“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

— William Arthur Ward

Navigating Texas’s Rising Tide of Bond-Funded Capital Improvement Programs

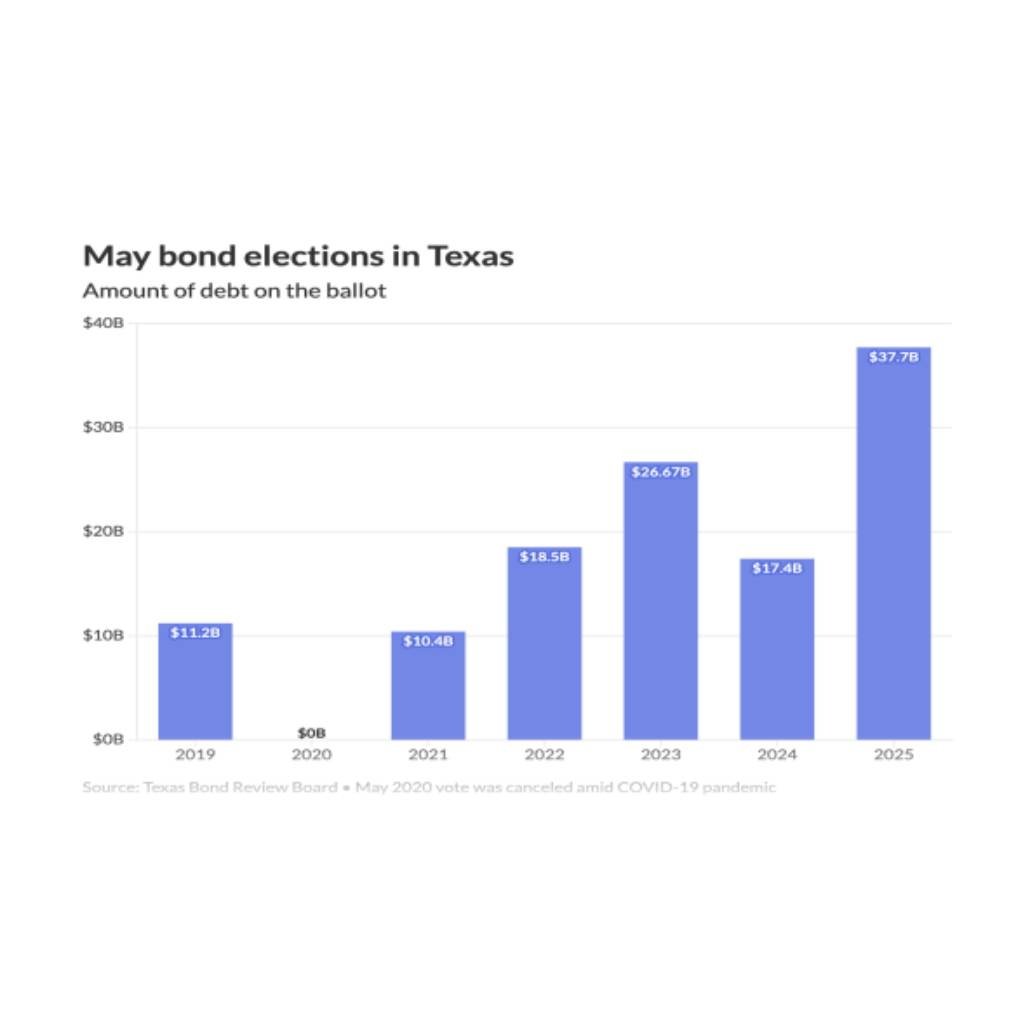

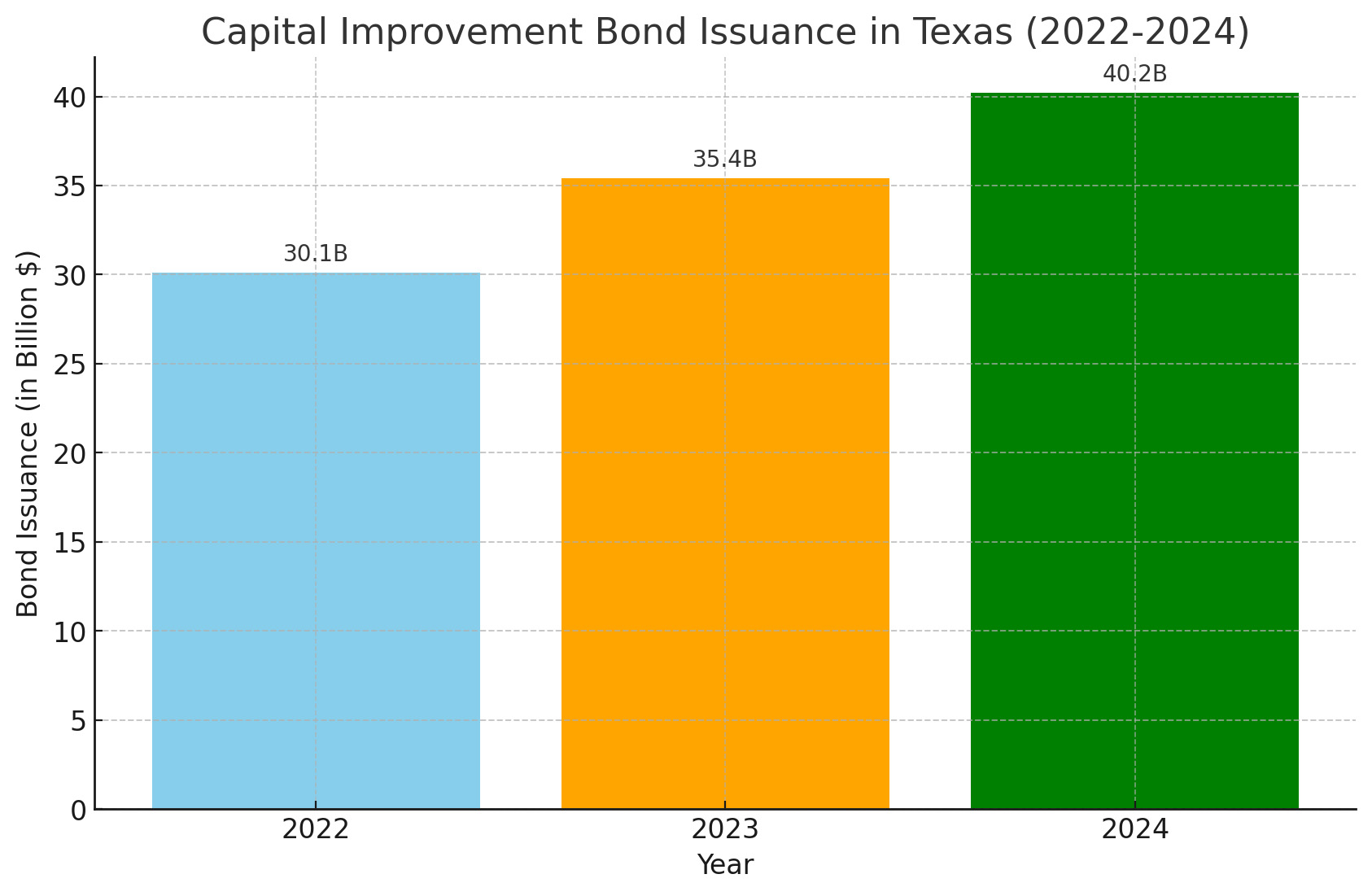

Texas is in the midst of an infrastructure boom. Over the past few years, local governments across the state have dramatically ramped up bond-funded capital improvement programs, financing everything from new highways and water systems to expanded emergency services. These programs have grown not just in size, but also in complexity, testing the limits of in-house capabilities for many municipalities. In 2022 alone, Texas counties and municipalities (excluding schools) issued roughly $30.1 billion in bonds; this jumped to $35.4 billion in 2023, and projections put 2024 at around $40.2 billion. Such massive investment reflects Texas’s rapid growth and ambition – but it also comes with new challenges that demand professional management and foresight.

The Drivers of Texas’s Infrastructure Boom

Several key drivers are fueling the surge in bond-funded projects across Texas:

- Explosive Population Growth: Texas’s population has been skyrocketing, making it one of the fastest-growing states in the nation. Over the 2010s, the state grew by roughly 16%, more than double the U.S. average growth rate. In 2022, Texas added nearly half a million new residents, the largest gain of any state. This influx of people creates immediate needs for roads, utilities, schools, and public safety facilities in booming suburbs and metropolitan areas alike.

- Infrastructure Expansion Needs: Decades of growth have stretched existing infrastructure. Many cities and counties face congested highways, aging water and sewer lines, and insufficient public facilities. Bond programs have become the tool of choice to fund capacity expansion – from widening major highways in Houston and Dallas, to building new water treatment plants in fast-growing counties, to upgrading emergency response networks along the Gulf Coast. The scale of these projects is unprecedented, with some individual bond programs exceeding $1 billion or more in authorized spending.

- Favorable Economic Climate: Until recently, low interest rates made borrowing historically cheap, encouraging governments to issue bonds to fund capital projects. Even as rates ticked up in 2023, Texas benefited from a strong economy with robust sales tax revenues and high property values. Many local governments earned solid credit ratings and debt capacity, allowing them to pursue big projects. The Municipal Securities Rulemaking Board (MSRB) consistently ranks Texas among the top states for municipal bond issuance, reflecting investor confidence in the state’s economic fundamentals.

- Legislative and Voter Support: State lawmakers and Texas voters alike have generally been supportive of infrastructure investment. Legislative initiatives in Austin have, for example, provided additional funding streams for transportation and disaster mitigation, or removed certain borrowing restrictions on counties. At the ballot box, Texans frequently approve local bond propositions – from city street improvements to county hospitals – signaling public willingness to invest in community upgrades. This political climate has emboldened local leaders to propose larger, more ambitious bond packages to meet long-term needs.

These drivers set the stage for Texas’s infrastructure renaissance. But they also sow the seeds of complexity. Each new bond measure adds dozens (sometimes hundreds) of individual projects, layers of oversight, and years of work. Capital improvement programs that once might have been a straightforward road expansion now resemble multi-headed hydras of transportation, utility, park, and safety projects, all moving simultaneously. Managing this effectively requires more than just good intentions.

Bigger Bonds, Bigger Challenges: A New Level of Complexity

As bond programs balloon in scale, the complexity of executing them grows exponentially. A decade ago, a typical city bond might fund a handful of projects – say, repave Main Street, build a fire station, and upgrade a library. Today’s bond programs, especially in Texas’s rapidly urbanizing counties, can involve hundreds of projects across multiple domains. Consider a modern transportation bond: it may include new roads, highway interchanges, public transit enhancements, pedestrian trails, and even fiber-optic broadband lines (for “smart” traffic management). Each component has its own stakeholders, regulatory hurdles, and technical challenges.

Transportation: Metropolitan areas like Austin and Dallas-Fort Worth are pushing massive transportation bonds to unclog roadways and expand transit. These often involve coordinating with state agencies (like TxDOT) and regional authorities. Interfaces are complex – for example, synchronizing a city-funded road widening with a state highway interchange project, while avoiding disruptions to existing traffic. Supply chain issues for materials, environmental permitting delays, and utility relocations under city streets can all throw wrenches into the schedule.

Utilities: Water and sewer infrastructure bonds are critical in fast-growing suburbs. A county water improvement program might include drilling new wells, laying miles of pipeline, expanding treatment plants, and even modernizing drainage for flood control. These projects demand specialized engineering and must comply with strict environmental and safety standards. They also tend to have long planning horizons – it can take years from design to ribbon-cutting, and any small error can ripple into big cost overruns later.

Public Safety and Facilities: Many bonds fund new fire stations, police substations, emergency operations centers, or hospitals. These often involve cutting-edge technology (like advanced 911 systems or resilient power backup) and must be built to last for decades. Coordinating architects, construction firms, and city IT departments – all under the watchful eyes of city councils and taxpayers – is no small feat.

Crucially, as programs get larger, the margin for error shrinks. With tens of billions at play statewide, small mistakes can carry big price tags. A single delayed project in a $500 million bond might be manageable; but if multiple projects slip or go over budget in a $2 billion program, the cumulative impact can be huge. Unfortunately, this scenario is not uncommon – across the U.S., large public infrastructure programs frequently experience delays and overruns.

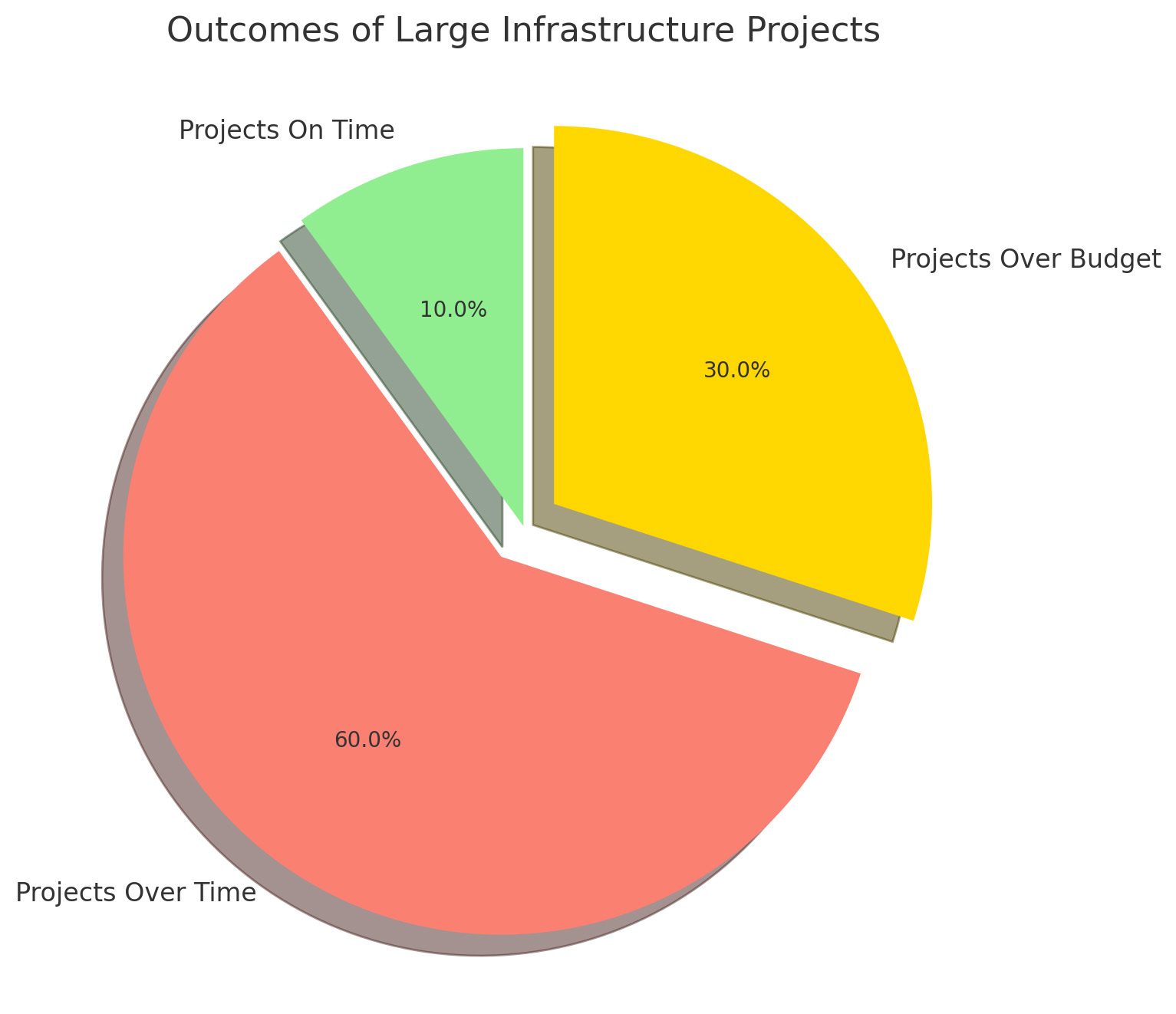

National studies paint a sobering picture. According to research aggregated by Oxford professor Bent Flyvbjerg, “nine out of ten [megaprojects] have cost overruns”, with overruns of 50% being common. Schedules fare no better: roughly one in ten megaprojects finishes on time. These eye-opening statistics – echoed by consulting firms like McKinsey and KPMG in various infrastructure reports – illustrate how challenging it is to keep large capital projects on track. The reasons range from long planning horizons and complex multi-stakeholder coordination, to technology and scope changes, and often simple over-optimism in initial estimates.

For Texas cities and counties now launching mega-scale bond programs, the implication is clear: Without specialized expertise and rigorous management, cost overruns and delays aren’t just possible – they’re probable. And the fallout can be severe.

When Big Dreams Meet Hard Reality: The Risks of “Going It Alone”

Imagine the following scenario, drawn from common patterns seen across Texas municipalities:

A city proudly passes a $500 million bond to upgrade roads, parks, and public safety facilities. The bond promises new parks on the east side, two fire stations in growing neighborhoods, and a major overhaul of downtown’s streetscape. City leaders opt to manage the program internally, confident in their public works department’s ability to handle it.

At first, things go smoothly. But as projects advance, cracks appear:

- The downtown streetscape project runs into unexpected utility relocations. Without a dedicated team anticipating these issues, the construction stalls for months – crews sit idle, costs mount.

- One of the new fire station projects faces design setbacks. The city’s architects are stretched thin, juggling multiple bond projects, and they miss a critical code requirement. Revisions push the timeline out, and the fire department grows anxious as response times in the area suffer.

- Over in the parks department, a new sports complex project is delayed because of environmental permitting challenges. Community excitement turns into frustration as the promised soccer fields remain a grassy empty lot year after year.

- As delays accumulate, constituent frustration grows. Neighborhood associations complain at city council meetings. Local news runs a story headlined “Bond Projects Behind Schedule, Over Budget.” Social media buzzes with discontent, accusing the city of overpromising and mismanaging taxpayer funds.

By year three of the bond program, the city has spent the $500 million – but only delivered half the projects. To finish the rest, they’ll need more money or to scale back plans. The bond that was meant to be a triumph has become a political black eye. In the next bond election, voters are understandably skeptical, and future investment for the community is jeopardized by a loss of public trust.

Versions of this story have played out in multiple locales. In some Texas cities, bond programs approved in 2017 were still incomplete in 2023, leading to public criticism. Cost overruns have forced tough choices, like shelving certain projects or seeking additional funds. And when the public loses faith that bond dollars will be spent effectively, essential projects can fail at the ballot box, leaving communities worse off.

What causes these woes is not ill intent or lack of effort – it’s lack of bandwidth and specialized expertise. Managing a multi-project, multi-year capital program is very different from handling routine city maintenance or a single construction job. It requires:

- Strategic Planning: sequencing dozens of projects smartly, so they don’t conflict or overstretch resources.

- Expert Risk Management: anticipating pitfalls (like utility relocations, permitting delays, or contractor issues) and devising contingency plans.

- Rigorous Financial Oversight: tracking budgets in real-time, catching overruns early, and adjusting across the program to stay on target.

- Constant Communication: keeping stakeholders – from elected officials and department heads to citizens and businesses – informed and engaged, to maintain support and manage expectations.

Many city and county staff are excellent engineers, planners, and administrators, but even the best can be overwhelmed when a program’s complexity exceeds the organization’s capacity. The Project Management Institute has noted that for every $1 billion invested in projects, a significant portion can be wasted due to ineffective management. In fact, studies have found hundreds of millions of dollars in public projects are lost to inefficiencies, rework, and delays when there isn’t a robust management structure in place. This is where Program Management Consulting (PMC) comes into play.\

From Luxury to Necessity: The Case for Program Management Consulting

In the past, hiring outside program managers or consultants for a bond program might have been seen as a luxury – a “nice to have” if budget allowed. Today, given the stakes and complexity, it’s a strategic necessity. Here’s why:

- Expertise at Scale: Program Management Consulting firms specialize in orchestrating large, complex projects. They bring proven methodologies and lessons learned from other major programs (in Texas and beyond). This means they can identify potential trouble spots before they become crises – for example, flagging that a certain bridge project will need geotechnical studies far in advance, or that a procurement plan needs adjusting to avoid material shortages. Their depth of experience acts as an insurance policy against costly rookie mistakes.

- Delivering On-Time and On-Budget: A professional program manager’s primary goal is to deliver the promised scope within the agreed schedule and budget. They set up centralized tracking for every project in the bond portfolio. If one project starts slipping, they can allocate additional resources or adjust timelines with minimal disruption to others. They also enforce discipline: regular contractor check-ins, schedule updates, and financial reporting. According to industry benchmarking, organizations that invest in mature project management practices are far more likely to hit their targets – avoiding the worst of the overruns that plague less-organized efforts.

- Integrated Team of Specialists: Large consulting teams often include a mix of engineers, construction managers, financial analysts, and community outreach specialists. This integrated approach means all angles are covered. For example, when engineering proposes a design change, the financial analyst immediately checks the budget impact, the scheduler assesses how it affects timeline, and the community liaison prepares updated communications if needed. It’s a 360-degree management approach that most local governments simply cannot staff internally for a temporary multi-year program.

- Stakeholder Confidence: Having a respected third-party program manager can boost confidence among stakeholders. Bond rating agencies, for instance, look favorably on municipalities that engage professional management for large debt-funded projects, seeing it as a risk mitigator. More importantly, taxpayers and voters see progress: regular reports, a transparent dashboard of project statuses, and a dedicated team whose success is tied to the bond’s success. This can preserve and even enhance public trust, making voters more likely to approve future bonds because they’ve seen the city deliver on past promises.

- Future-Proofing and Knowledge Transfer: Good program managers don’t just parachute in and out – they help build long-term capacity within the city or county. Throughout the bond program, they can train staff in modern project management tools, set up systems that remain in place afterward, and document best practices. By the end of the program, the local government not only has new infrastructure to show for the bond, but also a stronger internal team and process for the next capital program.

The bottom line: with the scale of Texas’s current bond programs, professional management support often pays for itself. By reducing waste, avoiding rework, and preventing delays, consultants can save millions in what would have been overrun costs – effectively making the program cheaper over time despite the upfront consulting expense. It’s analogous to hiring an expert builder for your home renovation; yes, you pay a fee, but you’re likely to avoid the budget blowouts and timeline nightmares a DIY approach might trigger.

Real-World Success: Turning the Tide with Professional Support

Conversely, some municipalities recognize the challenges early and structure their bond programs accordingly:

In one example, a fast-growing county initiated a $900 million bond focused on transportation and flood control improvements. Early on, officials acknowledged the sheer complexity was beyond their internal staff’s capacity. They engaged a professional Program Management Consulting team to guide the program.

The firm immediately set up a centralized program management office with a real-time project dashboard accessible to county leaders and the public. They proactively coordinated supply chain logistics, ensured tight construction sequencing, and mitigated environmental permitting risks well in advance.

When unexpected challenges arose — such as material shortages or historic rain events — the team quickly adapted without derailing the program. By the end of the bond’s timeline, over 95% of the projects were delivered on schedule and within budget contingencies. Public confidence soared, and subsequent bond propositions passed with strong community support, reinforcing the idea that effective program management builds lasting trust.

Conclusion: Building Texas’s Future, One Managed Project at a Time

Texas stands on the cusp of a transformative era in public infrastructure. The dollars are unprecedented, the needs are undeniable, and the public appetite to invest is strong. With tens of billions in bonds flowing into new projects, the stakes for successful delivery have never been higher. Complexity is the new normal for capital improvement programs – but complexity can be tamed with the right approach.

Program Management Consulting is no longer a luxury for Texas’s ambitious bond programs; it’s a linchpin of success. It provides the skillset, oversight, and agility required to turn voter-approved bonds into the promised roads, bridges, parks, and emergency facilities that Texans need. By embracing professional management, municipalities can deliver on their promises – on time, on budget, and with an eye toward the future, ensuring that each bond program lays the groundwork for the next era of growth.

In the end, effective program management isn’t just about avoiding headaches or saving money (though it certainly does both). It’s about building trust. Every time a city completes a bond project as promised, public trust is strengthened. And that trust is the foundation upon which the next bond will be passed, the next project launched, and the future of Texas’s communities built.

Front Line Advisory Group (FLAG) is a Program Management Consulting (PMC) firm focused on delivering bond-funded infrastructure projects on time and on budget through disciplined management and data-driven controls. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at Info FLAG

Bibliography:

- Texas Bond Review Board – Annual Report on Local Government Bond Issuance and Debt, 2022-2024 (for Texas municipal bond issuance statistics).

- Municipal Securities Rulemaking Board (MSRB) – Municipal Bond Market Statistics, 2022-2023 (Texas’s rank in issuance, market conditions).

- U.S. Census Bureau – State Population Totals and Components of Change: 2020-2022 (Texas population growth figures).

- Bent Flyvbjerg (Cato Institute) – “Megaprojects: Over Budget, Over Time, Over and Over” (statistics on large project overruns and delays).

- McKinsey & Company – “Avoiding the Pitfalls of Large Infrastructure Projects”, 2016 (on complexity and risk in megaprojects).

- KPMG – Global Construction Survey, 2015 (findings on project delivery performance).

- Deloitte – “Managing Capital Projects to Success”, 2018 (on the importance of governance and oversight in public projects).

- Project Management Institute – Pulse of the Profession, 2017 (data on the cost of poor project management, e.g., waste per $1 billion invested).

- City of Dallas Bond Program Audit, 2023 – (example of challenges faced without adequate project controls, leading to delays).

City of Austin Corridor Program Report, 2022 – (illustrative reference on using program management for transportation bonds).