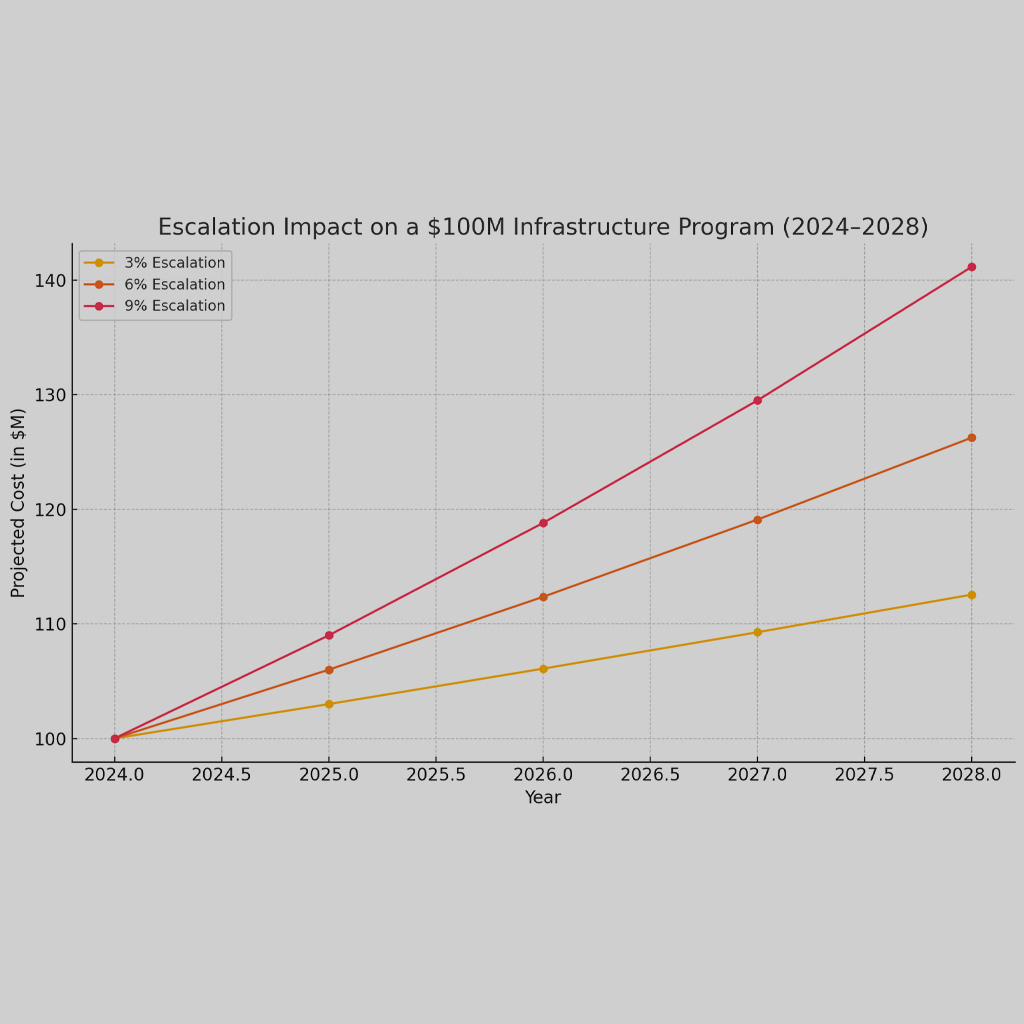

The sheer breadth of the bond program management domain demands a PMC with an advanced level of technical acumen. They need to comprehend and apply knowledge across various interconnected sectors, including finance, construction, and legal issues. This understanding should extend to financial modeling, budgeting and cost estimation, understanding of bond market trends, risk mitigation, construction management, and legislative compliance. With these skills, a PMC can ensure that the bond program progresses smoothly, tackling technical challenges that may arise and making informed decisions that reflect a holistic view of the program’s landscape.

5. Acute Strategic Insight

Beyond the day-to-day execution of tasks, a PMC must possess an acute sense of strategic insight. This involves understanding the wider implications of their decisions, recognizing opportunities and threats in the bond market, and formulating a strategic roadmap that aligns with the organization’s broader goals and objectives. The ability to balance short-term demands with long-term planning is an invaluable skill. By having a clear vision and demonstrating forward-thinking, a PMC can guide the program managers and the team towards achieving the program’s milestones, all while maintaining strategic alignment with the overall business strategy.

6. Unyielding Adaptability and Flexibility

The business landscape of bond programs is a constantly evolving terrain that presents new challenges and unforeseen variables. Consequently, a PMC must exhibit unyielding adaptability and flexibility to navigate these shifting sands effectively. This attribute allows them to pivot plans as circumstances change, ensuring the bond program remains on track despite potential disruptions. The readiness to adapt implies being open to learning, unlearning, and relearning — traits that are integral to the continuous improvement and resilience of the bond program.

7. Exceptional Leadership Qualities

Beyond managing processes and systems, PMCs must also excel at managing people. They should showcase exceptional leadership qualities, demonstrating the ability to inspire and guide a diverse team of professionals. A PMC must encourage a culture of collaboration, stimulate creative problem-solving, and drive the team towards shared objectives. As the decision-making authority, they must also be capable of making tough calls when necessary, and bear the responsibility for the outcomes of the program. Exceptional leaders foster an environment where every team member feels valued, motivated, and aligned with the program’s goals.

8. Uncompromising Ethical Commitment

Lastly, a PMC’s commitment to ethical principles should be unwavering and transparent. Upholding the highest standards of integrity is paramount in their role, given the responsibility and trust placed upon them. This implies a commitment to honesty, fairness, and respect for all stakeholders involved. By acting ethically, a PMC can engender trust, create a positive organizational culture, and safeguard the reputation of the bond program and the broader organization.

In conclusion, the role of a Program Management Consultant in a bond program is a demanding yet crucial one. They should be an expert strategist, a master communicator, a technical specialist, an adaptable leader, and above all, a principled professional. The blend of these attributes creates a PMC that not only navigates the complexities of bond program management effectively but one who also steers the program towards its intended goals efficiently and ethically. The enormous impact of their role underscores the importance of selecting a PMC who embodies this comprehensive skill set. Thus, their contributions become the linchpin for the success of any bond program, reflecting their significance in shaping the financial future of organizations and communities alike.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com