Capital budgeting and financing play a pivotal role in the financial management of local governments and communities. These concepts are not limited to businesses alone but are equally essential for public entities in their pursuit of economic development, infrastructure improvement, and the provision of essential services. This article explores how capital budgeting and financing strategies are applied by local governments to enhance the well-being of communities, promote sustainable growth, and address the unique challenges they face.

Capital Budgeting for Local Governments

Local governments face diverse challenges in meeting the needs and aspirations of their communities. Capital budgeting helps these entities prioritize and allocate resources to critical projects that create long-term value and improve quality of life. Some key considerations in capital budgeting for local governments include:

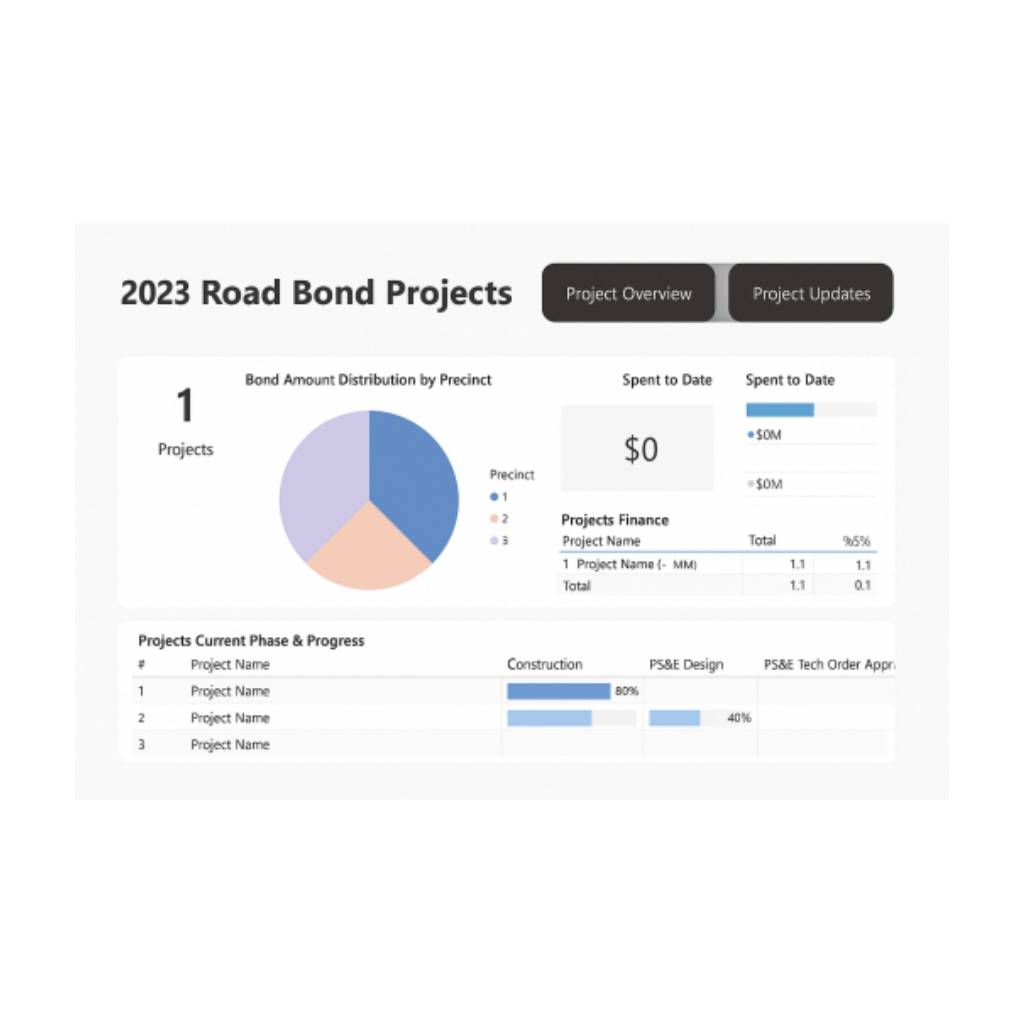

- Infrastructure Development: Local governments must maintain and develop infrastructure systems, including roads, bridges, water supply, sanitation, and public facilities. Capital budgeting allows for the evaluation of infrastructure projects based on their expected benefits, costs, and potential economic impact.

- Public Services: Efficient allocation of resources is essential in providing quality public services such as education, healthcare, public safety, and social welfare. Capital budgeting helps local governments assess the viability and impact of these services, ensuring their delivery aligns with community needs.

- Economic Development Initiatives: Capital budgeting enables local governments to support economic development by identifying and investing in projects that attract businesses, foster job creation, and enhance the local economy. This may include initiatives like industrial parks, business incubators, or infrastructure improvements to support commerce.

Financing Options for Local Governments

Local governments employ various financing strategies to fund capital projects and meet their financial obligations. These strategies take into account the unique circumstances and constraints faced by public entities. Some common financing options for local governments include:

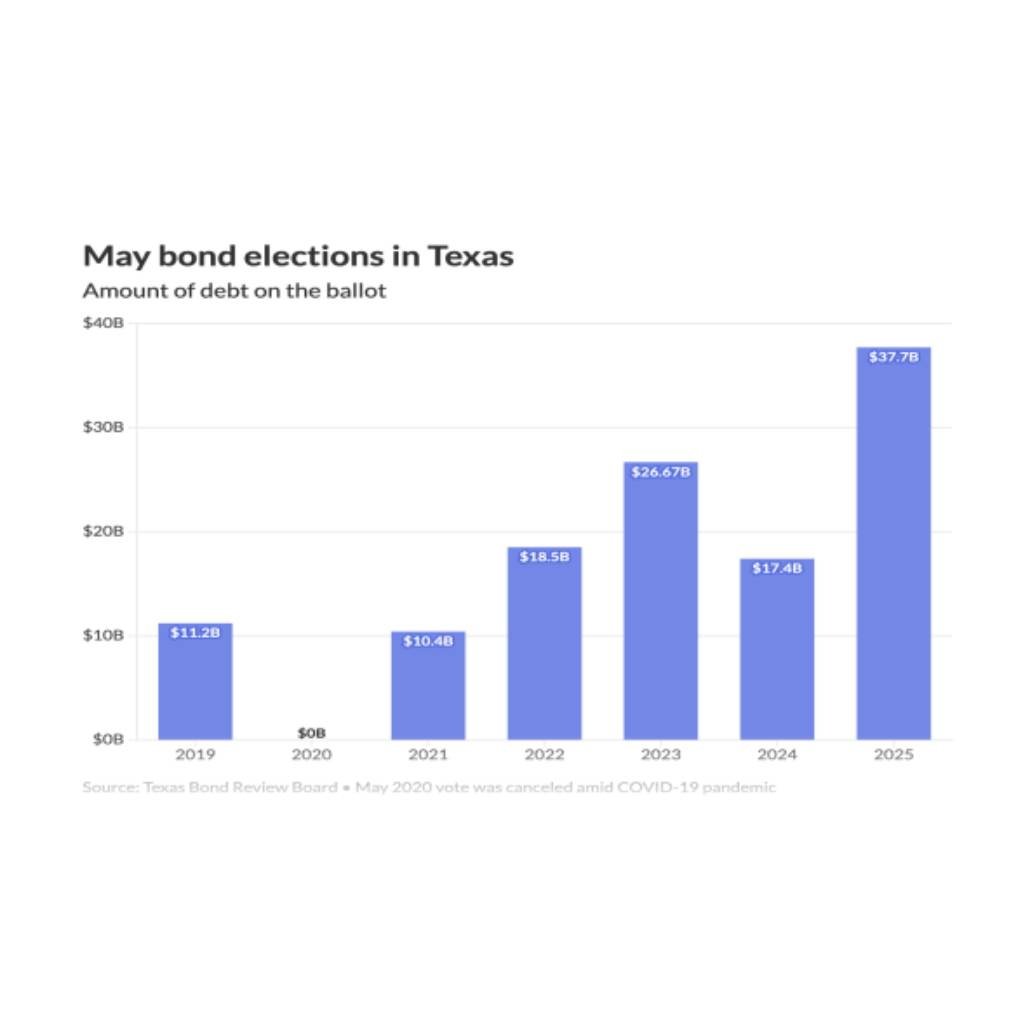

- General Obligation Bonds: Local governments issue general obligation bonds to finance capital projects. These bonds are backed by the full faith, credit, and taxing power of the government entity. Investors are repaid through taxes or other revenue sources, and interest paid on these bonds is typically exempt from federal income tax.

- Revenue Bonds: Revenue bonds are issued to finance specific projects that generate dedicated revenue streams, such as toll roads, airports, or utilities. The repayment of these bonds comes from the project’s generated revenue rather than general tax funds.

- Grants and Subsidies: Local governments seek grants and subsidies from federal, state, or private sources to fund specific projects or initiatives. These funds do not require repayment and can significantly support community development and improvement efforts.

- Public-Private Partnerships (PPPs): Local governments collaborate with private entities through PPPs to finance and manage capital projects. This approach allows the sharing of risks, costs, and resources between the public and private sectors.

- Special Assessment Districts: Local governments may establish special assessment districts, where property owners within a defined area contribute to funding specific projects or services benefiting that district, such as street lighting or neighborhood beautification.

The Impact on Local Governments and Communities

Effective capital budgeting and financing strategies have a profound impact on local governments and communities, fostering sustainable development and enhancing the well-being of residents. Here are some key benefits:

- Improved Infrastructure: Capital budgeting enables local governments to prioritize infrastructure projects that enhance connectivity, transportation, and public services. Upgraded infrastructure supports economic growth, attracts investment, and improves the overall quality of life for residents.

- Enhanced Service Delivery: By allocating resources efficiently, capital budgeting allows local governments to provide essential services more effectively. Investments in education, healthcare, public safety, and social welfare contribute to the well-being and social progress of communities.

- Economic Growth and Job Creation: By strategically investing in economic development initiatives, local governments can stimulate business activity, attract investments, and foster job creation. This, in turn, improves local employment rates, income levels, and economic opportunities for residents.

- Community Engagement and Empowerment: Involving community members in the capital budgeting process fosters transparency, accountability, and citizen participation. Engaged communities can voice their needs and priorities, ensuring that public funds are allocated in line with community aspirations.

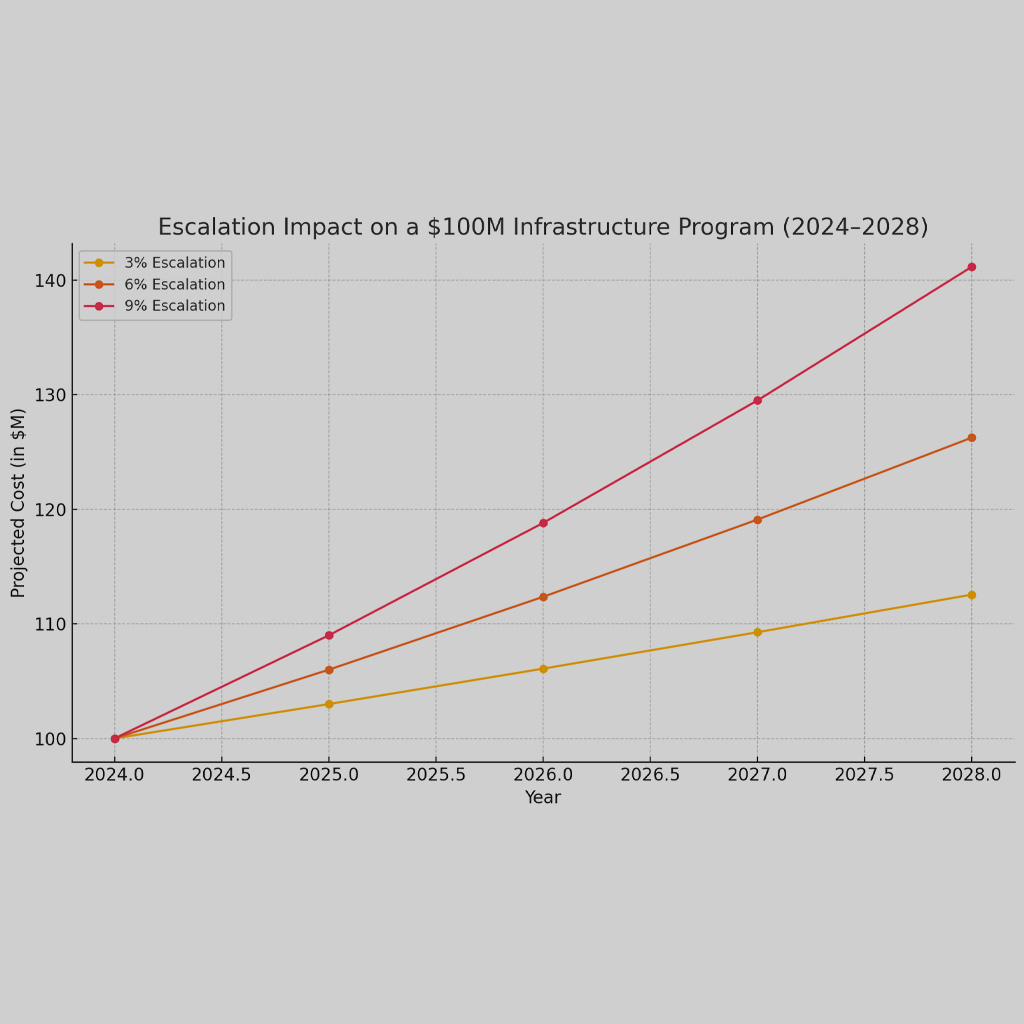

- Long-Term Financial Sustainability: Sound capital budgeting practices help local governments maintain fiscal discipline and long-term financial sustainability. By carefully evaluating projects’ financial viability and considering various financing options, local governments can balance their financial obligations while meeting the needs of their communities.

Effective capital budgeting and financing strategies have a profound impact on local governments and communities. They facilitate improved infrastructure, enhanced service delivery, economic growth, community engagement and empowerment, and long-term financial sustainability. By implementing these strategies, local governments can create thriving communities that prioritize the well-being and prosperity of their residents.

At Front Line Advisory Group, we provide program management consulting services for capital improvement bonds. We are revolutionizing the construction industry and transforming client expectations by obsessing over the basics of budget oversight, schedule enforcement, compliance, vendor management, and stakeholder communication. Contact us for more info at info@frontlineadvisorygroup.com.