Executing a capital infrastructure bond program involves a series of intricate and complex processes, from design and approval stages to construction and completion. However, there are several challenges that can frequently be experienced during the execution phase of such a program. This analysis aims to identify and expound on these prevalent issues, to provide insight for prospective implementers.

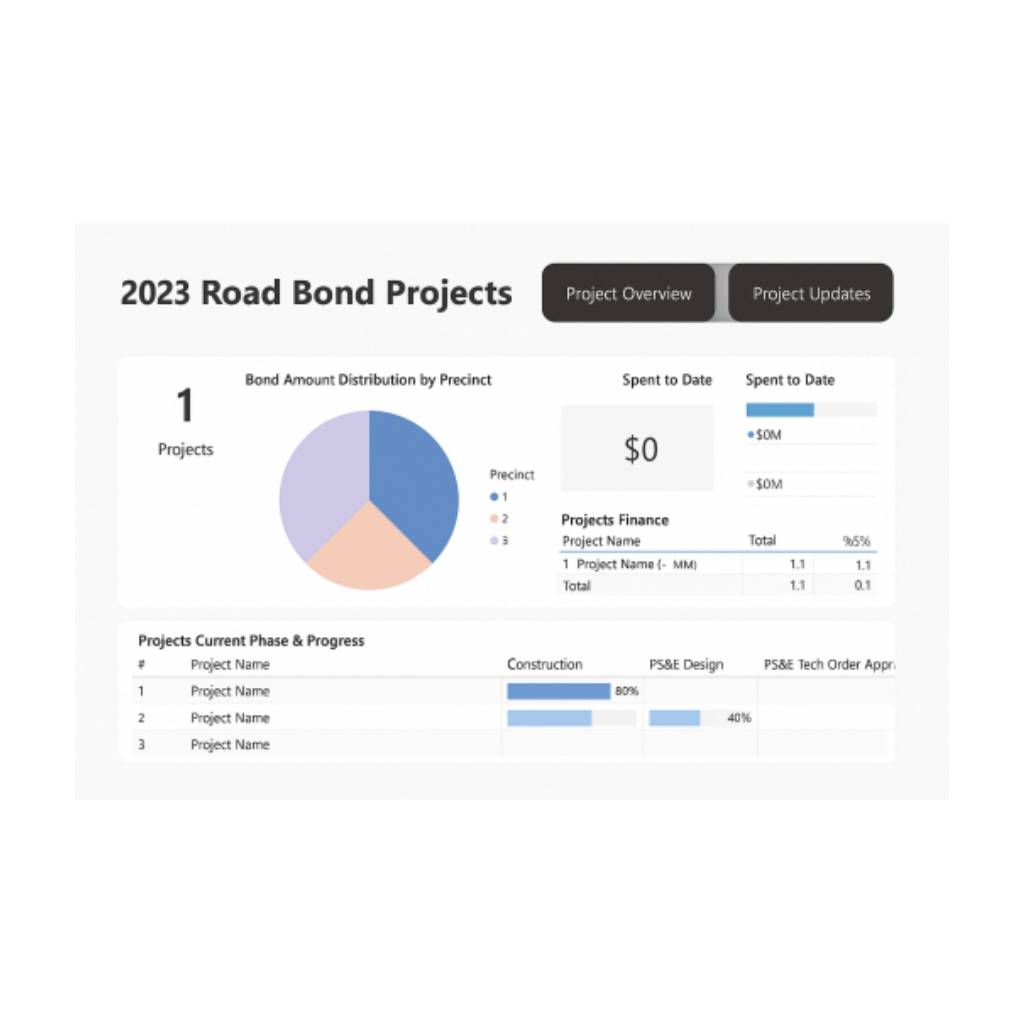

- Navigating the Planning Maze: Effective planning can mean the difference between a triumphant completion and a disheartening halt. A comprehensive plan acts like your project’s GPS, guiding every move. However, many projects skid off course due to deficient planning. Be it budget overshooting, deadline slippage, or worse, project abandonment, the devil is in the lack of detail. Infuse your plan with flexibility and foresight, preparing for potential bumps in the road. Remember, strategic risk management isn’t a luxury but a lifeline in the complex world of capital infrastructure bond programs.

- Unraveling the Funding Knot: Infrastructure bonds might appear like a financial superhero, but don’t let that lull you into complacency. Unanticipated expenses can show up uninvited, tightening the noose around your budget. Moreover, delays in bond issuance can disrupt the lifeblood of your project – cash flow. Here’s where an in-depth funding strategy comes into play. Think ahead, factor in potential financial hurdles, and keep a buffer for surprises. Inject your project with financial accountability and maintain a clear, honest relationship with your investors – it’s the key to trust-building and future resilience.

- Walking the Regulatory Tightrope: As you march ahead with your infrastructure project, remember, you’re walking a regulatory tightrope. A false step can pull you into a quicksand of legal troubles, escalating costs, and project delays. Here’s your safety net – rigorous regulatory due diligence. Assemble a team of legal eagles to scrutinize project plans, anticipate legal challenges, and ensure regulatory harmony throughout the project lifecycle. Your compliance with regulations is not just a requirement – it’s the lifeline that keeps your project moving forward.

- Taming the Public Perception Beast: Infrastructure development often requires taming the beast of public opinion. Neglecting stakeholder interests can stir a hornet’s nest of dissent, obstructing project progress. But worry not, the right communication tools can turn this beast into an ally. Foster an open dialogue with the community, enlighten them about project impacts and benefits, and lend an ear to their concerns. Building bridges of understanding can smoothen your project’s journey and pave the way for long-term success.

- Traversing the Green Jungle: In today’s eco-conscious world, your infrastructure project must learn to walk the green path. Ignoring environmental regulations can lead to formidable barriers. So, start your journey on the right foot – embed sustainability into your project DNA. It should become a core value, guiding your project decisions. Not only will this help you meet regulatory requirements, but it can also be a powerful public relations tool, winning over the hearts of the green-conscious public and investors alike.

- Decoding the Technical Enigma: The world of infrastructure projects is littered with technical enigmas. Land acquisition issues, design challenges, engineering complexities – they can pop up at any turn, leading to costly delays. To crack these codes, you need a team armed with technical expertise and problem-solving prowess. Regular technical audits and progress monitoring can also help you stay ahead of potential technical stumbling blocks. Remember, in this complex labyrinth, being proactive is your best defense.

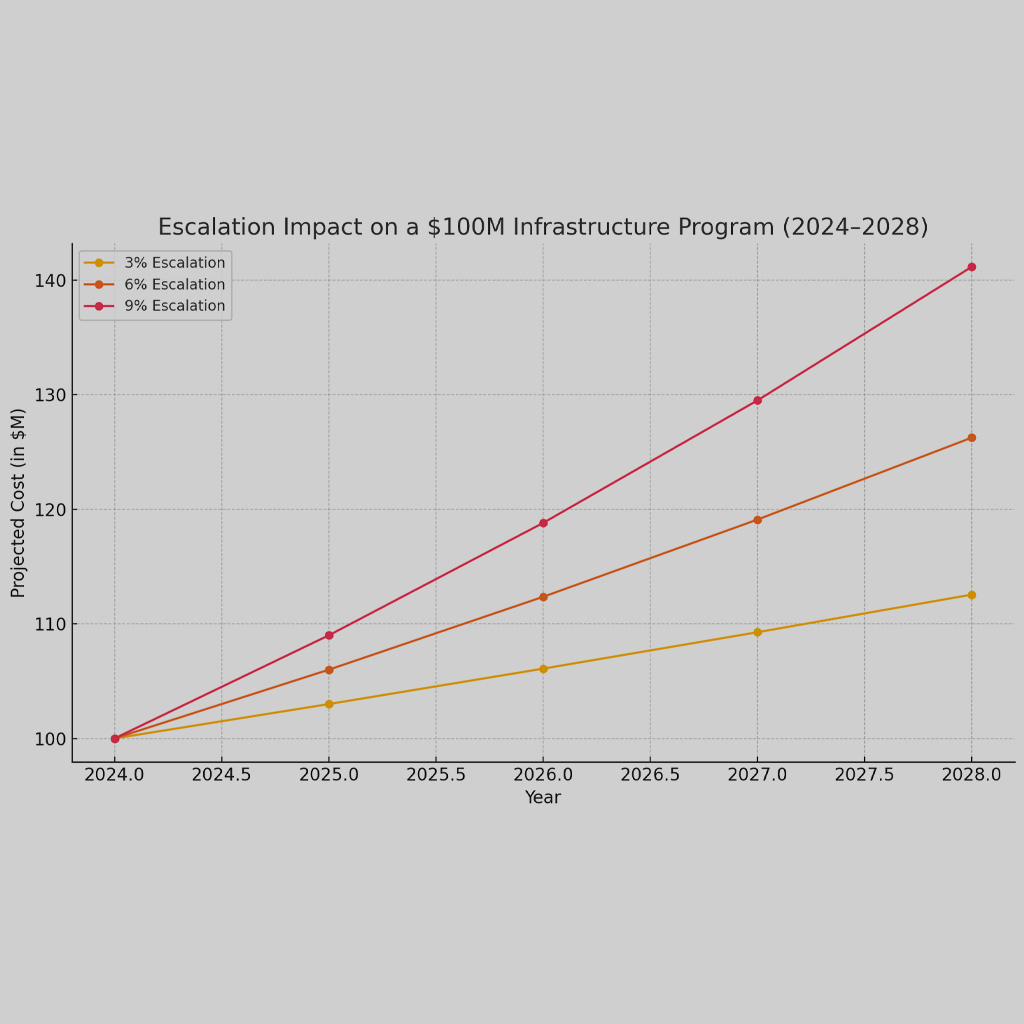

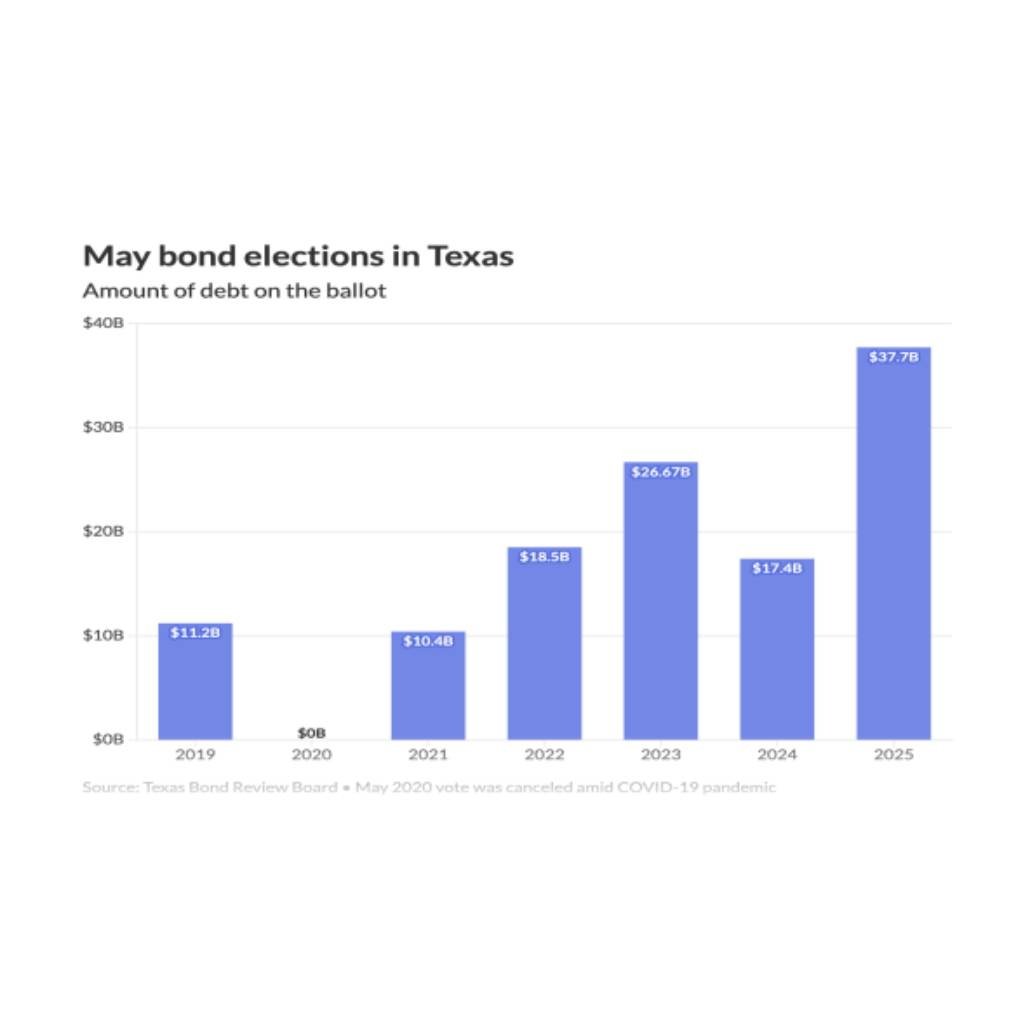

- Riding the Economic Roller Coaster: Capital infrastructure bond programs are not immune to the wild ride of economic fluctuations. Changing interest rates can impact your debt servicing burden, while economic downturns can dampen investor enthusiasm. This roller coaster ride is not for the faint-hearted. It requires keen economic acumen, keeping a pulse on macroeconomic trends, and crafting adaptable strategies. This way, you can brace for the dips and peaks, ensuring your project withstands the test of economic volatility.

- Dodging the Unforeseen Curveballs: As you step up to bat in the field of capital infrastructure projects, be ready to dodge a few unforeseen curveballs. Unexpected events like natural disasters, political unrest, or even global pandemics can disrupt the pace of your project, causing cost inflation and logistical nightmares. While it’s impossible to foresee every twist and turn, having a solid risk management strategy helps you stay on your feet. Regular scenario planning exercises and cultivating project flexibility can ensure your project doesn’t strike out when these curveballs are thrown.

In the thrilling game of capital infrastructure bond programs, challenges are part and parcel of the journey. However, remember, these obstacles are not insurmountable. With careful planning, strategic thinking, and a bit of tenacity, you can navigate this course successfully. After all, every challenge overcome is a testament to your project’s resilience and your team’s determination to innovate and excel. Stay tuned as we continue to explore more facets of infrastructure development in our future posts. Here’s to building a brighter, stronger future!

At Front Line Advisory Group, we are pioneers in Capital Improvement Bond Management, leveraging unparalleled expertise and deep industry insights. Our mission extends beyond consultation – we empower our clients to realize the full potential of their investments, ensuring tax dollars are put to maximum use through astute Program Management Consulting. For more information or to commence your journey towards transformative bond management, reach out to us at info@frontlineadvisorygroup.com.