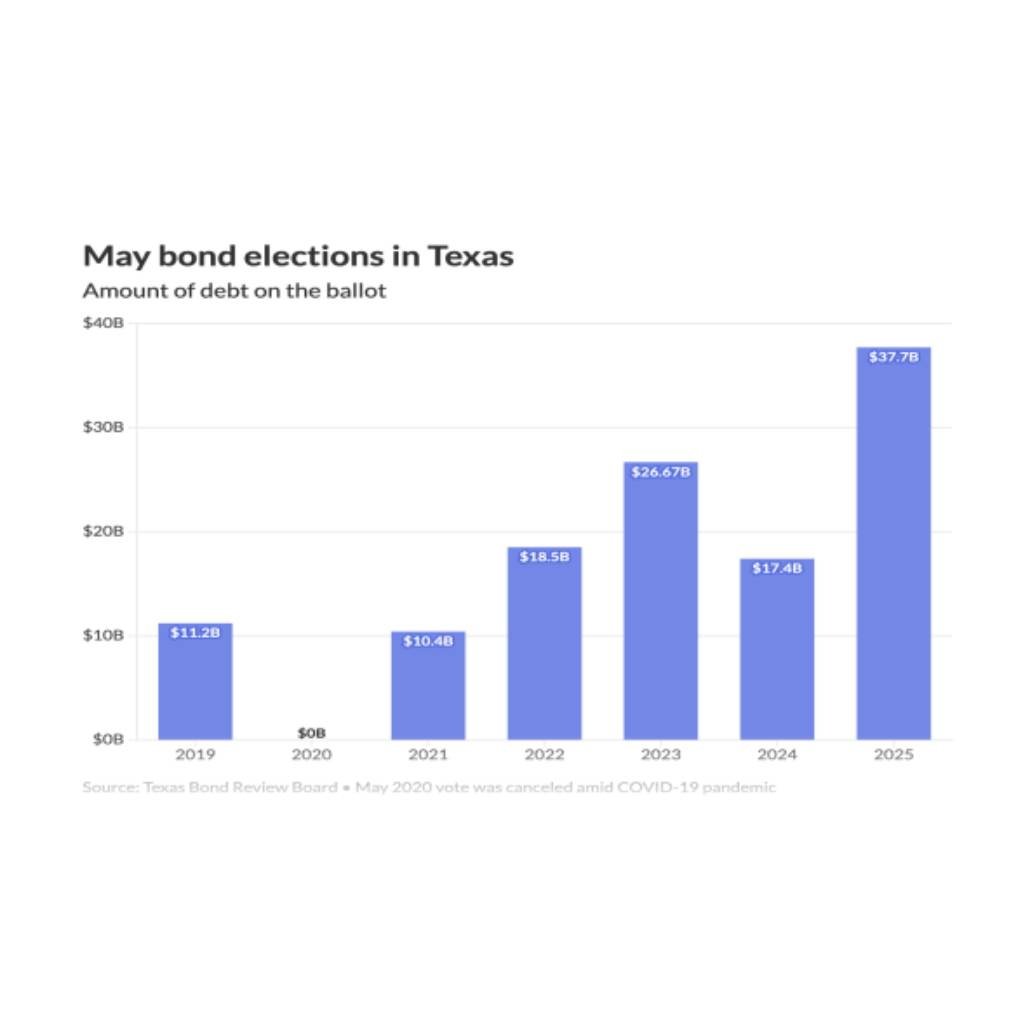

A historic $37.7 billion on the line

On Saturday, May 3, 2025, Texas voters faced an unprecedented choice: authorizing $37.7 billion in general‐obligation bonds—the largest May bond ballot in state history. That sum eclipses prior spring totals and underscores the mounting financing needs of school districts, municipal utility districts (MUDs), cities, and counties across the Lone Star State.

Why May may vanish as a ballot date

This record‐setting volume comes against a backdrop of intense legislative push to eliminate May elections for local tax and bond measures. Governor Greg Abbott and key Republican lawmakers argue that too many off‐cycle votes dilute turnout and undermine the property‐tax relief passed in 2023.

Under House Bill 19—pending in the House Ways and Means Committee—bond and tax referenda would be confined to the November general election require a supermajority (e.g., 60%) to pass impose caps on annual debt‐service enforce tighter controls on anticipation notes and certificates of obligation

The stakes for bond proponents

Industry experts warn that these changes will make future bond approvals far more difficult:

- Turnout dynamics: May elections typically draw an informed and engaged electorate—more favorable to bond passage. November’s high‐profile races can bury bond measures at the bottom, where unfamiliar voters may default to “no.”

- Ballot crowding: Consolidating measures into November may produce lengthy ballots, voter fatigue, and higher rejection rates.

- Financing costs: Simultaneous approvals across jurisdictions could crowd the bond market, increasing yields and borrowing costs.

As Doug Williams, former district superintendent and bond consultant, bluntly put it:

“People voting in November…when they get to the end of the ballot, if they don’t know a whole lot about the measure but they see a tax increase, they vote no.”

— Doug Williams, former district superintendent and bond consultant

Who’s asking for what?

- Public school districts alone account for 133 May measures totaling $12.7 billion. Rapid enrollment growth north of Dallas fueled Celina ISD’s $2.29 billion two‐part request-designed to accommodate a projected quadrupling of students over the next decade. Melissa ISD is seeking $875 million to address doubled enrollment in five years, plus security and technology upgrades.

- MUDs and other special districts represent 53.7% ($20.27 billion) of the total. Collin County MUD 11 is on the hook for $1.32 billion in roads and water infrastructure; Fort Bend County MUD 270 wants $790 million for projects and another $790 million in refundings.

- Cities and counties: Plano leads municipal requests with a nearly $648 million, seven‐part bond package. Laredo, tapping voters for the first time in 32 years, is pursuing $417 million for safety, roads, and housing; Montgomery County is on the ballot for $480 million in road improvements.

- Higher‐ed: Alamo Colleges District plans a $987 million bond to scale up for a forecasted 100,000 students by 2030.

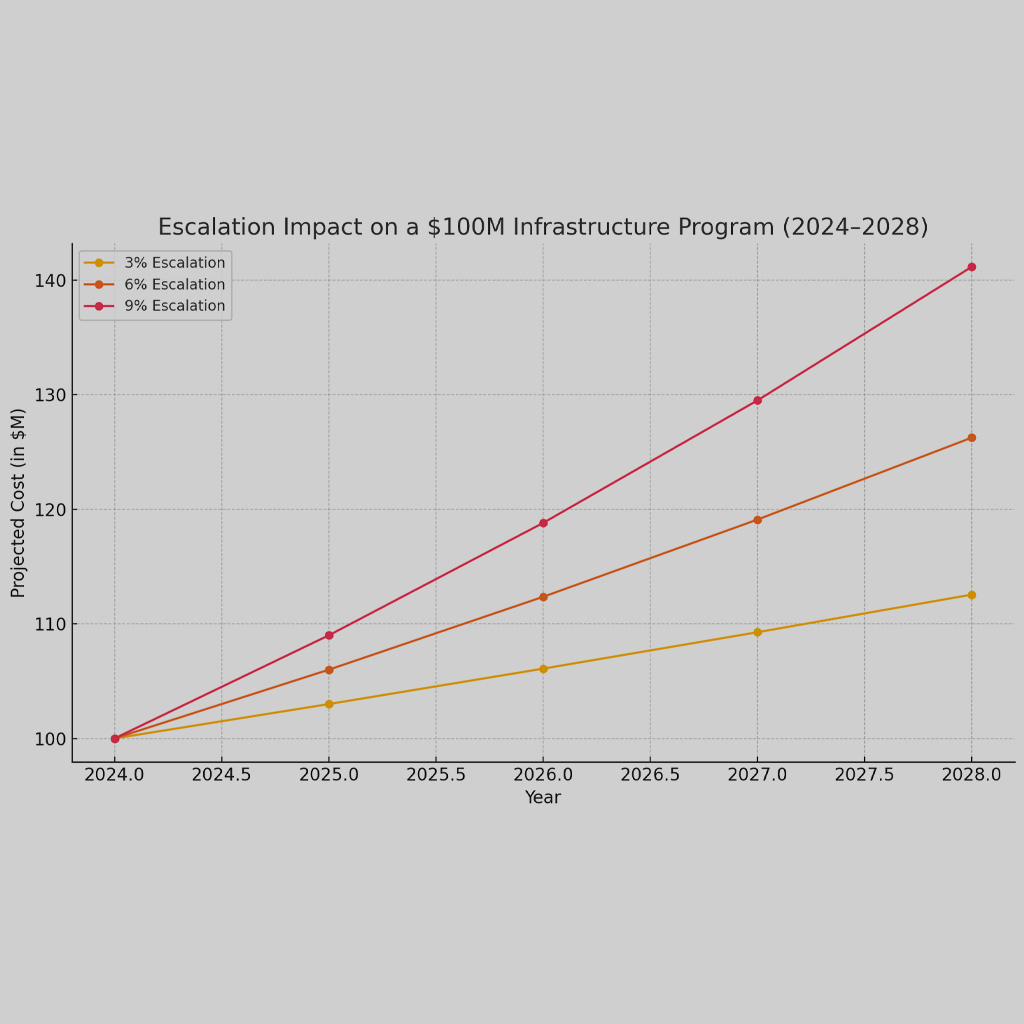

Underlying forces: enrollment and cost pressures

Two core drivers are compelling districts back to voters:

- Enrollment surges: Rapid growth in north-central Texas brings capacity issues

- Inflation in construction costs: Existing bond projects need supplemental funds due to rising costs

Rating agencies note that while Texas school districts benefit from the Permanent School Fund’s AAA guarantee, growing authorized but unissued debt—over $32 billion heading into this May—poses a long‐term liquidity challenge. Meanwhile, stagnant state per‐pupil funding and the tapering of federal pandemic aid strain operating budgets, prompting some districts to draw on reserves or accept credit downgrades.

What comes next?

If HB 19 or similar legislation becomes law:

- May 2026 will almost certainly see no bond propositions. All local debt measures would wait until November 2026.

- Voters would need a higher bar-potentially 60%-to approve bonds, a significant shift from the simple‐majority standard in most districts.

- Jurisdictions may face higher borrowing costs as their issuance windows narrow and market timing becomes crowded.

For bond program managers and public‐sector leaders in Texas, the clock is ticking. If this truly is the last May vote, local officials must ensure clarity, transparency, and vigorous community outreach now—because the easier path to approval in an off‐cycle spring election may soon disappear forever.

Bottom line Texas set a May bond record at $37.7 billion, driven by school growth and rising project costs. But legislative efforts threaten to end May elections and raise approval thresholds—raising the stakes for local governments to sharpen their messaging and engage voters more deeply than ever before.

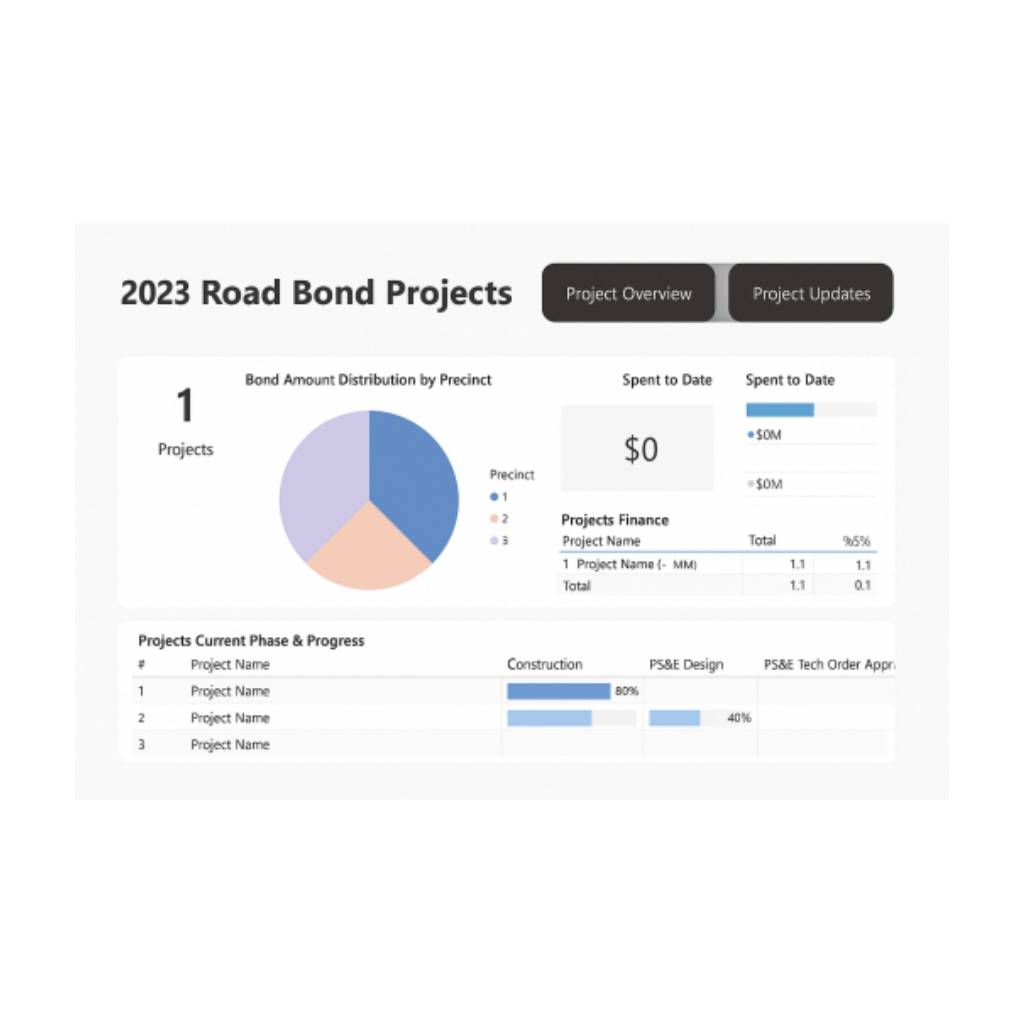

Front Line Advisory Group (FLAG) is a Program Management Consulting (PMC) firm focused on delivering bond-funded infrastructure projects on time and on budget through disciplined management and data-driven controls. Our mission extends beyond consultation — we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting.For more information or to commence your journey towards transformative bond management, reach out to us at Info FLAG.