“A society grows great when old men plant trees in whose shade they know they shall never sit.”

— Greek Proverb

The Hidden Debt and Infrastructure Crisis in U.S. Cities

A recent Strong Towns article, “Cities Are Already Defaulting on Their Debts” (April 14, 2025), sounds an alarm for municipal finance. Author Charles Marohn reveals that many American cities are essentially defaulting on their own infrastructure promises due to unsustainable debt and flawed financial models. City finances have become opaquely balanced through accounting tricks: for example, budgets that begin with massive deficits somehow end up “balanced” without new taxes or service cuts, often by shifting funds or borrowing against future revenue. These maneuvers create the illusion of stability while critical maintenance is deferred. As Marohn observes, “City after city has low and declining rates of infrastructure life remaining. They’re not maintaining what they’ve built. They’re falling behind”.

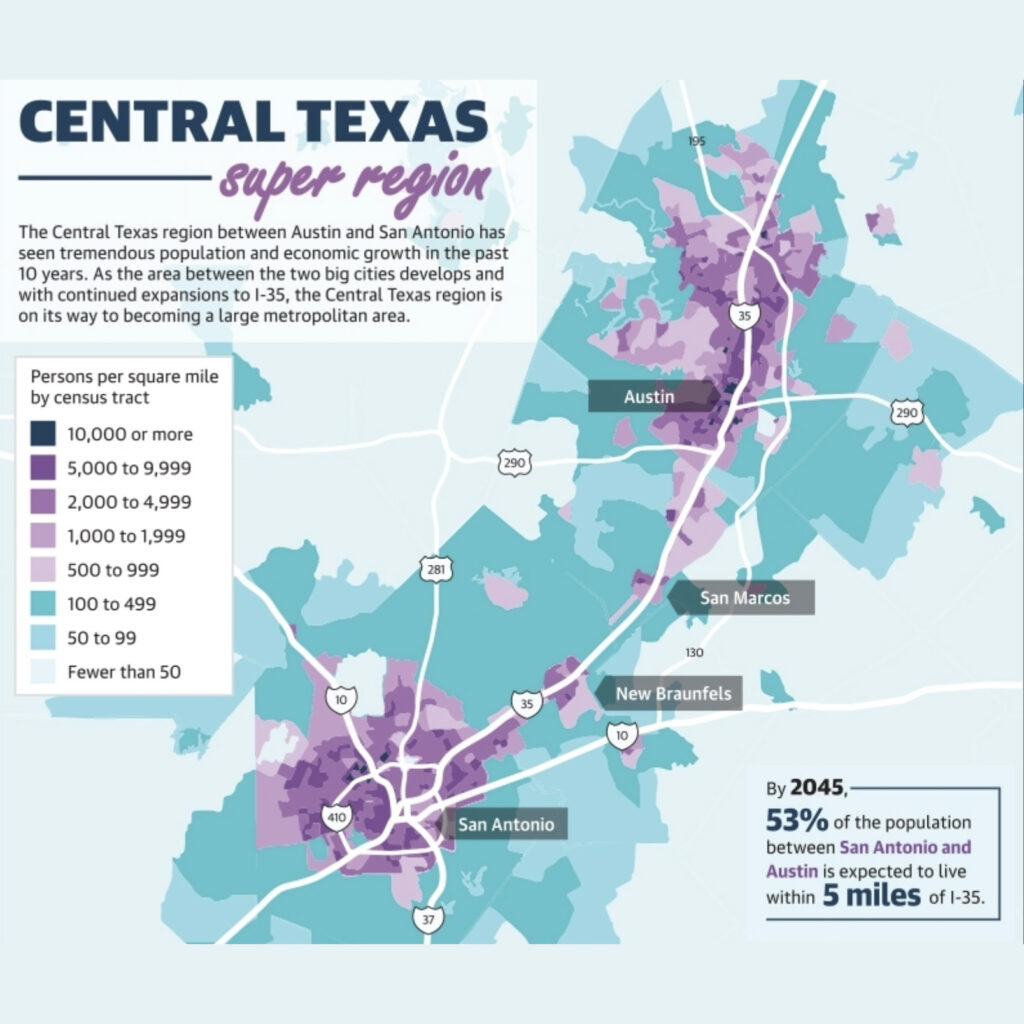

The core problem is a development model that prioritizes short-term growth over long-term sustainability. For 75 years, cities have chased rapid expansion – new subdivisions, roads, and utilities – enjoying a “sugar high” of upfront cash in exchange for unpayable maintenance liabilities down the road. The result? Even cities with stellar credit ratings can be financially fragile, spending more than they take in and banking on future bonds or bailouts. Eventually, the bill comes due. Marohn notes that while cities may not be defaulting on bond payments, they are defaulting in a deeper sense: “Cities aren’t defaulting on their bondholders. They’re defaulting on their own people. They’re failing to maintain roads, letting pipes corrode…”. In other words, countless U.S. municipalities — big and small, red and blue — can’t keep up with the infrastructure they’ve built under these flawed models. This quiet crisis shows up as cracked streets, aging water systems, and budgets that never seem to stretch far enough.

From Fragility to Resilience: The Case for Strong Program Management

How can cities break this cycle of debt-driven fragility and get back to keeping their promises? One powerful approach is to adopt professional program management with strong controls and oversight for capital projects. A program management consultant acts as an owner-side advocate, bringing discipline and transparency to the planning and delivery of infrastructure. Here are five ways program management can help municipalities nationwide address the issues raised by Strong Towns:

- Financial Transparency & Controls: A dedicated program manager establishes clear budgeting and reporting practices for bond-funded projects. This means no more “murky” finances – every dollar of debt and expenditure is tracked. By implementing transparent accounting (e.g. real-time dashboards and regular public reports), cities can understand their true financial position and avoid the hidden obligations that currently pile up. With open books, leaders and citizens can see the big picture and make informed decisions before deficits spiral.

- Schedule Discipline & Deferred Maintenance Reduction: Program management brings rigorous schedule oversight, ensuring that maintenance and capital improvements happen on time. Instead of deferring road repairs or facility upgrades to plug short-term budget holes, a disciplined program sticks to a long-term maintenance schedule. This prevents small problems from compounding into expensive crises. By delivering projects on schedule, cities also avoid the costly overruns and interest expenses that come from delay.

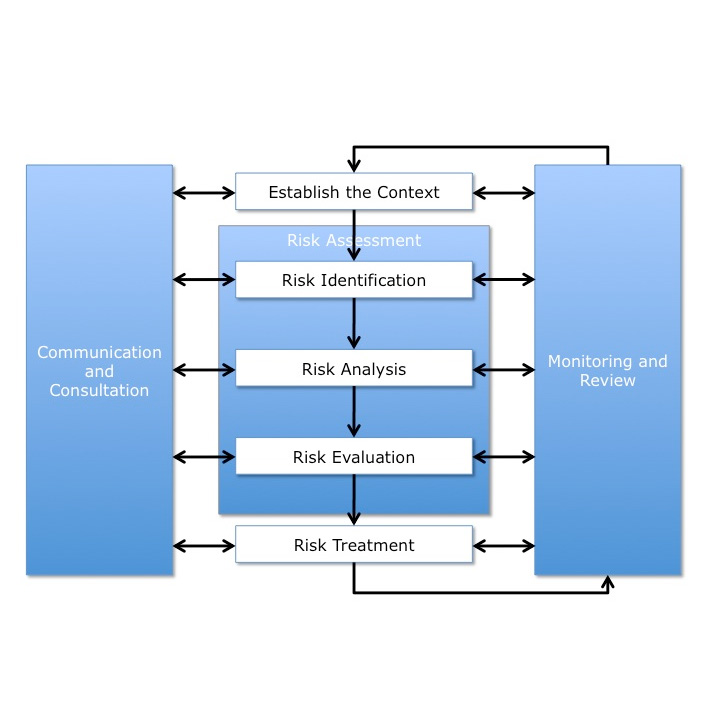

- Risk Mitigation Planning: A skilled program manager helps a city anticipate and mitigate risks in its capital program. Through techniques like risk registers and scenario planning, they prepare for funding shortfalls, economic swings, or construction surprises. Proactive risk management means fewer nasty surprises in the budget. For example, if revenue projections fall or construction costs rise, contingency plans are in place to adjust scope or timing – so the city doesn’t resort to the “gimmicks” and inter-fund loans that create long-term trouble.

- Vendor Accountability & Quality Assurance: Cities often rely on third-party vendors and contractors to build infrastructure, which can lead to cost inflation or quality issues if not closely managed. Program management establishes strong oversight of vendors – enforcing contract terms, verifying work quality, and holding contractors accountable for on-budget, on-spec delivery. This owner-side vigilance ensures the city gets durable roads, pipes, and facilities that won’t prematurely fail. In the long run, better-built infrastructure reduces maintenance costs and helps avoid the scenario of assets deteriorating faster than expected (a key weakness noted in the article).

- Long-Term Planning & Sustainable Investment: Perhaps most importantly, professional program managers help city leaders adopt a long-range perspective. Every new capital project is evaluated not just for its up-front cost, but for its life-cycle cost and impact on the community’s future. By integrating capital improvement plans with realistic maintenance funding strategies, a program manager makes sure today’s projects won’t become tomorrow’s liabilities. This strategic foresight directly tackles the flawed model of growth-by-debt. Cities can focus on projects that deliver value over decades, not ones that look good now but burden the future. Program management also encourages setting aside reserve funds for asset replacement and avoiding the trap of financing routine maintenance with debt.

Rethinking Infrastructure Delivery: A Call to Action

For municipal administrators, elected officials, and finance officers, the takeaway is clear: cities must rethink how they manage bond-funded infrastructure. The status quo of opaque budgets, deferred maintenance, and reactive fixes is a slow path toward defaulting on community needs. It’s time to embrace transparency, accountability, and long-term thinking in capital programs. By partnering with experts in program management – like Front Line Advisory Group (FLAG) – cities can turn a vicious cycle into a virtuous one.

FLAG’s owner-side advocacy and disciplined approach to program controls offer a way for cities to regain control of their financial destiny. We help ensure every project is delivered with financial clarity, on schedule, and with future upkeep in mind. The result is not just infrastructure that gets built, but infrastructure that lasts and stays within budget. Municipal leaders are invited to take action: question the old financial models, demand clear answers about debt and maintenance obligations, and seek out professional guidance to put your city on a stronger footing. It’s not too late for cities to stop “defaulting” on their residents and start delivering on their promises. By rethinking infrastructure delivery and partnering with trusted program management advisors, communities nationwide can rebuild trust, restore fiscal health, and create sustainable prosperity for the next generation.

Now is the time to act – to move from fragility to resilience, and to ensure that every dollar spent on infrastructure truly serves the public in the long run. Front Line Advisory Group stands ready to help cities make this critical transition, providing the oversight and expertise needed to build a stronger, more accountable future. Together, we can keep our cities from quietly falling into disrepair and debt, and instead steer them toward stability and strength.

Front Line Advisory Group (FLAG) is a Program Management Consulting (PMC) firm focused on delivering bond-funded infrastructure projects on time and on budget through disciplined management and data-driven controls. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at Info FLAG

Marohn, Charles. Cities Are Already Defaulting on Their Debts. Strong Towns. April 14, 2025.

Available at: https://www.strongtowns.org/journal/2025/4/14/cities-are-already-defaulting-on-their-debts