In the intricate world of finance, the recent challenges faced by closed-end municipal-bond funds stand out. These funds, which have been a staple for many investors, especially retirees, are now grappling with the repercussions of rising interest rates. The situation has become so dire that many are drawing parallels with the tumultuous period of the 2008-09 financial crisis. This article delves deeper into the intricacies of these funds, the challenges they face, and the broader implications for the financial market.

Understanding the Basics: What are Closed-End Municipal-Bond Funds?

Before diving into the current challenges, it’s crucial to understand what these funds are. Closed-end municipal-bond funds are a type of investment vehicle that pools money from various investors to purchase a diversified portfolio of municipal bonds. These bonds are essentially debts issued by state and local governments to fund public projects like roads, schools, and hospitals. The interest paid on these bonds is typically exempt from federal taxes, making them an attractive option for investors in higher tax brackets.

The Allure of Leverage

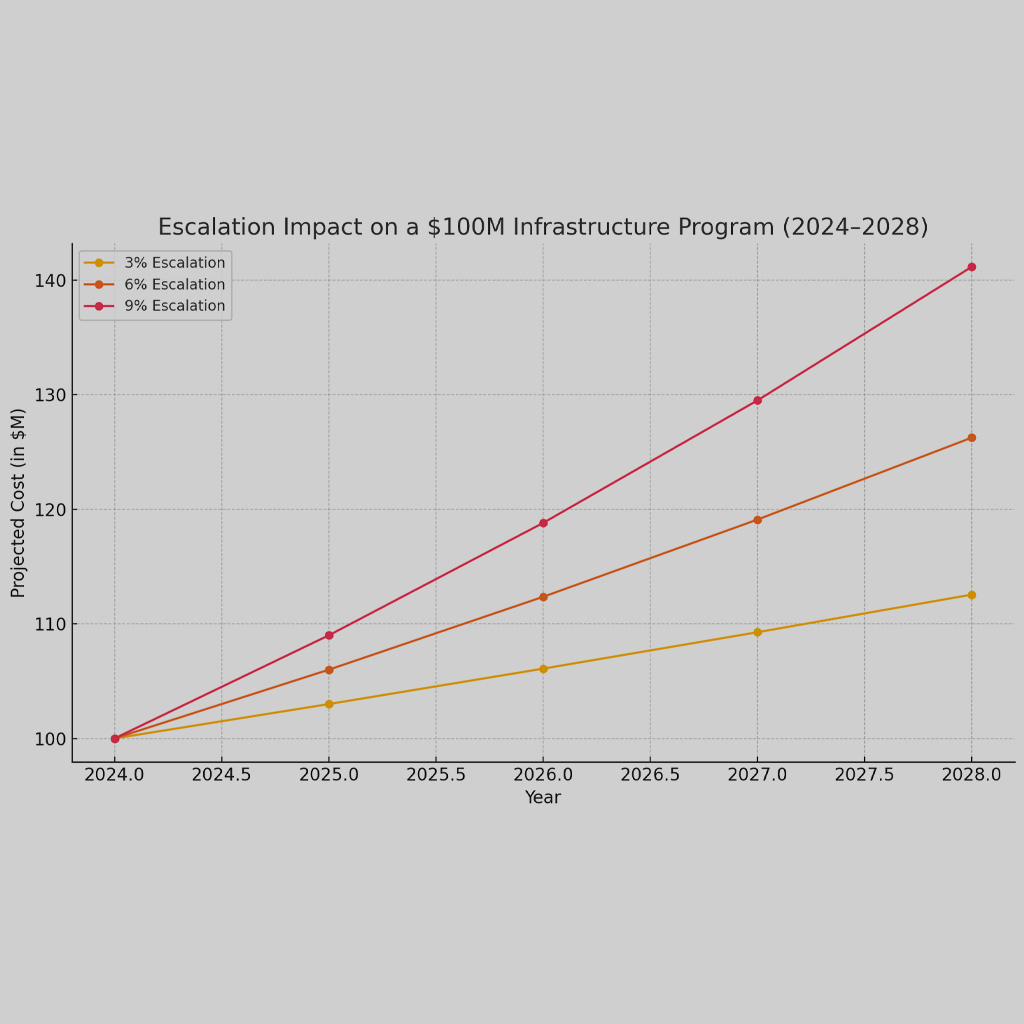

For much of the past decade, the strategy employed by many of these funds was straightforward yet effective: leverage. By borrowing money at low short-term rates and investing in long-term bonds that paid higher interest, these funds could amplify their returns. This approach, while lucrative in a low-interest-rate environment, becomes problematic when rates start to rise.

The Double-Edged Sword of Rising Interest Rates

As the U.S. economy began showing signs of recovery and inflationary pressures mounted, the Federal Reserve initiated a series of rate hikes. These hikes, meant to curb inflation and prevent the economy from overheating, had a cascading effect on the financial markets.

For closed-end municipal-bond funds, the impact was twofold. Firstly, the cost of borrowing, which they had been leveraging to boost returns, began to rise. This increased the funds’ expenses, squeezing their profit margins. Secondly, as newer bonds came into the market offering higher interest rates, the older, lower-yielding bonds in their portfolios saw a drop in market value.

The Structural Challenges

The very structure of closed-end funds exacerbates these challenges. Unlike open-end funds, where investors can redeem their shares directly with the fund, closed-end fund shares are traded on the stock market. This means their price is subject to market forces and can deviate significantly from the net asset value (NAV) of the underlying bonds in the fund.

Furthermore, managers of closed-end funds can’t issue new shares to raise capital. This lack of flexibility means they often don’t have the liquidity needed to capitalize on newer, higher-yielding bonds entering the market.

The Broader Impact on the Financial Ecosystem

The challenges faced by closed-end municipal-bond funds are not isolated. They are indicative of broader shifts in the financial ecosystem. Rising interest rates impact various sectors, from housing to corporate investments. For instance, higher rates can make mortgages more expensive, potentially slowing down the housing market. Similarly, corporations might delay or scale back capital-intensive projects due to increased borrowing costs.

The Silver Lining: Opportunities Amidst Challenges

While the current environment poses challenges, it’s not devoid of opportunities. Some closed-end funds are adapting by reducing their leverage, thereby limiting potential losses. Others are diversifying their portfolios, moving away from bonds and into other asset classes less sensitive to interest rate fluctuations.

For astute investors, the current situation presents a unique opportunity. The market prices of many closed-end funds are currently trading at a significant discount to their NAV. This means investors can purchase these funds at a price lower than the value of the underlying assets. Over time, as market conditions stabilize, this discount is expected to narrow, potentially offering substantial returns.

The Road Ahead

The challenges faced by closed-end municipal-bond funds underscore the dynamic nature of financial markets. As economic conditions change, investment strategies that once seemed foolproof can quickly become liabilities. However, with challenges come opportunities. By understanding the underlying factors at play and adapting accordingly, both fund managers and investors can navigate these turbulent waters and emerge stronger.

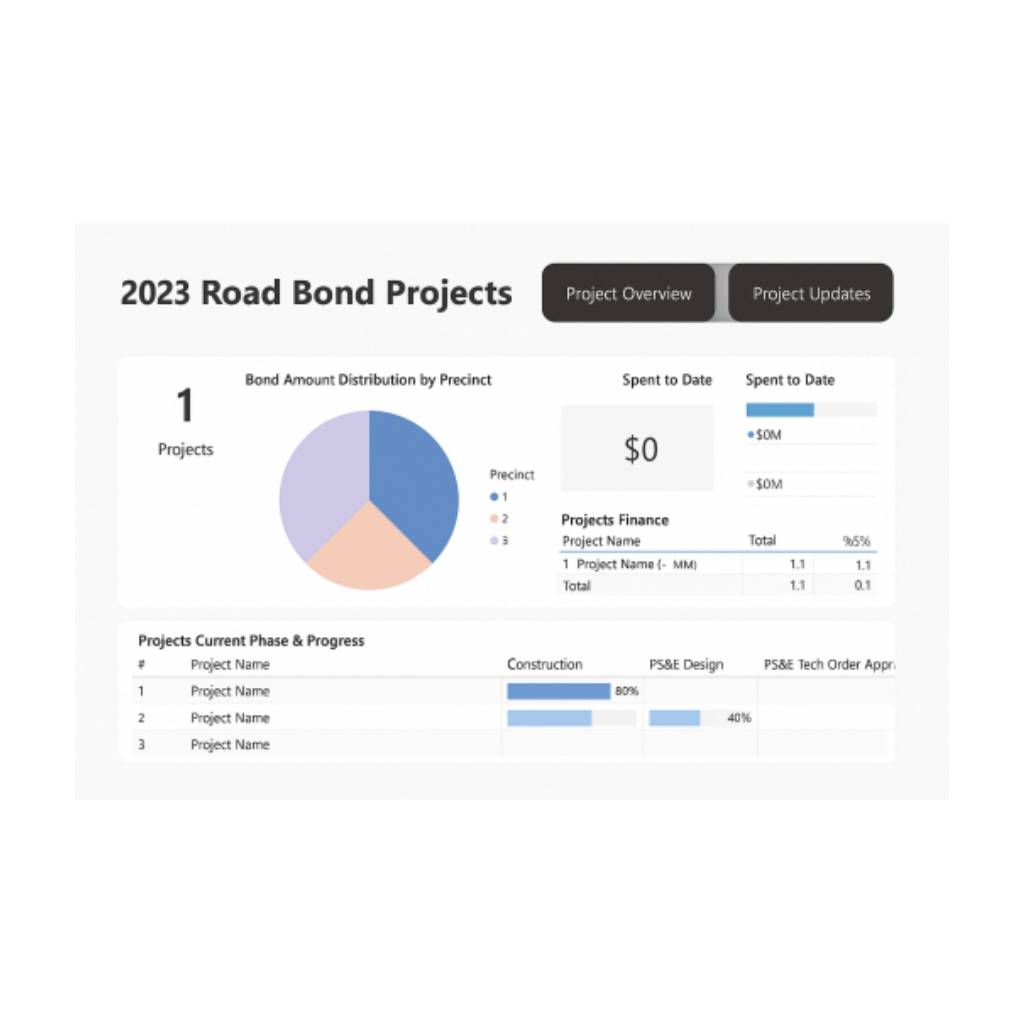

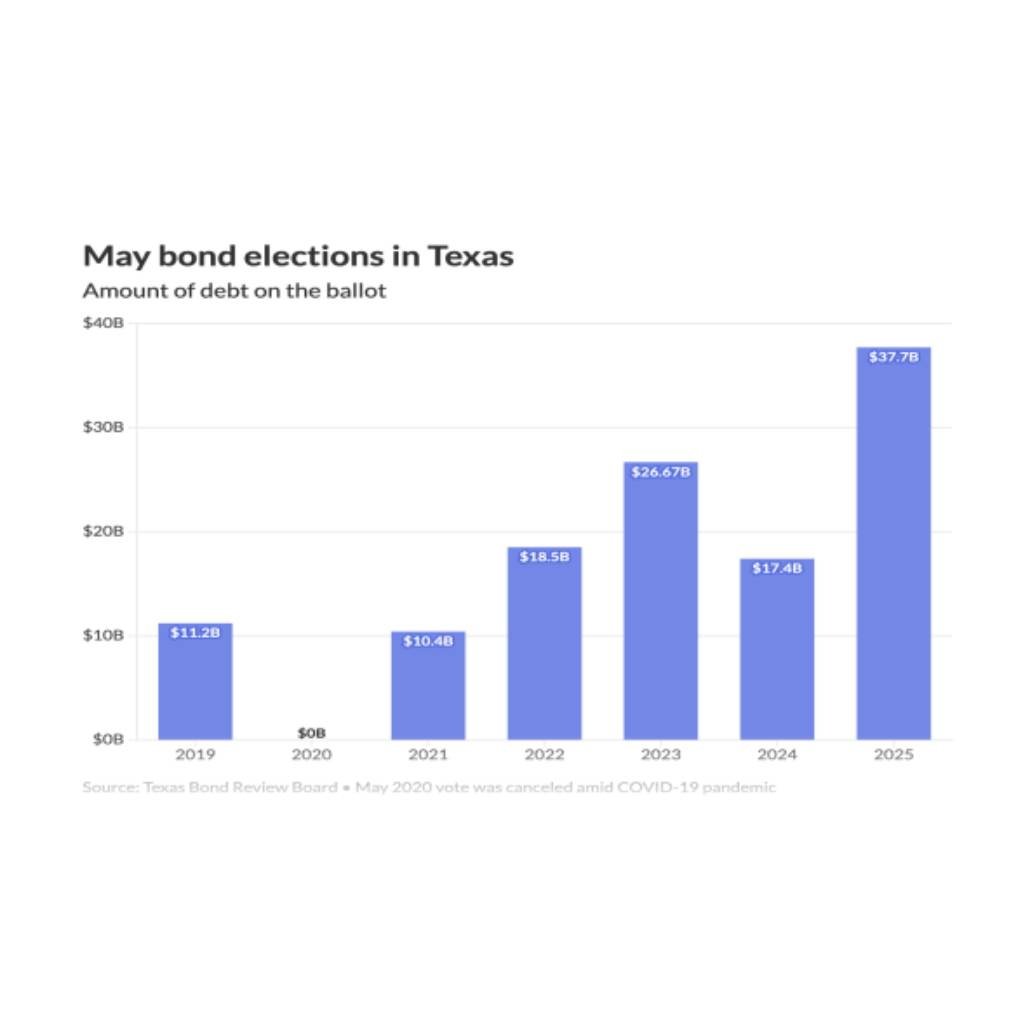

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com

For further insights and a deeper understanding of the current financial landscape: