In capital improvement bond programs, distinctly separating the roles of the Program Management Consultant (PMC) and the General Engineering Consultant (GEC) proves strategic. The PMC focuses on program governance, ensuring judicious budgeting and timely execution, while the GEC delves into technical intricacies. This division enhances efficiency and offers a robust defense against potential challenges, underpinning a resilient implementation strategy.

Objectivity and Checks and Balances

When two different entities are involved, each can act as a counterbalance to the other. This balance ensures that neither entity can push forward unchecked agendas or make unilateral decisions without oversight. For instance, if the GEC proposes a particular design or technical approach, the PMC can evaluate its feasibility in terms of budget, timeline, and program objectives. This dual-layer of scrutiny can result in better decision-making.

Specialization

Different entities bring specialized expertise to the table. A PMC might have professionals well-versed in project management, finance, and logistics, while the GEC would have engineers and technical experts. When each entity focuses on its area of expertise, the likelihood of mistakes due to unfamiliarity or lack of knowledge decreases. This results in a more efficient and effective program.

Risk Management

Risks are inherent in any large project or program. By having two distinct entities, there’s a double layer of risk assessment. While the GEC might identify technical risks, the PMC can focus on programmatic risks like timeline slippages or budget overruns. This dual risk assessment can provide a comprehensive risk profile, leading to better risk mitigation strategies.

Transparency and Trust

Public trust is crucial, especially when public funds are involved in capital improvement programs. By separating roles, there’s an inherent system of oversight, making it harder for unethical practices to occur. The public, or any stakeholder, can rest assured that decisions and actions are being cross-reviewed, leading to higher trust in the program’s management.

Flexibility

Imagine a scenario where the GEC isn’t delivering to expectations. If roles were combined, making a change could disrupt the entire program. However, with separate entities, one can be changed or adjusted without causing a complete program upheaval. This modular approach allows for greater flexibility in management.

Focused Responsibility

When something goes wrong, accountability is crucial. With distinct roles, pinpointing areas of responsibility is more straightforward. If there’s a technical flaw, it falls under the GEC’s purview, while programmatic issues like delays or budget overruns would be the PMC’s responsibility. This clear delineation of roles ensures that corrective actions are directed appropriately.

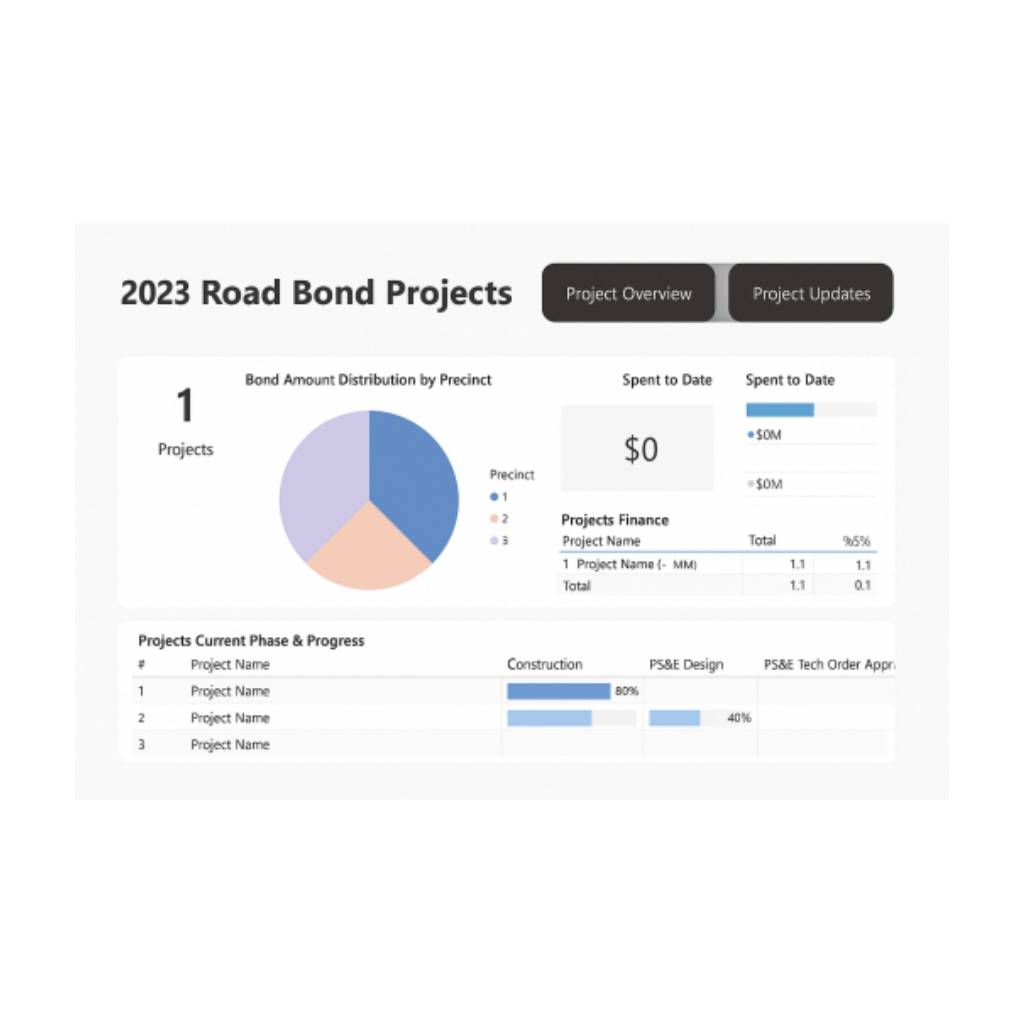

Efficient Communication

With a centralized PMC responsible for overarching program communication, stakeholders receive consistent, coherent updates. Instead of having multiple technical voices from the GEC trying to communicate various aspects of the projects, the PMC can consolidate information, ensuring that stakeholders get a clear and unified picture of the program’s status.

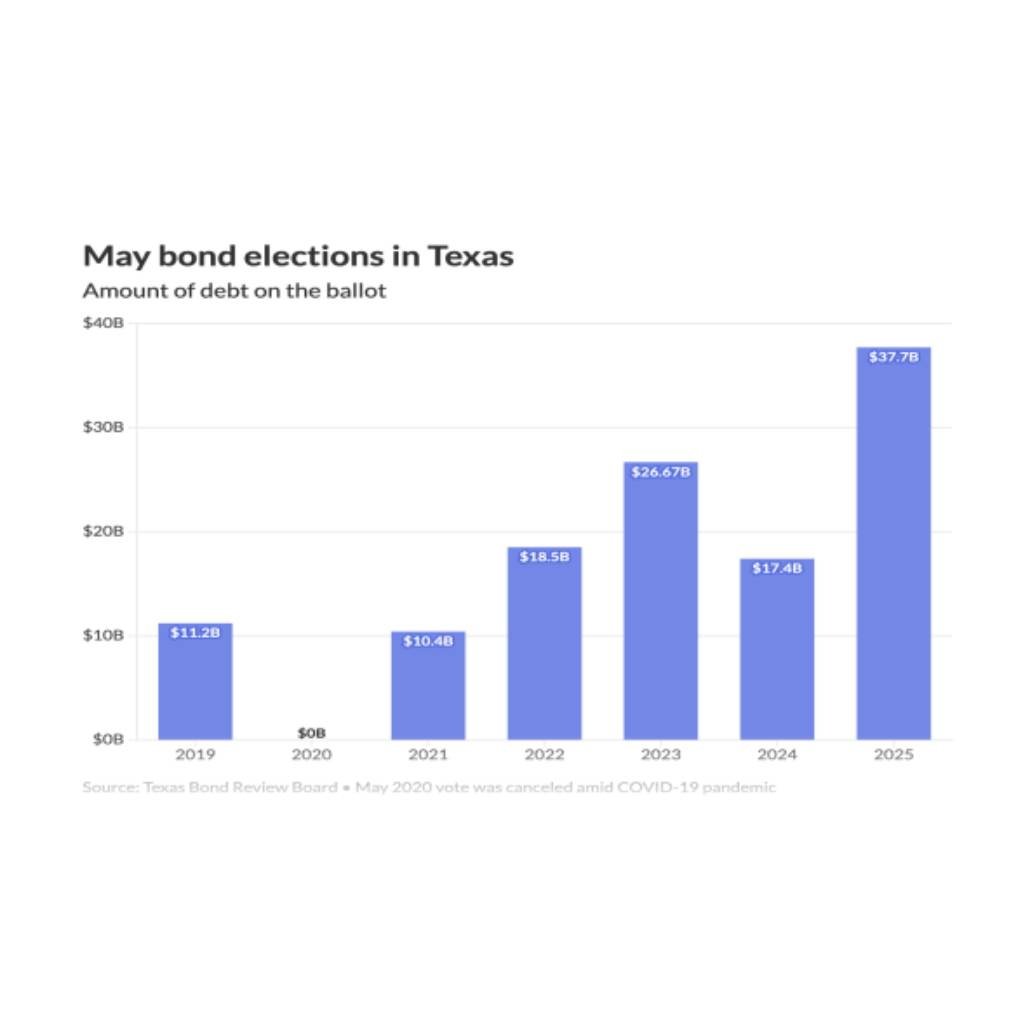

The question many ask though, “How much more will this model cost me?!?!”

The inclusion of a Program Management Consultant (PMC) in a capital improvement bond program can introduce financial efficiencies that can result in significant cost savings, ultimately allowing the PMC’s presence to effectively “pay for itself.”

HOW?

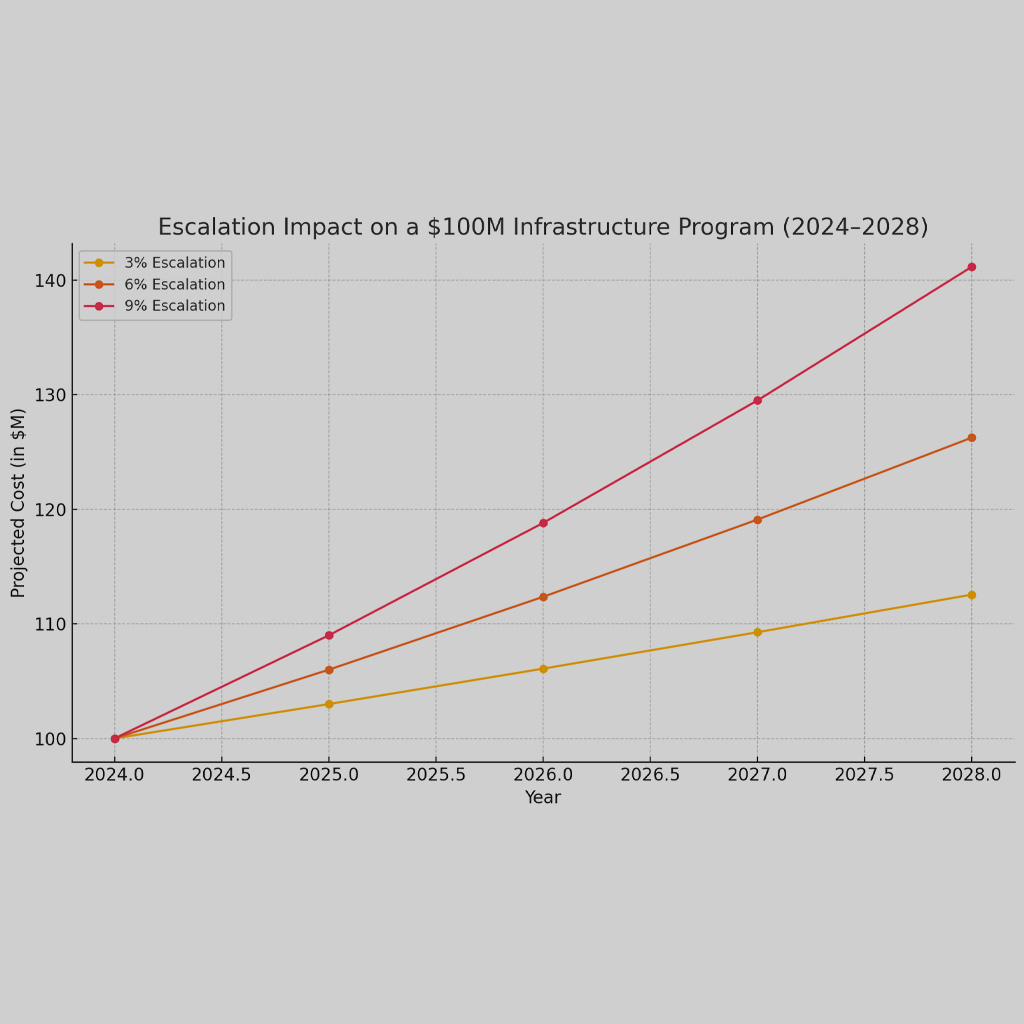

Strategic Planning and Budget Oversight

A PMC’s primary responsibility is to ensure that a program is executed as efficiently as possible within its scope and budget. With their expertise in project management and finance, PMCs can set realistic budgets, closely monitor expenditures, and identify potential financial pitfalls early on. This proactive financial management helps avoid unexpected costs and budget overruns that could be more costly in the long run.

Risk Mitigation

Every project has associated risks, and without proper management, these risks can lead to costly delays or mistakes. A PMC can identify, evaluate, and prioritize these risks, then develop strategies to mitigate them. By preventing or minimizing the impact of these risks, the program can avoid unexpected expenses, thereby saving money.

Efficiency in Resource Allocation

PMCs are adept at ensuring resources—both human and material—are used efficiently. This means deploying the right number of people for specific tasks, ensuring equipment and materials are procured at the best prices, and avoiding wastage. Efficient resource management can result in substantial savings over the lifecycle of a project.

Vendor and Contract Management

PMCs can manage contract negotiations, ensuring that the program gets the best value for its money. Their expertise in the market allows them to identify and negotiate with vendors effectively, ensuring quality work at competitive prices. Additionally, by monitoring contractor performance and deliverables, PMCs ensure that all contractual obligations are met, reducing the potential for costly disputes or redoing of work.

Value Engineering

One of the roles of a PMC is to evaluate technical solutions proposed by the General Engineering Consultant (GEC) or contractors. By doing so, PMCs can suggest alternatives that achieve the same objectives at a lower cost or recommend solutions that provide better long-term value, even if they come with a slightly higher initial price tag.

In essence, while hiring a PMC introduces an additional cost to the program, the efficiencies and savings they bring to the table can more than offset their fees. Over the span of a large capital improvement bond program, a PMC’s strategic oversight and management expertise can lead to substantial cost savings, effectively allowing their inclusion to pay for itself.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com