“It’s the little details that are vital. Little things make big things happen.”

— John Wooden

Unseen Architects: The Invisible Power of Municipal Bonds in Shaping Our Cities

When you stroll through a city’s lively streets, marvel at its architectural wonders, or enjoy a sunny afternoon in a well-kept park, it’s easy to credit visionary architects, dedicated urban planners, and perhaps even the city’s leadership. Yet, there’s a hidden force at play—an invisible architect—that turns ambitious blueprints into tangible reality: municipal bonds. These financial instruments quietly fund the public projects that define our daily experiences, shaping the very essence of urban life.

The Silent Backbone of Development

Municipal bonds are essentially loans made by investors to local governments. In return for their investment, investors receive periodic interest payments and the promise of repayment at a future date. This mechanism allows cities to amass the capital needed for large-scale projects without immediately taxing residents or depleting reserves. From building new schools and hospitals to upgrading transportation systems, these bonds are the silent backbone enabling cities to grow and thrive.

Turning Visions into Reality

Imagine a neglected waterfront transformed into a vibrant public space with walking paths, recreational facilities, and cultural venues. Such transformations require significant upfront funding—money that municipal bonds can provide. By securing this capital, cities can undertake projects that revitalize neighborhoods, boost local economies, and enhance the quality of life for residents.

Empowering Communities Through Infrastructure

Municipal bonds don’t just build structures; they build communities. Funding from these bonds can modernize public transit, reducing commute times and lowering carbon emissions. They can expand libraries and community centers, providing educational resources and gathering places that strengthen social ties. Every project financed through a municipal bond has the potential to leave a lasting positive impact on the community it serves.

A Tale of Two Bonds

There are two primary types of municipal bonds that cities employ:

- General Obligation Bonds: These are backed by the full faith and credit of the issuing municipality. They are considered low-risk because they are secured by the government’s power to tax its residents. Funds from these bonds typically go toward projects that benefit the public good but may not generate direct revenue, like public schools or emergency services.

- Revenue Bonds: These are repaid through the income generated by the specific project they fund. For instance, a city might issue a revenue bond to build a toll bridge, repaying investors with the tolls collected from drivers. While potentially more lucrative, they carry higher risk if the project doesn’t generate expected revenues.

The choice between these bonds depends on the nature of the project and the financial strategy of the municipality.

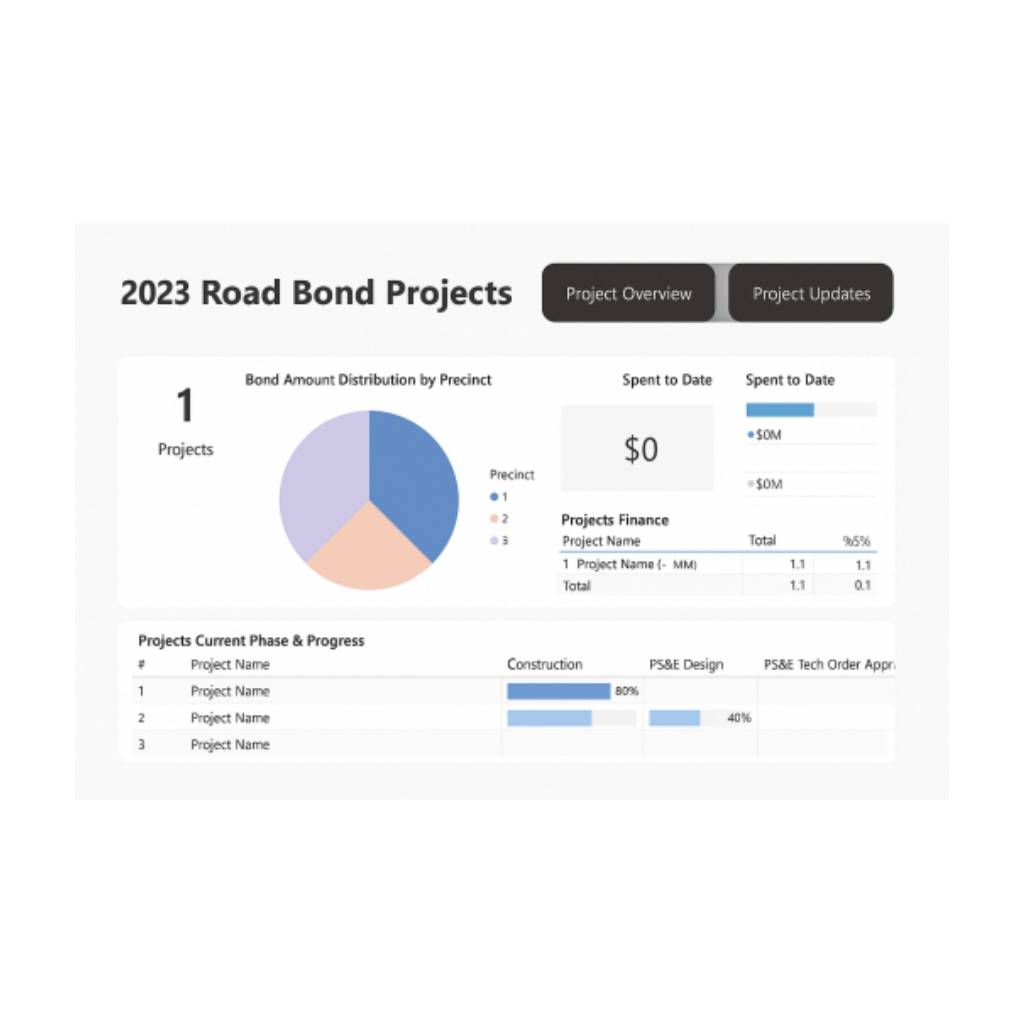

The Intricacies Behind the Scenes

While the outcomes of municipal bonds are visible—a new park here, an expanded highway there—the processes behind them are complex and meticulously planned. City officials and financial advisors assess economic forecasts, interest rates, and community needs. They must balance ambition with fiscal responsibility, ensuring that today’s developments don’t become tomorrow’s burdens.

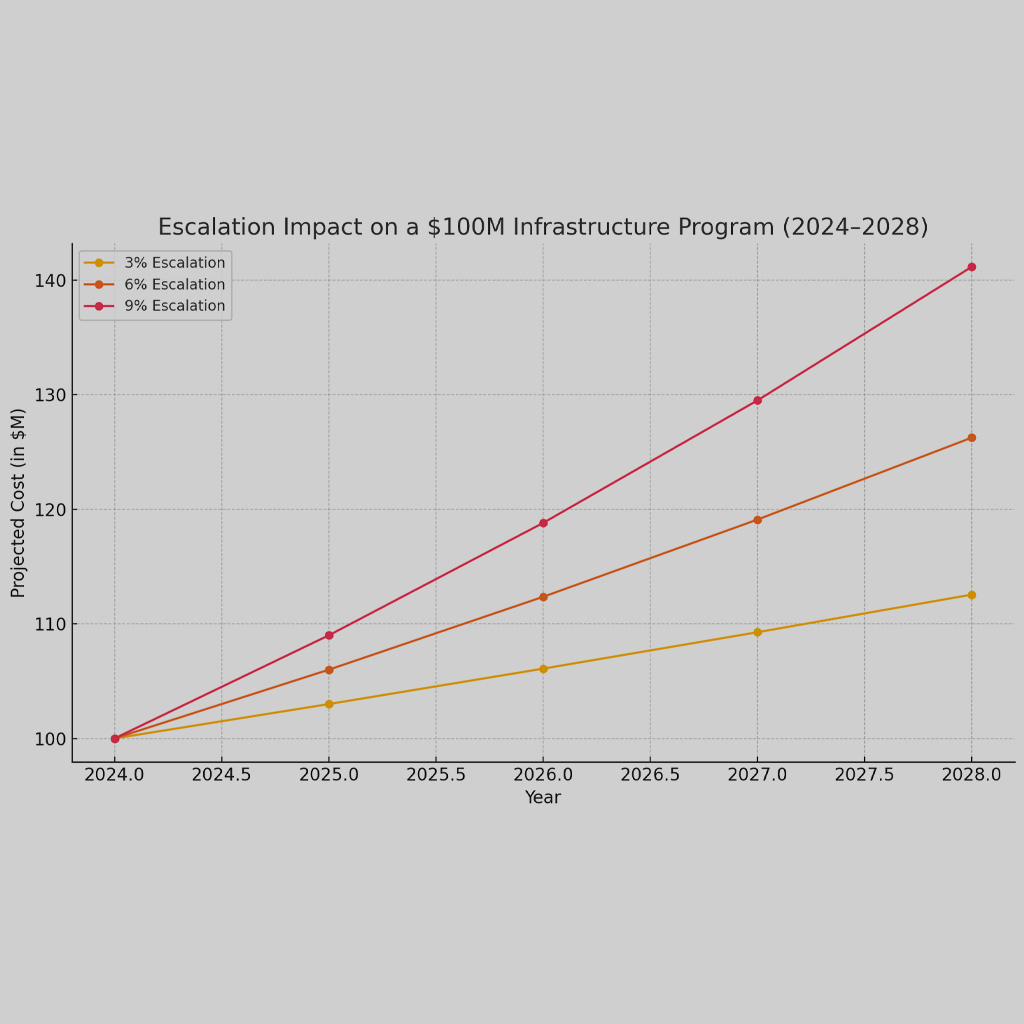

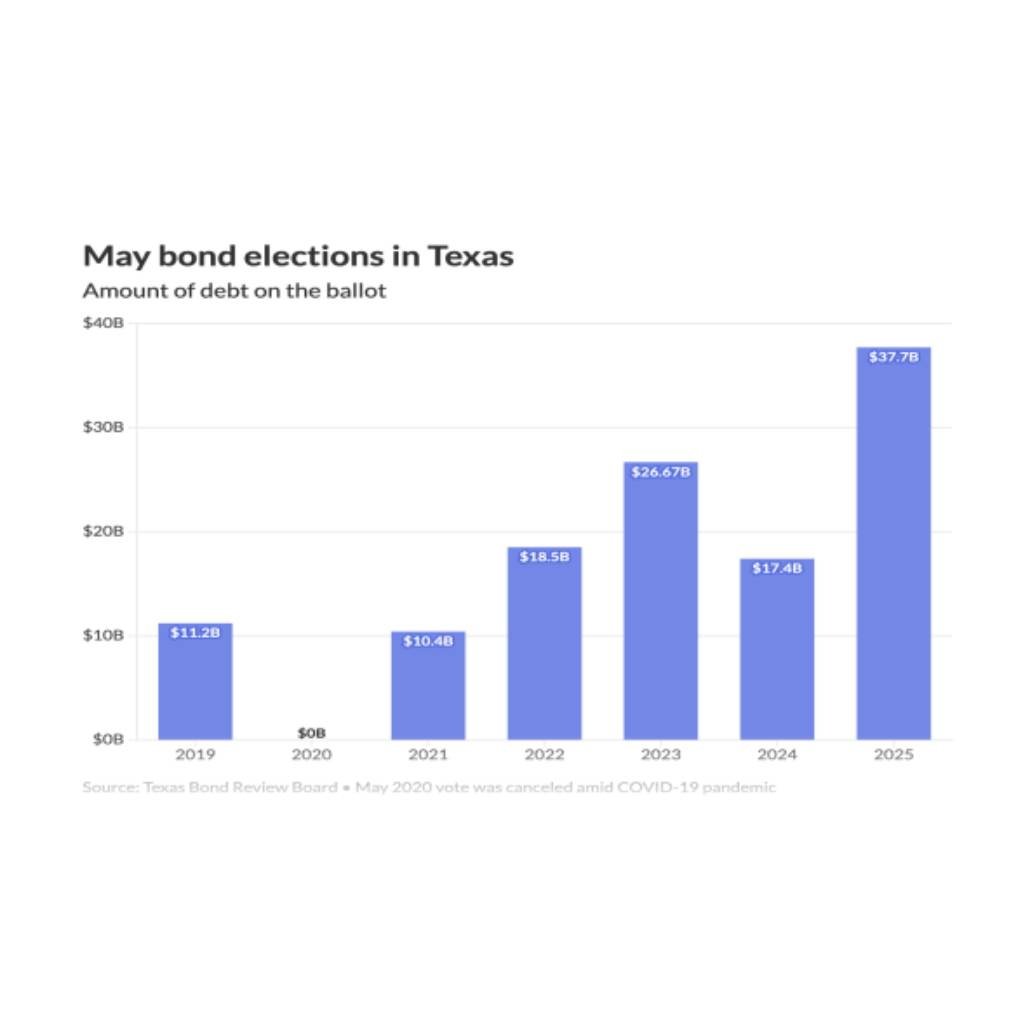

Challenges on the Horizon

Municipal bonds are powerful, but they’re not without challenges. Economic downturns can strain a city’s ability to repay its debts, potentially leading to budget cuts or increased taxes. Projects funded by revenue bonds might underperform, leaving municipalities scrambling to cover shortfalls. Transparency with the public about these risks is crucial to maintain trust and support.

Stories of Transformation

Consider the story of a mid-sized city that faced declining industry and a shrinking population. City leaders envisioned a renaissance centered around tech innovation and sustainable living. Through municipal bonds, they financed the construction of a green tech park, complete with energy-efficient buildings and spaces for startups. The project attracted new businesses, created jobs, and reversed the city’s economic decline. Residents witnessed firsthand how these unseen financial tools could catalyze real-world change.

Investing in the Future

As cities grapple with challenges like climate change, aging infrastructure, and population growth, municipal bonds offer a pathway to proactive solutions. They can fund renewable energy projects, resilient infrastructure designed to withstand extreme weather, and affordable housing initiatives. By investing now, cities position themselves to meet future demands head-on.

The Human Element

At the heart of every municipal bond is a collective decision about what a community values. These bonds reflect priorities—be it education, safety, health, or the environment. They are instruments through which residents, investors, and governments collaborate to build a shared future. This partnership is a testament to the power of communal effort and the belief that, together, we can create something greater than ourselves.

Conclusion

Municipal bonds may operate behind the scenes, but their impact is all around us. They are the unseen architects, crafting the framework upon which our cities stand. By understanding and appreciating the role they play, we gain a deeper insight into how our urban environments come to life. The next time you enjoy a new library, drive on a freshly paved road, or visit a revitalized downtown district, you’ll know there’s more to the story—a story of financial ingenuity quietly shaping the world we inhabit.