“He who will not economize will have to agonize.”

— Confucius

The Bond Paradox: Financing Progress or Mortgaging the Future?

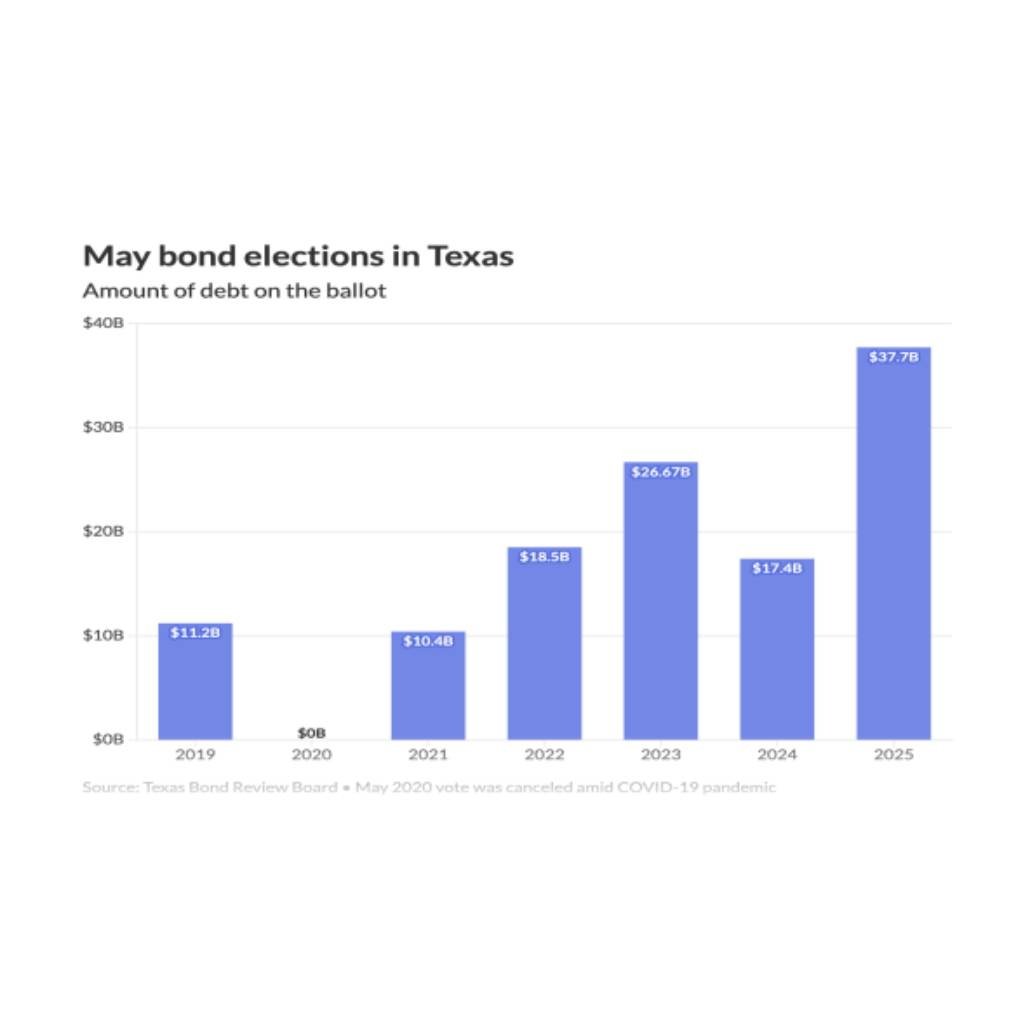

When municipalities envision growth and improved quality of life for their communities, Capital Improvement Programs (CIP) often become the blueprint for action. These programs outline essential infrastructure projects—roads, bridges, public safety facilities—that promise to enhance daily life and stimulate economic development. To fund these ambitious initiatives, local governments frequently turn to municipal bonds. But this reliance on debt raises a critical question: Are we genuinely financing progress, or are we mortgaging the future?

The Appeal of Municipal Bonds

Municipal bonds, especially those issued under CIP bond programs, offer an immediate influx of capital without the need to drastically increase taxes or cut services. They enable cities and counties to embark on large-scale infrastructure development projects that might otherwise be unattainable. The two primary types of bonds used are Revenue Bonds and General Obligation Bonds. Revenue bonds are repaid through the income generated by the projects they fund, such as toll roads or utilities. In contrast, general obligation bonds are backed by the full faith and credit of the issuing municipality, often relying on taxpayer dollars for repayment.

Understanding Debt Capacity and Financial Health

While bonds provide necessary funding, they also contribute to a municipality’s debt load. Debt capacity refers to the maximum amount of debt a municipality can take on without jeopardizing its financial stability. Exceeding this capacity can lead to increased borrowing costs, reduced credit ratings, and strained budgets. It’s imperative for local governments to assess their financial health comprehensively before diving into new debt obligations.

The Role of Long-Term Strategic Planning

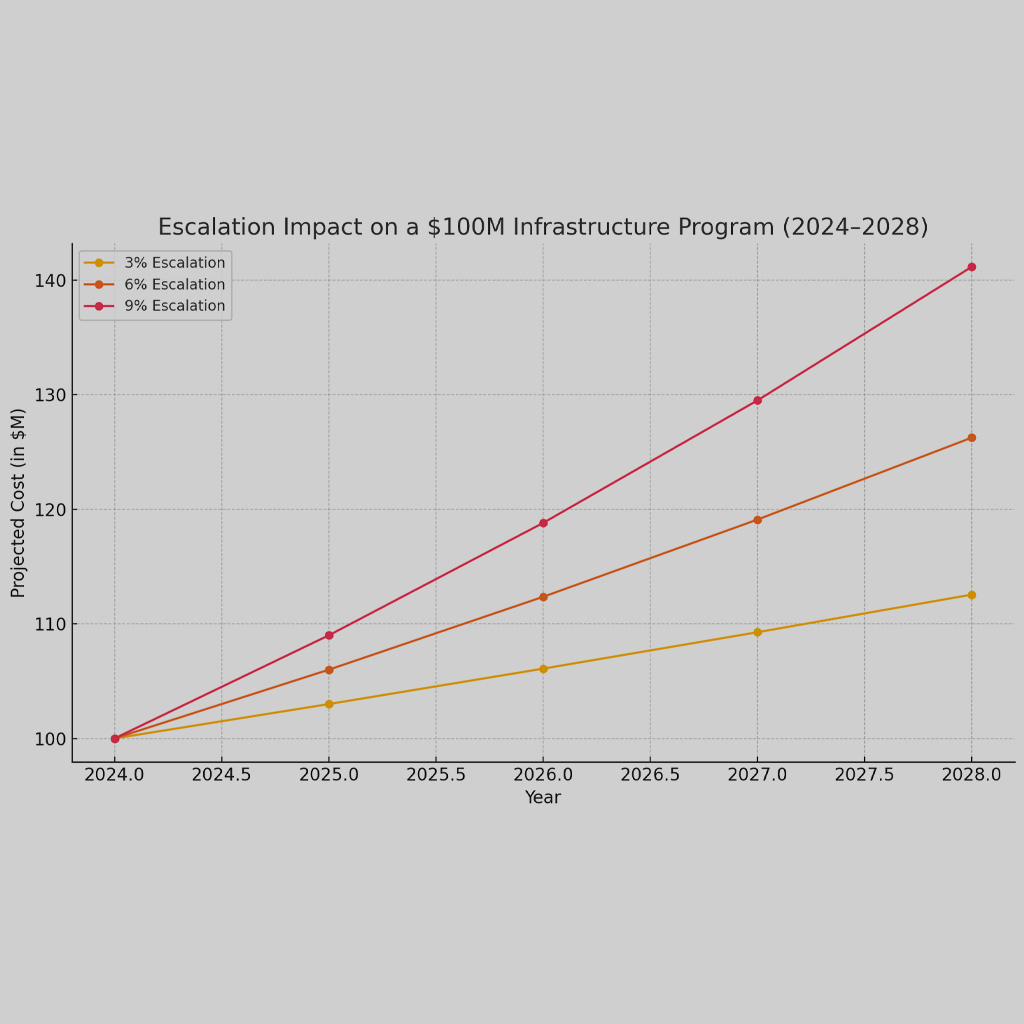

Effective long-term strategic planning ensures that today’s infrastructure investments remain assets rather than liabilities in the future. This planning involves meticulous forecasting of revenues and expenditures, consideration of maintenance costs, and alignment with broader economic goals. By anticipating future challenges, municipalities can avoid the pitfalls of overextension and ensure that infrastructure remains sustainable and beneficial for generations.

Community Needs Assessment and Engagement

A successful CIP begins with a thorough community needs assessment. This process identifies the most pressing infrastructure needs and prioritizes projects that offer the greatest benefit. Community engagement is crucial here; involving residents in decision-making fosters transparency and builds public support. When citizens understand and contribute to the planning process, they’re more likely to back funding initiatives, even those that involve increased taxes or fees.

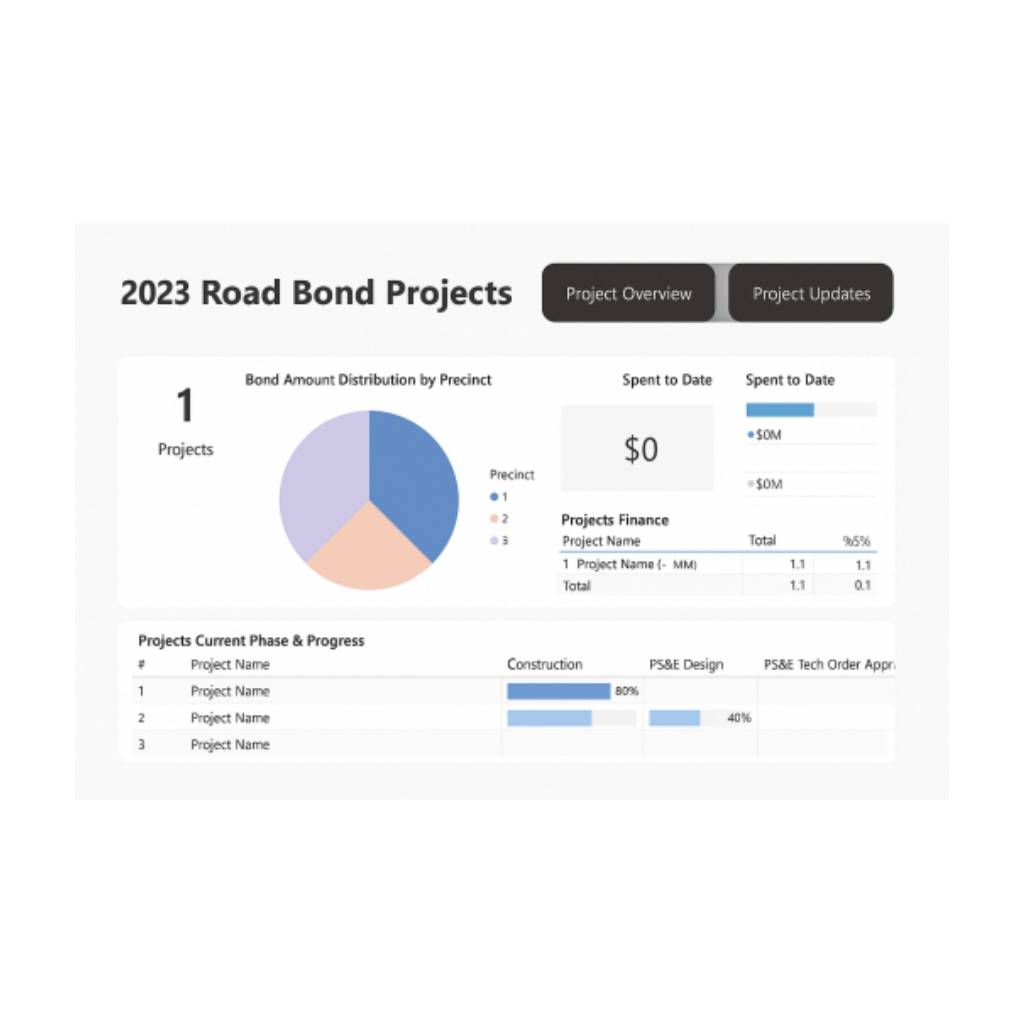

Project Management Frameworks and Sustainability

Implementing robust project management frameworks can keep CIP projects on schedule and within budget, maximizing the return on investment. Incorporating principles of sustainable development and infrastructure sustainability ensures that projects not only meet current needs but also preserve resources for the future. Sustainable infrastructure can reduce long-term operational costs and minimize environmental impacts, aligning with growing public demand for eco-friendly development.

Economic and Social Impacts

Infrastructure projects have far-reaching economic and social impacts. They can stimulate local economies by creating jobs, attracting businesses, and improving accessibility. Enhanced public safety facilities, for instance, not only protect residents but also contribute to a community’s attractiveness for new residents and investors. However, these benefits must be weighed against the potential burden of debt repayment on future budgets and taxpayers.

Revenue Bonds vs. General Obligation Bonds: A Critical Choice

Choosing between revenue bonds and general obligation bonds is a significant decision. Revenue bonds place the repayment risk on the project’s success, potentially insulating taxpayers but possibly leading to higher interest rates due to increased risk for investors. General obligation bonds typically offer lower interest rates but commit the municipality’s taxing power to repayment, directly impacting taxpayers if revenues fall short.

The Paradox Unveiled

The bond paradox emerges from this complex interplay: municipal bonds are both a catalyst for progress and a potential mortgage on the future. They enable critical infrastructure development that can drive economic growth and improve living standards. Yet, they also commit future revenues to debt service, potentially limiting fiscal flexibility for decades.

Navigating the Future

To resolve this paradox, municipalities must adopt a balanced approach:

- Assess Debt Capacity Carefully: Understand the limits of borrowing and avoid exceeding them.

- Engage the Community: Foster transparency and gain public support through active involvement.

- Prioritize Sustainable Projects: Focus on infrastructure that offers long-term benefits and aligns with sustainability goals.

- Strategize Funding Sources: Weigh the pros and cons of revenue bonds versus general obligation bonds in the context of each project.

- Implement Strong Project Management: Ensure projects are delivered efficiently to maximize value and minimize waste.

Conclusion

Municipal bonds remain an essential tool for funding infrastructure, but they are not without risks. By embracing meticulous planning, community engagement, and sustainable practices, municipalities can harness the power of bonds to finance progress without unduly mortgaging the future. The key lies in acknowledging the paradox and navigating it with foresight and responsibility.