“Failing to plan is planning to fail.”

– Benjamin Franklin

Planned Unit Developments: Investing in Communities

The article will cover:

- What a PUD is and how it functions

- How PUDs resemble financial instruments like bonds

- Why PUDs are growing in popularity

- Benefits and drawbacks of PUDs

- Case studies of successful (and failed) PUDs to illustrate their impact

Planned Unit Developments (PUDs) are popping up in cities and suburbs across the country, promising a mix of homes, shops, parks, and more in one thoughtfully designed neighborhood. For local elected officials, PUDs offer a way to guide growth and boost the tax base, while for residents they create convenient, amenity-rich communities. This article explains what PUDs are, how they work financially (in ways similar to bonds), why they’re growing in popularity, and what benefits and drawbacks they bring. We’ll also look at real-world case studies – including both success stories and cautionary tales – to see PUDs’ impact on finances and neighborhoods.

What Is a Planned Unit Development (PUD)?

A Planned Unit Development (PUD) is a type of development and zoning plan that creates a cohesive community with a mix of housing and other uses, often governed by a homeowners association (HOA). In a PUD, developers and local authorities agree on a custom plan for an area, which can include single-family homes, townhouses, apartments, and sometimes commercial buildings, all integrated with shared open spaces and amenities. Unlike traditional projects, a PUD doesn’t strictly follow standard zoning for each lot – developers get flexibility to cluster buildings, mix uses, and preserve green space in exchange for meeting overall community standards. Every homeowner in a PUD owns their individual property as well as a share of common areas, and membership in the HOA is mandatory to ensure the community’s upkeep and rules are followed.

In practical terms, a PUD functions like a neighborhood with a master plan. The development might include features such as parks, playgrounds, walking trails, a clubhouse or pool, and even shops or schools nearby – all by design. Local planning commissions usually require developers to go through a special approval process for PUDs, often in multiple stages (preliminary plans, public hearings, final plan approval). This process lets the city negotiate conditions like infrastructure improvements or affordable housing before granting the zoning flexibility. Developers may also be required to provide guarantees – for example, posting a performance bond to ensure the PUD is built according to the approved plans – which protects the city and residents if the developer fails to complete promised improvements.

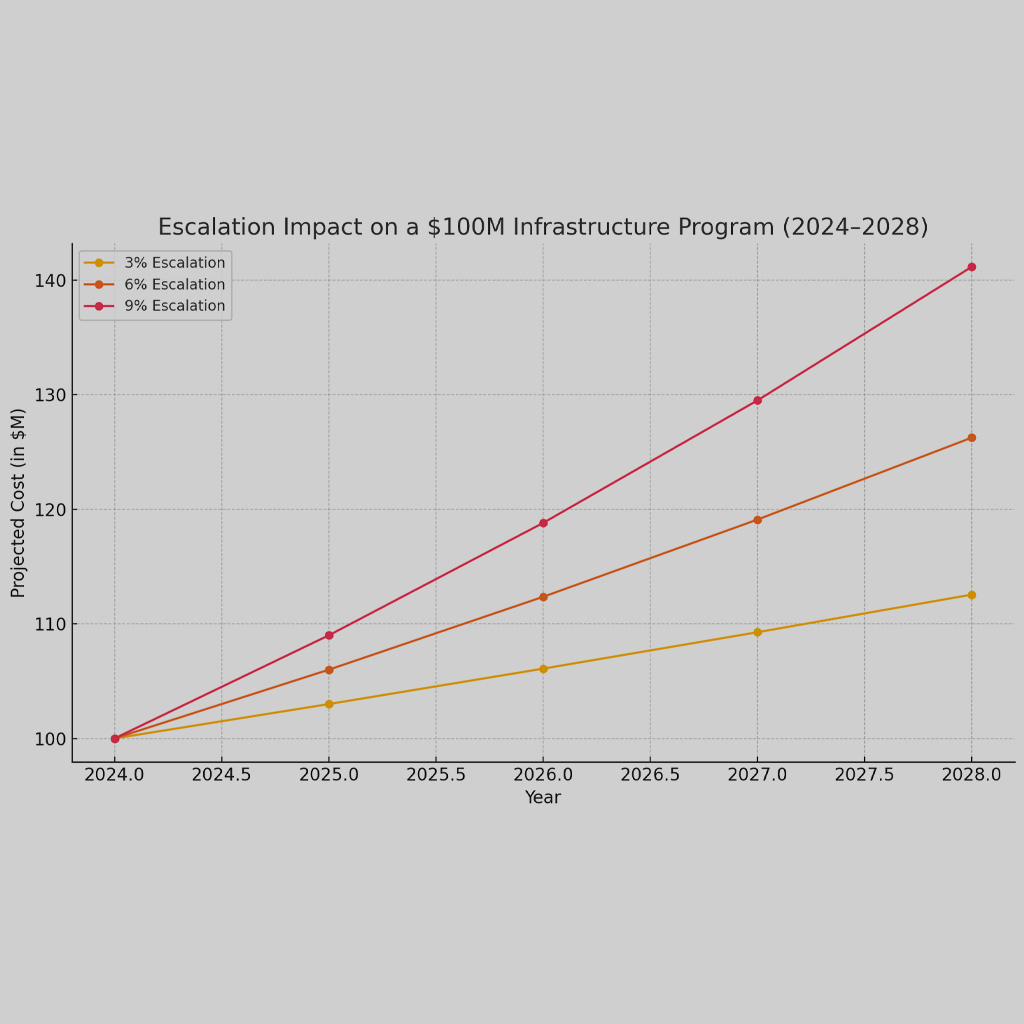

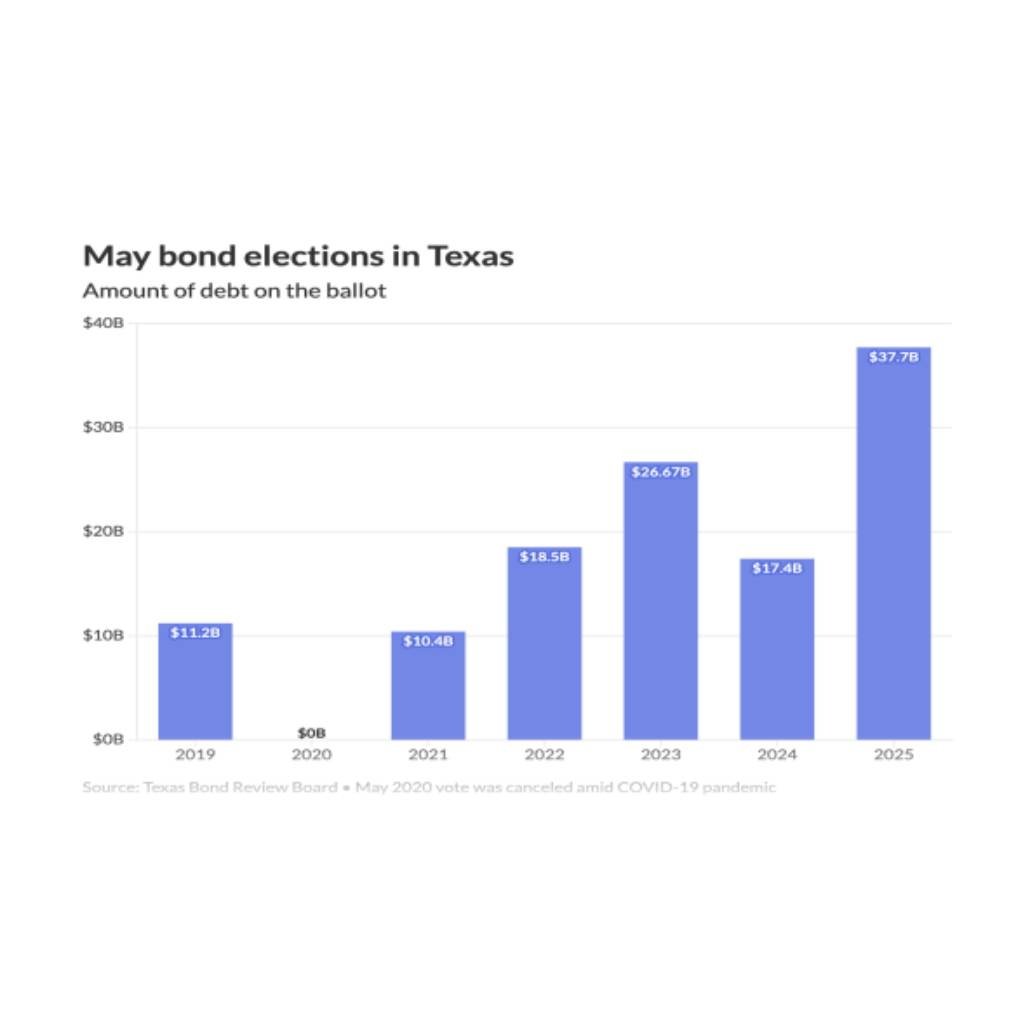

How a PUD’s Financing Is Similar to a Bond

From a financial perspective, developing a PUD is a bit like issuing a bond: it involves big up-front investments with the expectation of long-term payoffs. Building roads, sewers, parks, and other infrastructure for a new community requires significant capital before any homes are sold. Often, a developer will borrow money (similar to how a city might issue a bond) to finance these improvements, then recoup the costs as the project sells homes or leases properties over many years. In some cases, special financing districts are created within PUDs that literally issue bonds to fund infrastructure, just as a city would. For example, in Texas master-planned communities, Municipal Utility Districts (MUDs) and Public Improvement Districts (PIDs) are commonly set up to sell bonds for water lines, sewers, streets, and parks. Homeowners in the development then repay those bonds over time through an extra MUD tax or PID assessment on their property tax bill. In effect, the community’s residents pay back the infrastructure investment gradually (plus interest) – much like paying off a municipal bond that was used to build their neighborhood.

Even when a formal special district isn’t used, the PUD model still attracts investment similarly to bonds because it offers predictable returns. A completed PUD with hundreds of homes and retail spaces represents a steady stream of future property sales, HOA fees, and tax revenue, which can be seen as relatively stable (almost like bond income) once the project is built out. Investors and lenders are often willing to finance large PUDs because the mix of uses can spread risk: if the housing market slows, the retail or office components can help support the project, and vice versa. This diversification means a PUD is less risky than a single-use development, protecting the developer’s investment if one segment of the market declines. In summary, a PUD’s financing often involves borrowing against future value – either through formal bond-like instruments or loans – making the development an exercise in long-term investment very much akin to how bonds work.

Why PUDs Are Increasing in Popularity

Over the past few decades, PUDs and master-planned communities have become increasingly popular for several reasons. Market demand is a big driver: many homebuyers today want more than just a house – they want a lifestyle. Communities that offer pools, parks, trails, shops, and good schools all in one package are highly attractive. In fact, master-planned communities (which are often developed via PUD-style agreements) consistently rank among the top-selling housing developments in the nation, even during challenging economic times. For example, a recent survey of top-selling master-planned communities found that their home sales remained strong and resilient despite high mortgage rates and other headwinds, underscoring “the perceived advantage of new homes in general and master-planned communities specifically”. Some of the most popular PUDs sell thousands of homes per year – The Villages in Florida sold over 3,200 homes in 2024, and another planned community in Florida, Lakewood Ranch, sold over 2,200 homes that year – showing how high the demand can be.

Local governments and officials have also come to appreciate the PUD approach as a tool for managing growth. Rather than letting piecemeal subdivisions sprawl out with no amenities, cities can negotiate PUD agreements that ensure developers include parks, upgrade roads, or contribute to schools. This public-private partnership aspect of PUDs (often involving upfront developer commitments in exchange for flexible zoning) appeals to officials looking to increase the tax base and expand infrastructure with minimal public expenditure. Additionally, changing zoning attitudes have made mixed-use development more popular – many planners now aim to recreate the feel of traditional towns where homes, shops, and workplaces are closer together. PUDs are a practical way to achieve this within modern zoning codes. In short, PUDs are on the rise because they align with what both residents and cities are seeking: convenient, well-planned neighborhoods that can attract investment and growth.

Benefits of PUDs for Communities and Investors

PUDs can deliver a range of benefits, which is why they attract buyers, developers, and city support. Key advantages include:

- Comprehensive Community Amenities: PUDs are designed with quality of life in mind. Residents often enjoy parks, recreation facilities, walking trails, and sometimes retail or dining options right in their neighborhood. These amenities foster a sense of community and convenience that can increase the desirability of the area and even boost surrounding property values by making the whole area more attractive to live and invest in.

- Higher Property Values & Maintenance of Standards: Because PUDs are governed by HOAs with agreed-upon standards, they tend to maintain a consistent look and upkeep. The HOA handles maintenance of common areas and enforces rules (like home appearance or landscaping), which helps protect each homeowner’s investment. PUD neighborhoods are “usually well-kept, have great amenities, and offer access to shared spaces,” encouraging a high standard of living and helping homes maintain long-term value. This stability is a plus for homeowners and also reassuring to lenders or investors.

- Flexible Design and Land Use: For developers and city planners, PUDs allow creative, efficient use of land. Homes can be clustered on smaller lots in exchange for more open space, or different uses (residential, commercial, civic) can be arranged thoughtfully. This flexibility can lead to better environmental preservation (like saving a wetland or creating a buffer of green space) and more efficient public service delivery. It also means a more resilient investment – the development isn’t putting “all the eggs in one basket,” so if one segment (say retail) faces a downturn, other segments (like housing) keep the project viable.

- Economic Uplift and New Investment: Successful PUDs can revitalize areas or create entirely new economic hubs. By bringing in new residents and businesses, a PUD can inject fresh tax revenue and consumer spending into a locality. Large-scale projects often result in “an influx of new capital and residents, and a burgeoning community,” which can benefit the broader city economy. Moreover, the initial construction of a PUD creates jobs and economic activity. For local governments, a thriving PUD means a broader tax base (property taxes, sales taxes from new shops, etc.) without the city having to fund the development entirely – a win-win financially.

Drawbacks and Challenges of PUDs

Despite their benefits, PUDs are not without downsides. Some common drawbacks and challenges include:

- Homeowner Fees and Restrictions: Living in a PUD means abiding by HOA rules and paying regular HOA fees. These rules can limit how homeowners use or modify their property (from paint colors to whether you can park a boat in the driveway). Some people chafe at these restrictions and lack of freedom. Also, while the fees fund great amenities, they add to the cost of living in the community. Residents who value independence or lower costs might see this as a negative.

- Potential for Uniformity and “Cookie-Cutter” Feel: Because PUDs are master-planned, there’s a risk they can all look a bit alike. The houses might have similar styles, and the tightly controlled aesthetic can feel homogenous. Investopedia notes that large planned developments can create “a feeling of isolation [and] homogeneity,” especially if they’re gated or walled-off from surrounding areas. In some cases, if a PUD is aimed at a particular market segment, it might lack diversity in housing types or price ranges, inadvertently excluding certain groups.

- Infrastructure Strain and Traffic: A new PUD brings new roads, but also new cars. If not well integrated, a big development can put strain on existing infrastructure – more traffic on nearby roads, greater demand on schools, water, and emergency services. Local officials have to carefully plan upgrades or else existing residents might feel the impact of congestion or stretched services. In some suburban PUDs, the design still assumes people will drive everywhere (the “necessity for a car” issue), which can contribute to traffic and undermine transit use. Car-centric layouts can also conflict with modern climate or sustainability goals.

- Complex Approval and Execution Risks: From the developer’s side, PUDs are complicated to get approved and to build. They often require multiple hearings, detailed studies (economic, environmental impact), and time-consuming negotiations with the city. This delays construction and adds cost. There’s also the risk of project failure – if the economy turns or financing falls through, a partially built PUD can stall, leaving an unfinished project. Such failures can hurt the community (incomplete amenities or maintenance issues) and leave the local government in a tough spot. We’ll see an example of this in a later case study.

Case Study: A Successful PUD – Reston, Virginia

One of the earliest and most famous PUD-style developments is Reston, Virginia, founded in the mid-1960s. Reston was conceived as a “new town” – an inclusive, master-planned community that broke the mold of cookie-cutter suburbs. Over decades, Reston grew into a thriving community of about 60,000 people, with a series of villages and a major urban core (Reston Town Center) for shopping, jobs, and entertainment. Reston’s plan deliberately mixed housing types (apartments, townhomes, single-family) and included plenty of parkland and walking paths, as well as pools, schools, and shopping areas within each neighborhood. This approach was revolutionary at the time and proved successful: Reston and its northern Virginia neighbor Columbia, MD are often cited as PUD success stories, having “achieved relative success in fulfilling their founders’ vision” of vibrant, diverse communities.

From a financial standpoint, Reston attracted significant investment over the years – from the initial developers to later real estate trusts – because it demonstrated the PUD promise of stable, long-term growth. Property values in Reston rose as the community matured, and businesses flocked to the area once the population reached critical mass. Local government also benefited: Fairfax County gained a large tax base and a model for smart growth. Reston’s success has inspired modern planners; its “live, work, play” motto (people being able to live, work, and enjoy leisure in one community) is now a common goal in new PUDs. Importantly, Reston also showed how community involvement is key – it has a strong HOA (Reston Association) and citizen participation, which helped maintain the vision over time. While not everything was perfect – Reston has faced challenges with traffic and ensuring affordable housing – it stands as a notable example of a PUD that delivered on both financial returns and community quality of life.

Case Study: A PUD That Struggled – Soul City, North Carolina

Not all planned developments live up to their promise. Soul City, North Carolina is an example of a high-profile PUD/New Town that failed to fully materialize, highlighting some risks of these ambitious projects. Launched in the 1970s with federal support, Soul City was envisioned as a new town built from scratch in a rural part of North Carolina, intended to spur economic opportunity for minority communities. Despite the bold vision and initial funding, Soul City encountered major economic and political hurdles. The project struggled to attract enough private investment and faced skepticism (some outright opposition) from state leaders. Within a few years, development stalled. Only a few hundred homes and some basic infrastructure were built before the project went bankrupt. Soul City became, as one analysis put it, a PUD that “faced an assortment of economic and political challenges that forced [it] to shutter”.

Several lessons emerge from the Soul City case. First, a PUD’s financial viability depends on realistic market demand – in Soul City’s case, the remote location made it hard to draw the businesses and residents needed to sustain growth. Second, overreliance on government loans or incentives can be risky if political winds change. When federal and state support waned, Soul City couldn’t stand on its own financially. Finally, this case underscores why local officials carefully vet PUD proposals: if a project fails mid-stream, it can leave behind half-finished infrastructure and dashed expectations. While Soul City’s fate was an exception and tied to unique historical factors, it reminds us that PUDs require strong long-term financing and market alignment. Modern PUDs that have succeeded (like Reston or many new suburban communities) did so with solid funding plans, experienced developers, and phased build-outs that adjusted to demand. Soul City lacked some of these, and thus serves as a cautionary tale for both developers and policymakers considering large planned developments.

Conclusion

Planned Unit Developments are reshaping neighborhoods and local economies – in many ways, they are an investment in community-building, combining the foresight of urban planning with the financial structuring of a bond. When done well, a PUD can uplift an area, provide homes and amenities people love, and yield steady returns for developers and tax revenue for cities. It’s clear why their popularity is growing: they respond to a desire for convenience and quality of life, and they offer a mechanism for funding growth (largely via private capital) that appeals to fiscally conscious local governments. However, PUDs come with trade-offs. They introduce fees and rules for residents, require diligent oversight from officials, and carry the inherent risks of any large-scale investment.

For local elected officials, the rise of PUDs means it’s increasingly important to understand their financial and community impact. Approving a PUD involves weighing short-term costs (new infrastructure, potential traffic) against long-term benefits (higher property values, vibrant growth) – much like evaluating a bond’s upfront cost versus its yield. Engaging with residents early, setting clear expectations for developers (through development agreements and safeguards), and planning for inclusive, diverse communities can help ensure PUD projects truly pay off. For the general public, being informed about how PUDs work helps demystify why that big new development down the road has its own parks and might come with an extra fee on the tax bill. In the end, PUDs are about shaping the future of neighborhoods. With careful planning and community input, they can strike a balance between private investment and public good – building not just houses, but enduring value in our communities.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at Info FLAG

Bibliography

- Government Finance Officers Association (GFOA). Best Practices for Capital Improvement Planning and Financing. Retrieved from www.gfoa.org

- Urban Land Institute (ULI). Planned Unit Developments: Lessons from Master-Planned Communities. Retrieved from www.uli.org

- Investopedia. Planned Unit Development (PUD) Definition and Examples. Retrieved from www.investopedia.com

- National Association of Home Builders (NAHB). Master-Planned Communities and the Evolution of Mixed-Use Development. Retrieved from www.nahb.org

- U.S. Department of Housing and Urban Development (HUD). PUDs, Zoning, and the Future of Smart Growth. Retrieved from www.hud.gov

- Reston Association. The History and Growth of Reston, Virginia. Retrieved from www.reston.org

- Fairfax County, Virginia. Economic Impact of Planned Unit Developments on Local Tax Revenues. Retrieved from www.fairfaxcounty.gov

- Texas Municipal League (TML). Municipal Utility Districts (MUDs) and Public Improvement Districts (PIDs) in Texas: Financing Tools for Growth. Retrieved from www.tml.org

- North Carolina Department of Commerce. Soul City: The Rise and Fall of a Planned Community. Retrieved from www.nccommerce.com

- National League of Cities (NLC). The Role of Local Governments in Planned Unit Developments and Smart Growth Strategies. Retrieved from www.nlc.org

- The Villages. Annual Sales Report and Population Growth of The Villages, Florida. Retrieved from www.thevillages.com

- American Planning Association (APA). Zoning for Planned Unit Developments and the Future of Urban Growth. Retrieved from www.planning.org