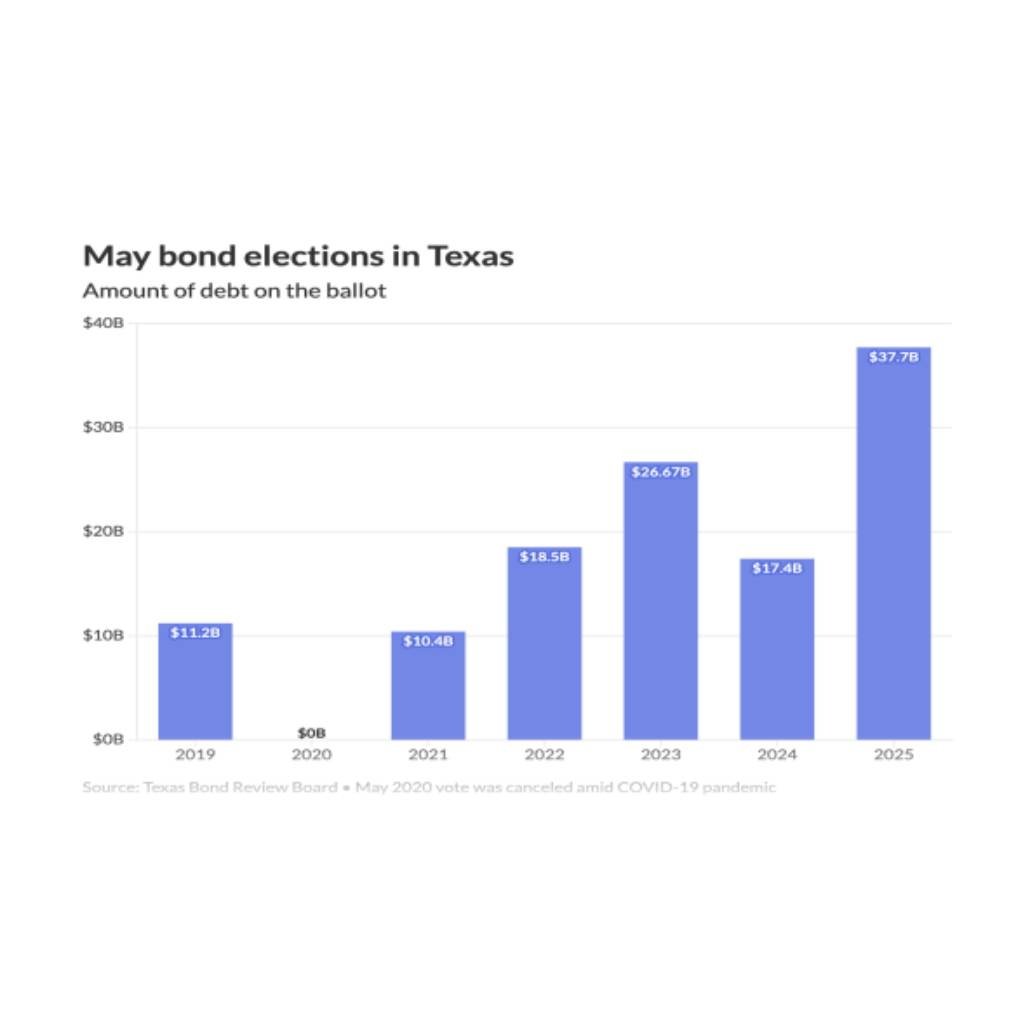

In the ever-evolving realm of capital improvement bond programs, inflation emerges as a pivotal factor, wielding a double-edged influence. For local governments and communities, understanding these dynamics is essential to ensure the longevity and success of their projects.

The Realities of Rising Inflation

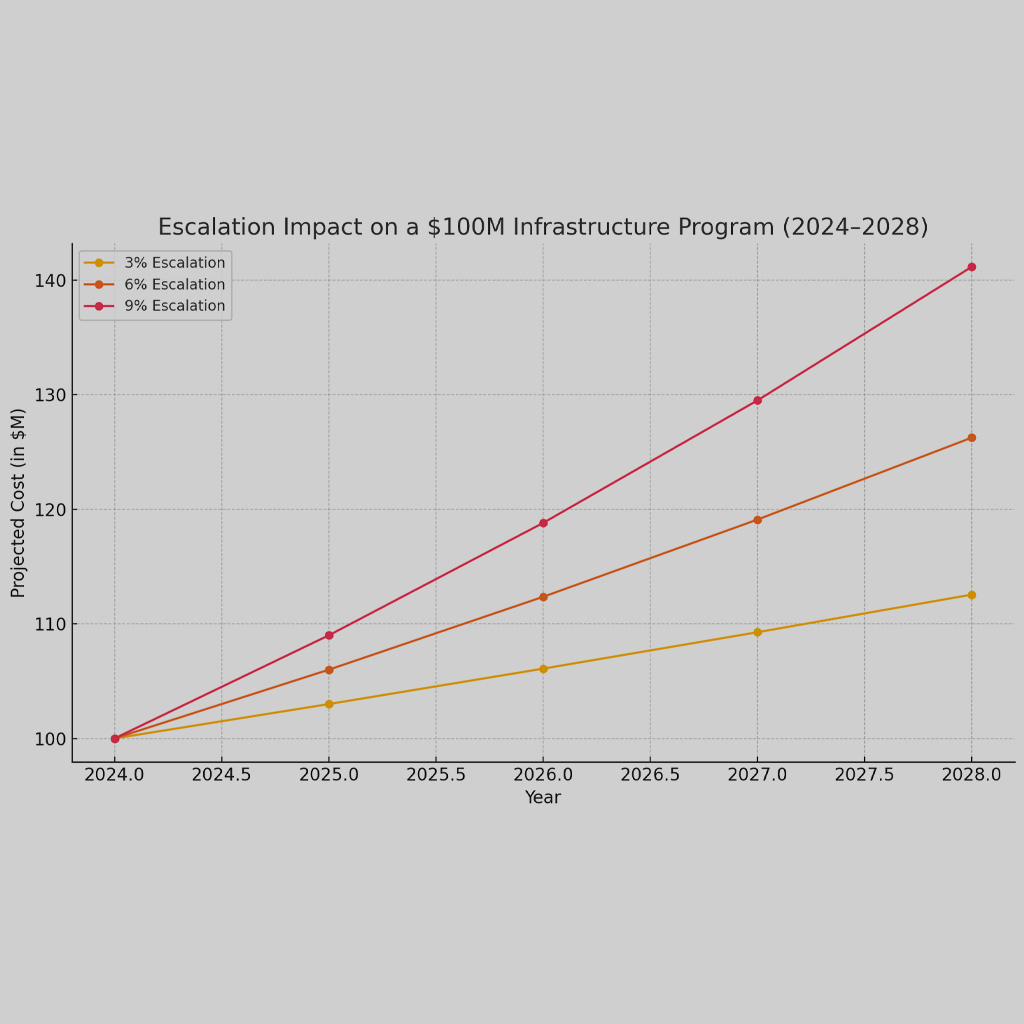

Increased inflation undeniably leaves its mark on construction ventures within a capital improvement bond program. Primarily, as inflation surges, so do the costs of materials and labor. The inevitable consequence? Escalated project expenses. This domino effect may trigger construction hold-ups, primarily if the requisite additional funds aren’t readily at hand. Moreover, the very essence of the bond proceeds is at stake, as inflation chips away at their purchasing power, truncating the scope of work feasible under the given budget.

Yet, there’s more. Inflation’s ripples extend to the arena of interest rates, which, when inflated, burden local governments with heftier borrowing costs. The aftermath is stark: a potential decline in the magnitude of feasible projects owing to a limitation in the bonds that can be rolled out.

The Silver Lining

But it’s not all doom and gloom. Inflation’s uptick can inadvertently stimulate the construction sector. As the demand for materials and labor burgeons in response to rising costs, it catalyzes economic activity within the construction ecosystem. The outcome? A boost in employment opportunities, economic augmentation, and an enhanced community quality of life.

Strategizing Against Inflation’s Tide

Though inflation’s challenges loom large, they aren’t insurmountable. Several tactical maneuvers can be deployed to combat the inflationary tide:

Diversifying Funding Streams

Local administrations could delve into alternative financing reservoirs, be it through grants, enticing private investments, or fostering public-private collaborations.

Budgetary Revamps

Periodic recalibrations of the budget to accommodate inflation can be a safeguard, ensuring projects aren’t left high and dry amidst escalating costs.

Rethinking Construction

Embracing innovative construction techniques, like modular constructs or prefabrication, can potentially temper material and labor costs.

Strengthening Project Oversight

Robust project management can be the linchpin that ensures projects align with their budgetary constraints, even when inflation threatens to derail them.

Inflation-Adaptive Bonds

An intriguing prospect is the issuance of inflation-tethered bonds. These instruments adjust their interest rate in tandem with inflation fluctuations.

However, a word of caution is merited. While these strategies hold promise, they aren’t a panacea. Inflation’s challenges will persist to some degree. Yet, with foresight and strategic planning, local governments can bolster their capital improvement bond programs, ensuring they thrive in the face of economic ebb and flow.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com