When it comes to establishing a capital improvement bond that stands the best chance of garnering voter approval, it’s not just about presenting the proposal but how you present it. Drawing on data, expert opinions, and industry studies, the following is a guide to strategizing for successful bond initiatives:

Engaging the Community from the Outset

The Rationale: Local communities form the crux of a bond initiative’s success. Their active involvement not only ensures transparency but fosters a sense of collective ownership over the proposed project.

The Strategy: Kick-start this involvement with early consultations. Public meetings can be designed as interactive forums where residents voice concerns, seek clarifications, and offer insights. Workshops can employ facilitators who break down the complexities of the bond, ensuring laypeople grasp its implications. Surveys, both online and offline, offer another avenue to gauge public sentiment and gather feedback.

Empirical Support: The National Association of Bond Lawyers provides empirical backing to this approach. Their study conclusively indicates a direct correlation between community involvement and the success rate of bond projects.

Crafting a Persuasive Narrative

The Rationale: In an age of information overload, a clear, compelling message cuts through the noise. Voters need clarity, not just on the ‘what’ but also the ‘why’ of the bond.

The Strategy: When formulating the bond’s narrative, prioritize clarity. Use jargon-free language and focus on tangible benefits. Infographics, visual presentations, and case studies can be employed to make the message more digestible and relatable to an average voter.

Empirical Support: A detailed report from the Government Finance Officers Association underscores this. Their findings reveal that transparent, no-frills messages register better with the electorate, ensuring a higher probability of gaining their endorsement.

Forming a Diverse Support System

The Rationale: Broad-based support enhances credibility. When a diverse cross-section of the community, from businesses to civic groups, champion a cause, it diminishes skepticism and amplifies confidence in the bond’s viability.

The Strategy: Initiate dialogue with local entrepreneurs, business chambers, neighborhood associations, and influential political figures. Their endorsement can be vocalized through joint press conferences, endorsements in local media, and shared community outreach events.

Empirical Support: This approach finds resonance in a report by the National League of Cities. Their data confirms that bonds supported by varied community stakeholders have a heightened probability of voter approval.

Undertaking a Feasibility Analysis

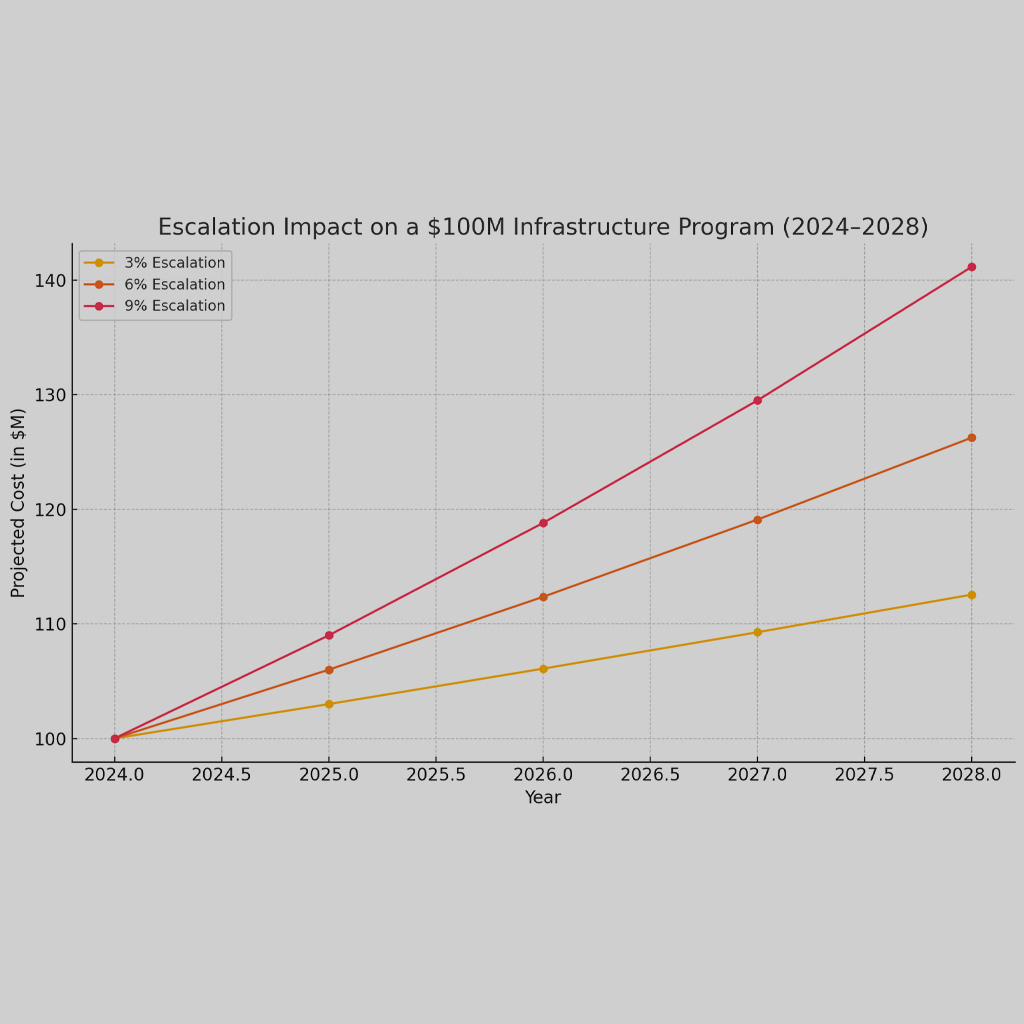

The Rationale: The feasibility of a bond initiative is its cornerstone. Voters need reassurance that the bond won’t just be beneficial but is also realistic in its financial projections.

The Strategy: Commission an exhaustive feasibility study by independent experts. This analysis should delineate the bond’s projected cost, the anticipated economic implications for residents, and potential return on investment for the community. Once the study is completed, organize sessions to disseminate its findings, ensuring the public has a clear understanding of its content.

Empirical Support: Bond specialist John M. Nicholas’s insights provide validation here. He asserts that feasibility studies, apart from equipping voters with crucial data, foster trust, and confidence, propelling a bond initiative’s chances of securing the community’s nod.

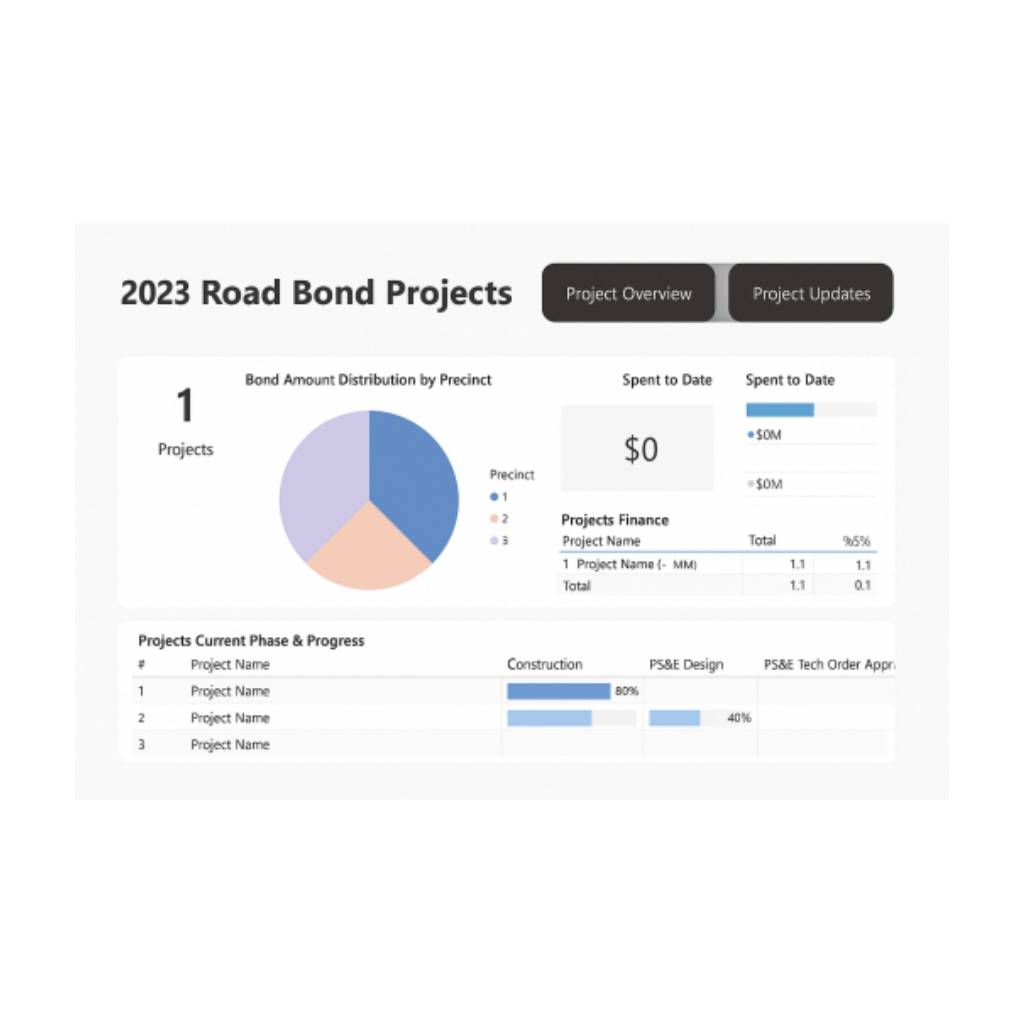

Ensuring Transparency and Responsibility

The Rationale: In the realm of public finance, transparency isn’t merely a desirable trait—it’s a fundamental requirement. When residents are assured of transparent dealings, their trust in the bond initiative increases manifold.

The Strategy: Maintain open channels of communication from the bond’s inception to completion. Utilize digital platforms to regularly post updates, ensuring they are accessible to all residents. Consider establishing an oversight committee—comprising independent experts and community representatives—to monitor the utilization of bond funds. Regularly published expenditure reports, ideally both online and through local media, ensure public funds’ usage remains under community scrutiny.

Empirical Support: Lisa Richman, a renowned figure in government finance, emphasizes the marriage of transparency and accountability. According to her, it’s this combination that cements public trust, ultimately enhancing the chances of a bond’s approval.

Voter Enlightenment

The Rationale: An informed electorate is a bond initiative’s greatest asset. When voters possess a clear understanding of what the bond entails, its financial implications, and projected benefits, they are better equipped to make decisions in the community’s best interest.

The Strategy: Organize informational sessions—both virtual and in-person—to break down the bond’s intricacies. Engage financial experts to elucidate the bond’s fiscal dynamics, urban planners to describe its impact, and local leaders to discuss the broader vision. Utilize visual aids like infographics and videos to simplify complex data. Moreover, establish dedicated helplines or community centers for voters to seek clarifications.

Empirical Support: A study conducted by the National Association of Counties offers compelling evidence on this front. Their research accentuates that voters, when well-informed about bond details, are significantly more likely to cast their vote in its favor.

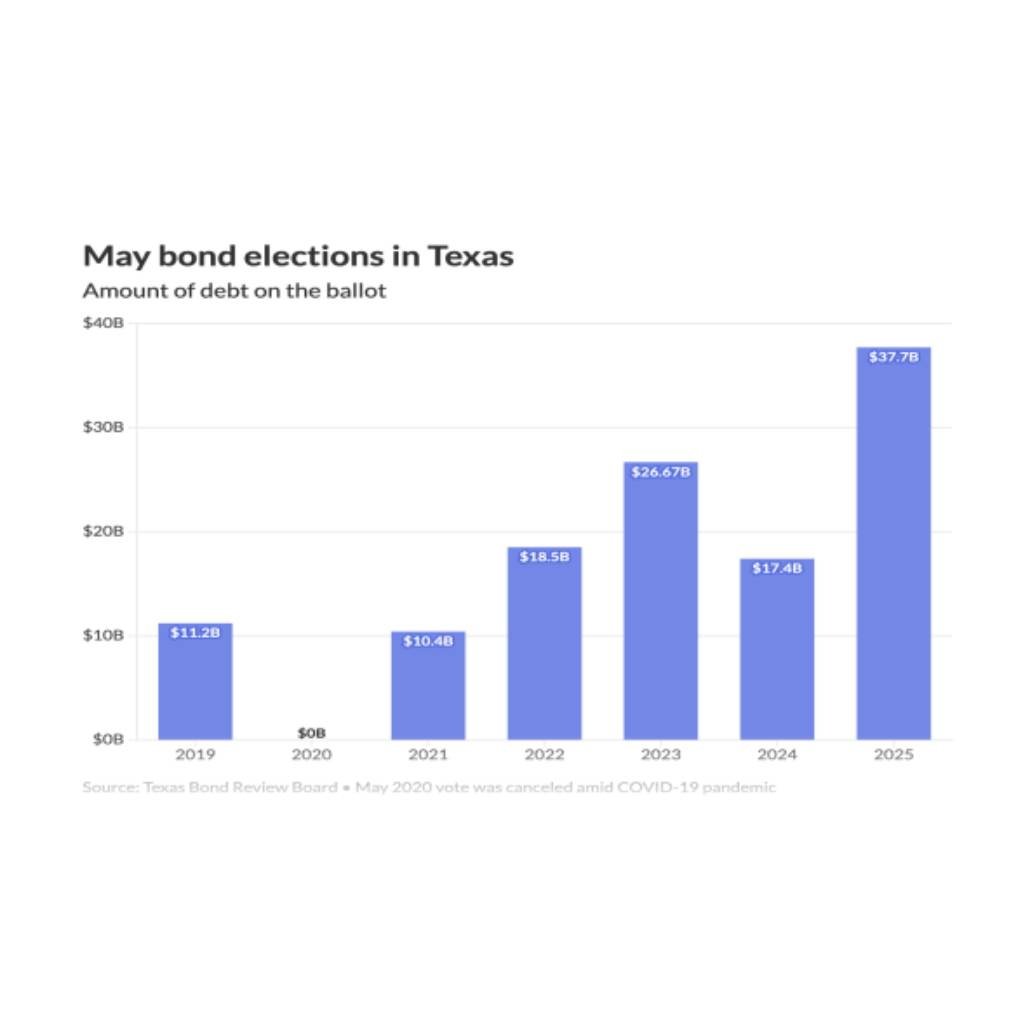

Intensive Bond Campaigning

The Rationale: Like any initiative, the success of a bond proposal often hinges on its visibility and the momentum of its outreach efforts.

The Strategy: Design a comprehensive campaign blueprint. This should span direct mailers elucidating the bond’s merits, targeted advertisements in local newspapers, TV, and radio, and community town halls or speaking events where bond champions address and interact with the public. Engage with local influencers or community figures who can amplify the bond’s message. Furthermore, harness social media platforms for wider reach, especially to engage younger constituents.

Empirical Support: Bond expert Susan Evanoff’s insights provide weight to this approach. She contends that the efficacy of a bond initiative often correlates with the vigor and precision of its campaign. A well-strategized and diligently executed campaign, she argues, can often pivot the outcome in favor of the bond.

In conclusion, as communities deliberate on bond initiatives, the trifecta of transparent operations, voter education, and rigorous campaigning emerges as pivotal. These strategies, when implemented meticulously, can guide a bond initiative to the threshold of success.

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com