Public finance is an intricate and multi-faceted domain. Its complexity becomes pronounced when we consider the case of bond underwriters working with high-growth municipalities and independent school districts. When these entities issue Capital Improvement Bonds for large-scale infrastructure projects, there’s more at stake than just the fiscal feasibility. A comprehensive preapproval process is crucial to effectively manage and mitigate not just financial risks but also the operational challenges associated with increased project volume and complexity. This blog will delve into why a solely financial-focused preapproval process falls short and why a broader approach is imperative.

The Dual Challenge: Rapid Growth and Limited Resources

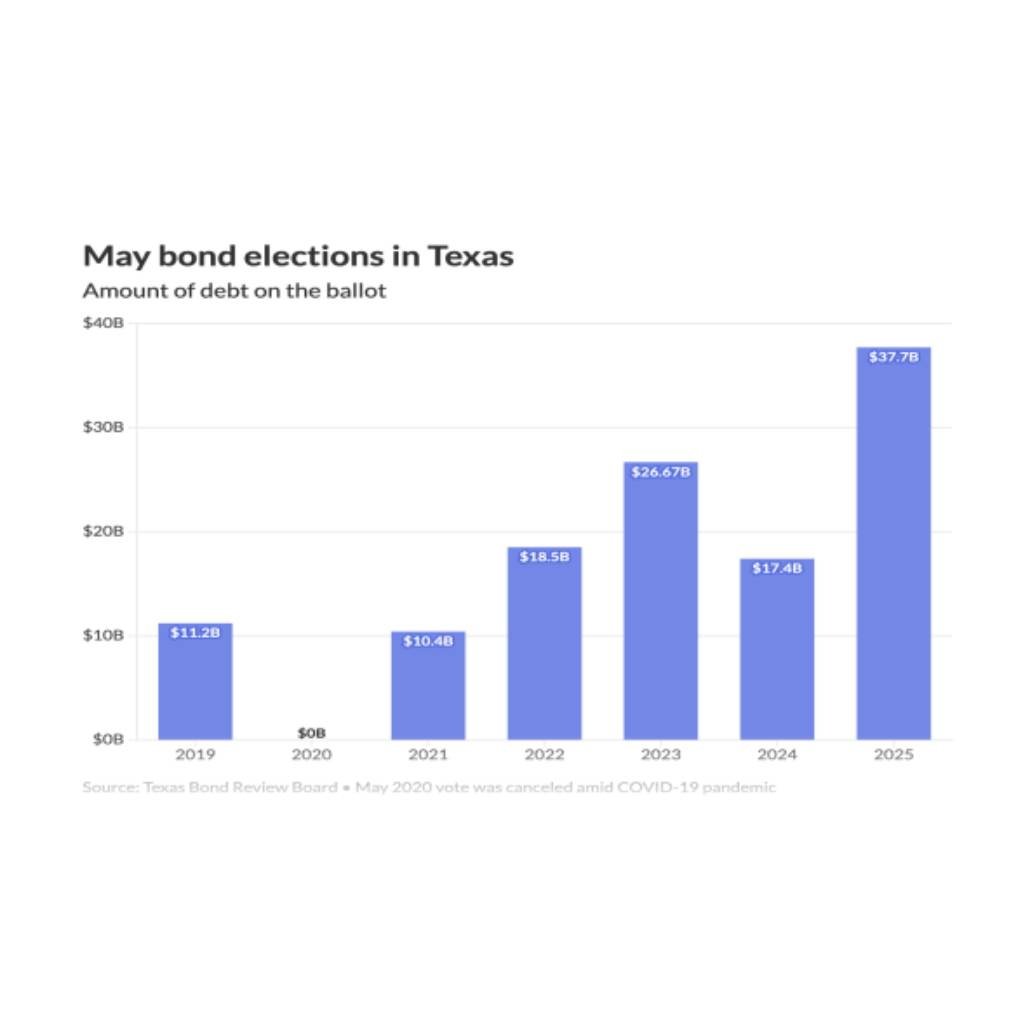

High-growth municipalities and independent school districts are witnessing a rapid escalation in the scale and number of infrastructure projects. The fast pace of growth often leads to a surge in Capital Improvement Bond issuances. However, the escalating scale and number of projects coincide with a scarcity of resources and experience in bond management. This situation creates a dual challenge. First, there’s the increased complexity and number of projects that the entities must manage simultaneously. Second, the limited resources and lack of experience in managing such large-scale bond programs increase the risk of operational inefficiency, mismanagement, and even project failure.

Why a Financial Focus Alone is Insufficient

A traditional preapproval process for bond underwriters often focuses primarily on financial feasibility. It assesses the fiscal viability of the bond issuance, evaluates repayment capabilities, and checks alignment with legal and regulatory requirements. While this financial scrutiny is critical, it’s not sufficient in the context of high-growth municipalities and independent school districts.

Why is that?

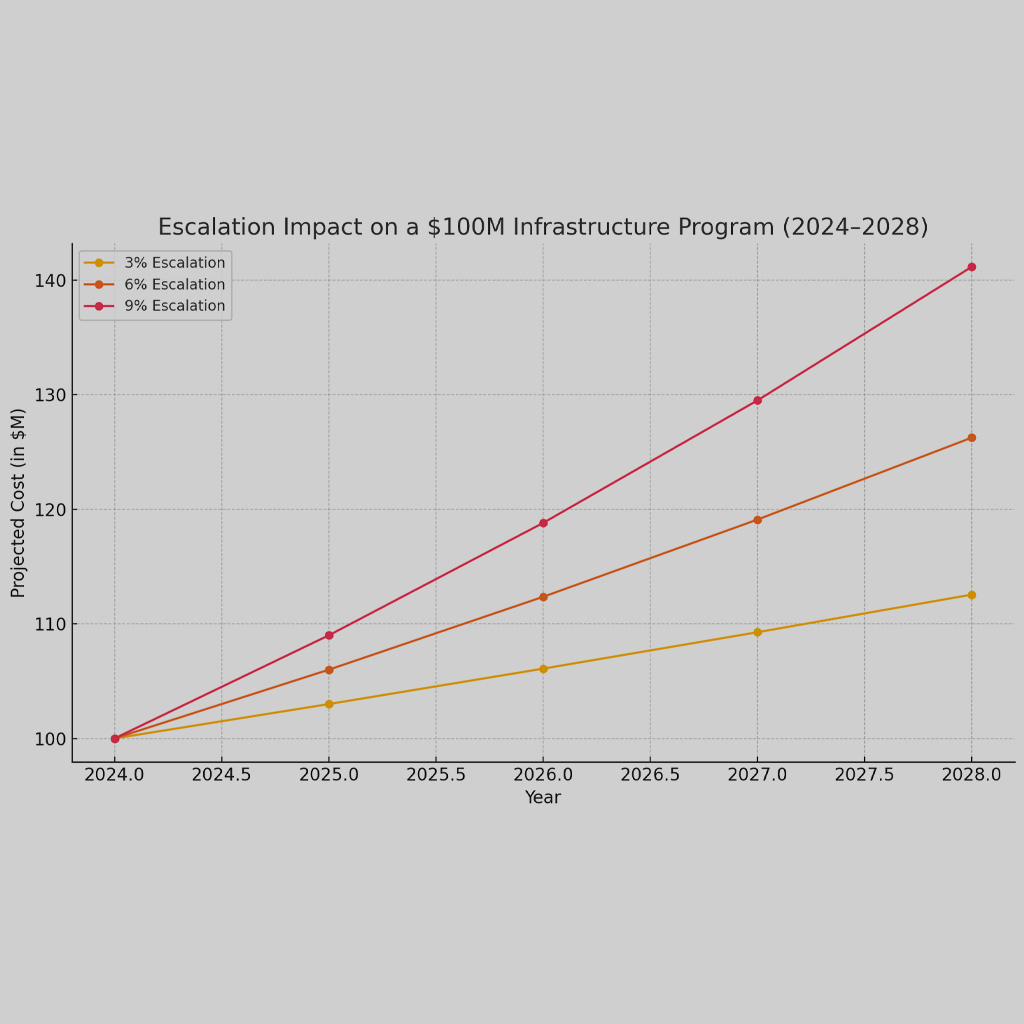

Because while it’s necessary to assess an entity’s financial capability to repay the bond, it’s equally important to evaluate its operational capacity to execute and manage the funded projects efficiently. Without this holistic examination, entities may find themselves with the necessary capital but lack the operational wherewithal to manage the funded projects effectively, leading to project delays, cost overruns, and in worst-case scenarios, project abandonment.

The Imperative for a Comprehensive Preapproval Process

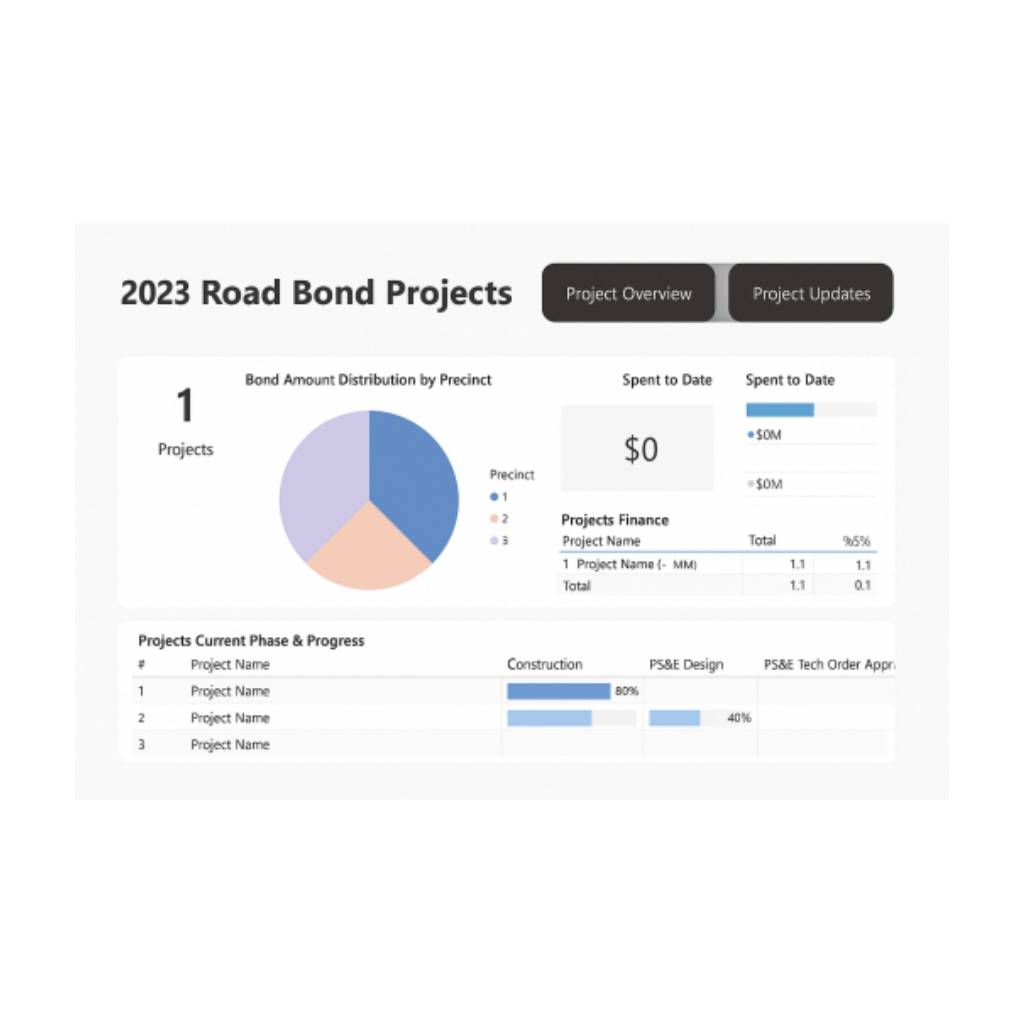

A comprehensive preapproval process is one that goes beyond financial feasibility. It includes operational factors such as project management capabilities, resource availability, risk mitigation strategies, stakeholder management plans, and performance measurement mechanisms. For bond underwriters working with high-growth municipalities and independent school districts, this broader approach helps assess an entity’s preparedness to manage the funded projects efficiently. It provides a clear picture of the entity’s operational strengths and weaknesses, enabling underwriters to make better-informed decisions and provide appropriate advice. In addition, it helps identify potential operational risks early in the process and allows for timely risk mitigation, contributing to the successful execution of projects.

Ensuring Success in High-Growth Environments

In high-growth municipalities and independent school districts, the possibility of default is not just a financial concern. It’s equally a function of operational challenges that arise due to increased project complexity and limited resources and experience. A comprehensive preapproval process helps address these challenges, ensuring that entities not only have the financial capacity to repay the bonds but also the operational capacity to execute the funded projects successfully.

Therefore, as bond underwriters, adopting a comprehensive preapproval process is not just a best practice – it’s a necessity to ensure responsible stewardship of public funds, successful project execution, and sustainable growth for municipalities and independent school districts.

Understanding the Multidimensional Risks

In high-growth environments, organizations are often drawn into a whirlpool of project planning and execution without understanding the multidimensional nature of risks involved. Failure to deliver on a single large project could not only lead to significant financial loss but also undermine public trust, which can be even more devastating. It’s important to comprehend that project failure doesn’t necessarily stem from financial mismanagement alone; it’s often the result of a combination of factors such as inefficient planning, inadequate resources, uncontrolled scope expansion, and a lack of effective risk mitigation strategies.

The Underwriter’s Role: From Evaluation to Guidance

Given the complex and multifaceted nature of these risks, the role of bond underwriters must extend beyond financial evaluation. They need to guide municipalities and independent school districts to strengthen their project planning and execution capabilities, resource allocation strategies, and risk management frameworks. By doing so, underwriters can significantly contribute to reducing project failures, ensuring the successful utilization of bond funds, and enhancing public trust in these entities.

Broadening the Scope of Preapproval Processes

To fulfill this extended role, bond underwriters must broaden the scope of their preapproval processes. Here are a few key areas they should consider:

Program Management Capabilities: This involves evaluating the entity’s experience in managing large-scale projects, its project management methodologies, and its track record of project delivery.

Resource Availability and Allocation: It’s important to assess if the entity has sufficient human resources, equipment, and technology to carry out the planned projects, and whether it has an effective system for resource allocation.

Risk Management Framework: A comprehensive review of the entity’s risk management framework can provide insights into its preparedness to identify, assess, and mitigate project risks.

Stakeholder Management Plan: Given the large number of stakeholders involved in public infrastructure projects, having a robust stakeholder management plan is crucial.

Performance Measurement Mechanisms: Evaluating the entity’s performance measurement mechanisms can help understand its ability to track project progress and make necessary adjustments in a timely manner.

The Road to Sustainable Growth

In conclusion, the challenges faced by high-growth municipalities and independent school districts demand a comprehensive approach to bond underwriting. A preapproval process that focuses only on financial aspects is no longer sufficient.

By broadening the scope of preapproval processes and providing guidance on project planning, resource allocation, risk management, and stakeholder engagement, bond underwriters can significantly contribute to the sustainable growth of these entities. They can ensure that these organizations not only have the financial means to repay the bonds, but also the operational capability to deliver successful projects, thereby fulfilling their responsibilities towards their citizens and laying a strong foundation for future growth.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com