Bond programs play a pivotal role in financing public infrastructure projects, from schools and hospitals to roads and bridges. These programs, funded by the sale of bonds to investors, are critical in meeting the community’s growing needs. However, as the scale and complexity of these projects expand, ensuring transparency and accountability in how funds are utilized becomes paramount. Taxpayers and investors alike demand visibility into the progress of these projects and the financial stewardship of their contributions. This blog post delves into the measures in place to uphold these principles throughout the lifecycle of bond programs, reflecting the evolving expectations in an era where technology enables real-time information sharing.

The Imperative for Transparency and Accountability

The complexity and size of modern bond programs underscore the need for stringent transparency and accountability measures. These are not merely administrative checkboxes but foundational elements that ensure public trust and the ethical management of funds. As taxpayers bear the financial burden, it’s only reasonable that they demand comprehensive insights into how their money is being spent. Transparency in bond programs serves to deter corruption and mismanagement, providing a clear trail of financial transactions and project milestones. Accountability mechanisms ensure that those responsible for managing these programs are held to high standards of performance and integrity. In today’s digital age, where information is expected to be readily accessible, these measures are no longer optional but mandatory expectations from tax-paying citizens.

Mechanisms for Ensuring Transparency and Accountability

1. Regular Updates

Frequent and detailed progress reports are crucial in maintaining transparency throughout the lifespan of a bond program. These updates should cover both financial expenditures and project milestones, providing a comprehensive view of how funds are allocated and utilized. Regular reporting fosters an environment of trust, allowing taxpayers to see the tangible outcomes of their investments.

2. Content of Updates

Updates should include detailed financial statements, budget allocations, spending to date, and projections for future expenses. Additionally, they should cover project progress, highlighting completed phases, current work in progress, and schedules for upcoming milestones. This dual focus ensures that stakeholders have a holistic understanding of both financial and operational aspects of the program.

3. Public Meetings

Public meetings serve as a platform for direct communication between the program managers and the community. These gatherings allow for the presentation of progress reports, financial overviews, and future plans. More importantly, they offer a forum for public feedback, questions, and concerns, ensuring that community voices are heard and considered in the decision-making process.

4. Conducting Meetings

To be effective, public meetings should be well-publicized, accessible, and held at convenient times. Utilizing various channels, including social media, local news, and community bulletins, ensures that a wide audience is reached. Facilitating participation through remote access options or town-hall formats can further increase engagement and inclusivity.

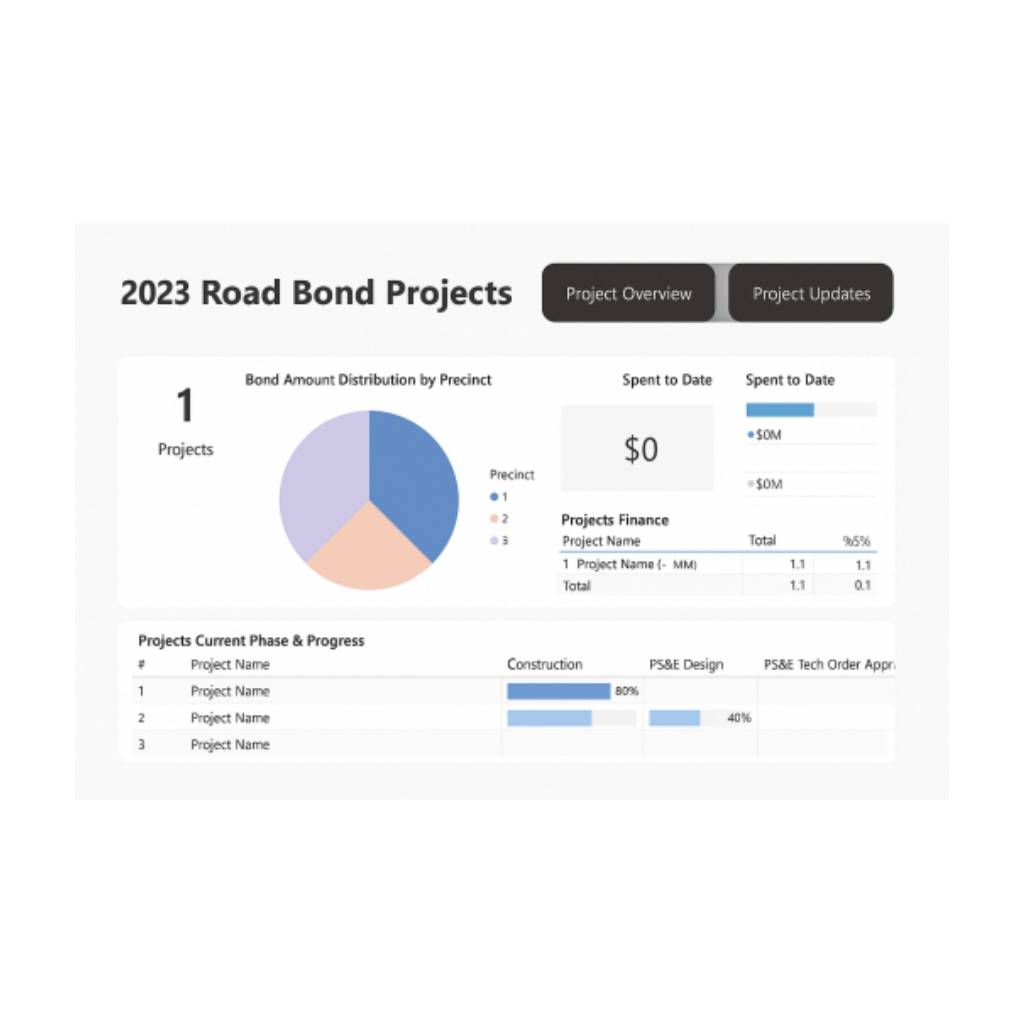

5. Online Dashboards

Technology plays a pivotal role in modern transparency efforts, with online dashboards offering real-time access to bond program information. These platforms can feature interactive maps, detailed financial tracking, and progress timelines, allowing users to explore data at their convenience.

6. Features of Dashboards

Effective dashboards should be user-friendly and regularly updated, providing access to financial reports, project updates, and future projections. Interactive elements, such as clickable project maps or graphical financial breakdowns, enhance the user experience, making complex information more digestible and engaging.

7. Independent Audits

Independent audits are a critical component of accountability, offering an unbiased evaluation of financial records and program management. Conducted by external entities, these audits verify the accuracy of financial reporting and the adherence to stated project timelines and budgets. The findings of these audits should be publicly available, adding an additional layer of transparency.

8. Community Involvement

Active community involvement in bond programs not only fosters transparency but also ensures that projects align with public needs and expectations. Encouraging community feedback through surveys, focus groups, and public comment periods allows stakeholders to contribute to project planning and evaluation.

Case Studies

To provide real-world examples of transparency and accountability in public infrastructure projects, we can look into initiatives that have demonstrated significant efforts in these areas.

One such example is found through the Open Contracting Partnership’s exploration of infrastructure transparency. Their work focuses on integrating contracting data with project information to enhance scrutiny and public understanding of infrastructure projects. They’ve examined various countries, including Ukraine, the UK, and Honduras, identifying opportunities to use open contracting data to support greater transparency for infrastructure projects. This approach emphasizes the importance of connecting various stages of infrastructure projects, from planning to completion, with transparent data sharing and public engagement to ensure accountability.

In the United States, the Bipartisan Infrastructure Law represents a substantial commitment to modernizing the country’s infrastructure with an emphasis on transparency and public accountability. This law, aimed at addressing a wide range of infrastructure needs—from roads and bridges to water systems and broadband internet—underscores the economic and social imperatives of investing in infrastructure. By focusing on areas critical to economic growth and public welfare, the law seeks to lay a foundation for long-term improvements in the U.S. infrastructure landscape. The initiatives under this law are geared towards not just the physical redevelopment of the nation’s infrastructure but also ensuring that investments are made transparently and accountably, reflecting the principles of good governance and public stewardship.

These examples underscore the evolving landscape of infrastructure development, where transparency and accountability are increasingly recognized as pivotal elements. By leveraging technology, open data standards, and public engagement, these projects aim to foster trust between governments and citizens, ensuring that infrastructure investments deliver maximum benefit to communities while adhering to principles of fairness and efficiency.

Conclusion

The measures to ensure transparency and accountability in bond programs are crucial in maintaining public trust and ensuring the ethical use of funds. As bond programs continue to grow in complexity, the implementation of these measures should be considered a mandatory expectation by all tax-paying citizens.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com

Further Reading: